Passive Income Planning for Millennials: What You Need to Know

Millennials today face unique challenges when it comes to financial planning, particularly in the realm of passive income. Understanding the importance of generating passive income is especially crucial for this generation, as they often encounter instability in employment and economic uncertainty. Passive income provides a financial cushion that can alleviate stress and allow millennials the freedom to pursue their passions. This type of income can be earned through various means, including investments, rental properties, and business ventures that require minimal ongoing effort. The key to successful passive income is to begin early and stay consistent with your investment strategy. One essential aspect is the knowledge of various investment options available, which can range from real estate to stocks and mutual funds, all aimed at generating income without day-to-day management. By diversifying their income sources, millennials can mitigate risks and increase their financial stability over time. In this article, we will discuss effective strategies for passive income planning that can help millennials achieve their financial goals in their 20s and 30s.

Investing in real estate is one of the most common ways millennials can generate passive income, but it requires careful consideration. With high property prices in many areas, millennials should start by researching real estate markets and identifying areas predicted to grow. A rental property can provide a steady stream of income, but maintenance and tenant management must be accounted for. Another approach to real estate includes investing in Real Estate Investment Trusts (REITs), which allow individuals to invest in properties without direct ownership responsibilities. Additionally, purchasing shares of real estate funds can be a viable alternative. Many millennials may also be interested in peer-to-peer lending platforms as a way to diversify their income. By lending money through these platforms, investors can earn interest on their loans, which creates an additional income source. It is essential to consider the risk involved with peer-to-peer lending since it requires in-depth knowledge of various borrowers’ creditworthiness. Regardless of the avenue chosen, the overriding principle should always be thorough research before engaging in any investment opportunity.

Another popular avenue for passive income is the stock market, widely recognized for its potential returns. Many millennials are turning to various investment vehicles such as ETFs and index funds as a way to start their investment journeys. ETFs allow investors to gain exposure to numerous assets without requiring constant transaction management. Low fees associated with these funds make them an appealing choice for individuals just starting with investing. It is vital for millennials to educate themselves about various stock options and to keep abreast of market trends. A simple investment strategy can yield significant passive income when done correctly over time. For those who lean toward more hands-on investments, exploring dividend stocks can also prove beneficial. These stocks pay dividends regularly, providing a reliable source of passive income. One tactic would be to reinvest dividends, allowing the investor to compound their returns over time rather than taking out cash. Today’s millennials must consider their long-term financial goals while balancing their current expenses, given that the right investments can pave a pathway toward financial independence.

Diversifying Income Streams

Achieving financial independence through passive income often requires multiple sources of income. While relying solely on one income stream can be risky, effective diversification helps mitigate this risk. For millennials, combining different passive income strategies is essential to creating a robust financial plan. For instance, real estate income can be complemented by investment from dividend stocks and interest from savings accounts or bonds. This financial strategy can result in a more stable cash flow, particularly during economic downturns, reducing dependency on one income source. Creating diversified income streams means collecting income from various channels, addressing financial goals from various angles. Moreover, engaging in hobbies or interests that could generate income can also be perfect for millennials. Activities like blogging, creating online courses, or even starting a YouTube channel can eventually turn into passive income sources. Therefore, every millennial should assess their passions and skills to see if there are monetizable opportunities waiting to be explored. This proactive approach towards income diversification is crucial in achieving financial security and peace of mind.

While passive income planning provides numerous benefits, it’s equally important to recognize the challenges it can pose. For millennials, discipline and patience are essential factors when investing in passive income strategies. Building sustainable income streams generally does not happen overnight. Time and effort are often required before seeing significant returns. Therefore, patience becomes an invaluable asset during the journey. Establishing realistic and achievable goals can aid individuals in staying motivated. Setting benchmarks ensures that the right path is taken while striving towards long-term financial objectives. It’s also valuable to revisit your plans periodically and adjust as necessary based on life events, market conditions, and personal financial needs. Having a solid financial education can empower millennials to navigate challenges with greater confidence and decisive action. Additionally, end-of-year evaluations of financial standings can help identify areas for improvement or re-evaluation. Staying informed about market trends, investing in self-education, and adapting to changes can ultimately position millennials for success in generating passive income. Mindful planning is a cornerstone of financial independence in today’s fast-paced economy.

Leveraging Technology for Passive Income

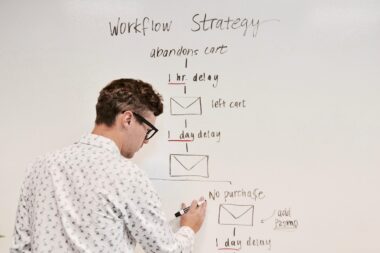

Technological advancements provide millennials with unprecedented opportunities to create passive income. Digital platforms can simplify investing, making it accessible to those who may not have had the resources to invest traditionally. Mobile apps support stock investments, allowing users to buy and sell shares with just a few taps. Platforms like Robinhood and Acorns help individuals start investing with little capital, paving the way for passive income growth. Additionally, the gig economy has transformed the landscape for passive income generation. Freelancers can easily monetize skills on various platforms, allowing them to supplement their regular income. While freelance work is often considered active income, developing a recognizable brand may eventually lead to passive revenue. Building a blog, for example, may generate income through affiliate marketing or ads once it gains traction. Moreover, technology enables the creation of online courses, providing another efficient way to produce passive income. The initial investment in time is often rewarded through subsequent income generation while mastering technology skills can further enhance income streams in the future.

Financial literacy plays a crucial role in successful passive income planning for millennials. Understanding budget management, savings, and investment options can lead to wiser financial decisions and improved income potential. By investing in knowledge, millennials equip themselves to face financial challenges head-on, enhancing their financial stability. Participating in financial workshops, or engaging in online courses can contribute to their financial intelligence. Accessing reliable financial resources and information is a critical step toward building a successful passive income portfolio. Additionally, networking with like-minded individuals can yield insights that promote growth and inspire innovative ideas within this ever-evolving space. Saving consistently and curb unnecessary spending, allowing funds to be redirected toward investments, is paramount. Millennials should also prioritize retirement plans, such as IRAs or employer-sponsored retirement accounts, as part of their passive income strategy. The earlier one begins saving for retirement, the more time their money has to grow through compounded interest. Consequently, embracing a proactive approach to education and continuous learning will lead to improved financial planning outcomes, making passive income a viable path for millennials to achieve financial independence.

In conclusion, passive income planning is a crucial aspect of financial stability for millennials. Embracing various strategies such as real estate investments, stock market engagement, and technology for income generation opens numerous opportunities. Diversifying income streams and continuously educating oneself about financial matters will amplify the chances of success. As millennials navigate economic uncertainties, passive income provides the essential backup and security needed to pursue their passions. The importance of consistent saving and smart investment choices cannot be overstated, as they form the foundation for future financial stability. Millennials can leverage their skills and resources to build income-generating avenues while maintaining a balance between active employment and passive income. Finally, creating a holistic view of financial planning, incorporating elements of passive income, can lead millennials toward sustainable financial success. This journey requires dedication, research, and a commitment to self-improvement. Nevertheless, the rewards that come from strategic planning today can result in a financially free tomorrow, where millennials can realize their dreams without the looming burden of financial insecurity.