Customer Journey Mapping with Market Research in the Financial Industry

Understanding customer journeys in the financial industry is crucial for gaining actionable insights. The process of mapping these journeys involves a detailed collection of data that highlights customer interactions with financial services. By incorporating thorough market research, organizations can identify key touchpoints that influence customer decisions. Effective customer journey mapping relies on understanding the emotional aspects and overall experience customers encounter. Thus, collecting qualitative and quantitative data through surveys, interviews, and feedback becomes imperative. This analysis helps in pinpointing pain points and opportunities within the customer journey. Moreover, utilizing analytical tools can enhance the way businesses visualize customer behavior patterns across various channels, including online transactions, customer service interactions, and financial advice sessions. Gathering real-time data allows companies to adapt and respond to changing customer needs swiftly. The end goal is to forge deeper connections with customers, ultimately leading to improved customer loyalty and retention. This approach not only boosts financial performance but establishes a foundation of trust between financial institutions and their clients. Thus, integrating market research into customer journey mapping proves to be an essential strategy within the industry.

Continuing from the previous ideas, the importance of data-driven decision-making cannot be overstated. Market research, when systematically applied, allows financial institutions to segment their target audience effectively. Understanding demographics, such as age, income, and lifestyle, can greatly influence marketing strategies. By tailoring financial products and services to specific customer segments, companies can enhance the relevancy of their offerings. This tailored approach requires close analysis of customer data and market trends to ensure alignment with evolving needs. To illustrate, younger customers might prefer digital banking solutions while older segments may value personalized service. Financial institutions also need to consider how technology affects consumer expectations of services. In an era where customers expect swift, seamless service, providing intuitive interfaces and responsive customer service is fundamental. Furthermore, maintaining open channels for customer feedback can significantly improve services. Continuous improvement based on real customer experiences ensures that businesses stay innovative and competitive. This environment not only promotes customer satisfaction but also generates positive referrals. Thus, leveraging market research throughout the customer journey can yield substantial competitive advantages in the bustling financial sector.

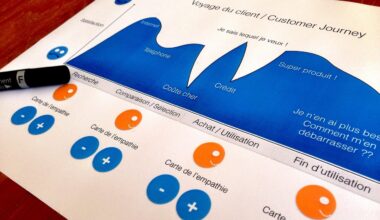

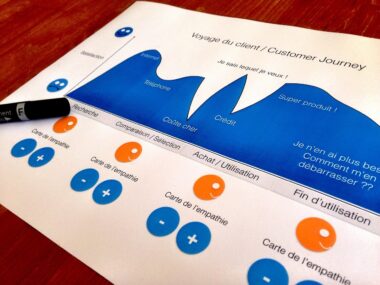

Now, let’s delve into the different stages of the customer journey. The mapping process typically begins with awareness, where potential customers first come into contact with the brand. Marketing tactics such as content marketing or social media advertisements can play a significant role at this stage. In this context, comprehensive market research can identify the most effective channels to raise awareness. This could mean focusing on digital marketing platforms that resonate with target customers. The following stage is consideration, during which customers assess various financial products or services. Here, insights from customer research can help institutions understand how consumers evaluate options, what factors matter most, and what barriers they face. Providing relevant information during this stage is crucial in aiding informed decision-making. Prospective customers are increasingly turning to online reviews, peer recommendations, and comparison tools. Financial companies must ensure that their value proposition is clear and easily accessible. The goal at this stage is to minimize friction and provide clarity. Overall, each stage requires tailored interactions based on comprehensive data analysis, leading to a more aligned customer experience.

The Role of Emotions

In customer journey mapping, emotional engagement plays a pivotal role, especially in the financial industry. Financial decisions often carry significant emotional weight due to their implications on personal and family welfare. Recognizing the emotional drivers behind customer decisions can greatly influence design strategies. Market research can uncover what aspects of their financial services resonate emotionally with customers, whether security, trust, or success. Understanding these emotional components allows institutions to align their messaging accordingly. This connection fosters deeper relationships and leads to customers feeling valued rather than just transactions. Additionally, delivering a positive emotional experience can mitigate negative sentiments stemming from financial stresses, such as debt management or investment fears. When companies address and empathize with these concerns, they foster a sense of loyalty. Moreover, employing storytelling techniques within marketing efforts can evoke emotions effectively. Stories about how products positively impacted others’ lives resonate strongly with potential customers. Consequently, weaving these emotional narratives into customer interactions can strengthen ties and enhance overall experience. Thus, emotional intelligence, informed by market research, becomes essential in creating meaningful customer journeys.

Moreover, it is essential to leverage technology to enhance the customer journey in the financial sector. The integration of customer relationship management (CRM) systems can significantly streamlining communication between customers and service providers. A well-utilized CRM allows institutions to track interactions and gather essential information, leading to a more personalized experience. Furthermore, automation tools enable proactive outreach, such as reminders for payments or alerts about account activities. By understanding individual customer preferences through data analytics, tailored communications can be deployed effectively. This personalized approach minimizes confusion and creates a seamless experience across all customer touchpoints. Additionally, implementing chatbots or AI-driven solutions can enhance customer support and provide immediate assistance. Customers appreciate quick response times, especially in financial matters where timely resolution is essential. Therefore, institutions should continually assess and refine the technology they employ to enhance customer interactions. Big Data analytics empowers financial organizations to predict future customer behavior and understand potential market shifts. In doing so, they can proactively adapt their strategies to meet emerging consumer needs. Thus, the integration of innovative technology is indispensable for optimizing the customer journey.

Continuous Improvement Through Feedback

Incorporating customer feedback is crucial for refining the customer journey continuously. Regularly soliciting opinions from customers through surveys or feedback forms can provide invaluable insights. Market research helps to analyze this data effectively, highlighting areas for improvement and innovation. By implementing changes based directly on customer feedback, institutions demonstrate that they value customer input and are committed to enhancing the experience. This philosophy of continuous improvement fosters customer trust and loyalty. Additionally, it is essential to analyze social media and online reviews for real-time sentiments regarding services. Monitoring online presence not only informs about customer satisfaction but can serve as a benchmark against competitors. Transparency in addressing concerns publicly can enhance brand reputation. Institutions should prioritize acting rapidly on negative feedback as a proactive strategy. By showcasing commitment to customer satisfaction through responses and adaptations, customer confidence strengthens. Moreover, investing in staff training on customer service practices can elicit more positive customer experiences. The cumulative effect of these efforts cultivates a relationship built on trust and satisfaction. Thus, open channels of communication and effective market research lead to sustainable growth and customer-centric strategies for the financial industry.

Ultimately, effective customer journey mapping, driven by comprehensive market research, lays a foundation for innovation in the financial industry. By thoroughly understanding and addressing the needs and preferences of customers, companies can position themselves competitively. Moreover, integrating feedback into decision-making processes ensures that financial institutions remain agile and responsive to changes in the marketplace. This adaptability is crucial in a rapidly altering industry where customer preferences evolve regularly. As companies embrace this iterative process, they can fine-tune their strategies, solutions, and services. The end goal remains centered around optimal customer experience while ensuring alignment with business objectives. Thus, this approach allows for innovation while also addressing regulatory requirements. Additionally, maintaining a customer-centric focus ensures that new products are developed in line with customer expectations. Helping the financial industry shift from a transactional to a relationship-focused model is paramount for long-term success. This evolution emphasizes the need for empowered customers, equipped with the right tools to manage their financial journeys confidently. Ultimately, the synthesis of market research and customer journey mapping establishes a framework for building lasting relationships within the financial landscape.

Conclusion

In conclusion, the integration of market research and customer journey mapping is vital for continued growth in the financial industry. As financial institutions navigate a competitive landscape, understanding consumer behavior and preferences becomes paramount. This understanding allows institutions to tailor their services to meet specific customer needs effectively. The continuous evolution of customer expectations necessitates a dynamic approach. With the rapid advancement of technology, financial companies must remain agile and adaptable. The ability to gather real-time data and analyze it effectively creates opportunities for innovation. Besides, fostering a culture of customer feedback enhances the overall experience, leading to successful long-term relationships. As organizations invest in understanding their customers deeply, the pay-off is evident in enhanced loyalty and engagement. The interplay of emotions, trust, and technology further influences customers’ financial journeys. Thus, successfully navigating the customer journey requires a keen understanding of both qualitative and quantitative metrics. As companies continue to innovate based on solid market research, they pave the way for future success. Therefore, the application of these strategies will undoubtedly shape the future of the financial industry, ensuring lasting and fruitful relationships with customers.