How to Avoid Common Mistakes in Passive Income Planning

Passive income planning involves recognizing methods to generate earnings without active engagement. Many investors rush into this without thorough research, leading to common mistakes. For instance, skipping the due diligence phase often results in poor decisions regarding investment sources. Many fail to analyze risks associated with those income streams, ignoring potential downturns. Remember the old adage: knowledge is power. To address this, one might consider a structured approach. Begin with identifying sustainable income sources. These might include rental properties, dividend stocks, or peer-to-peer lending opportunities. Each source has its risks and benefits. Engage with seasoned investors to gain insights into what works and what does not. Collaborating with experienced advisors can provide added advantages in navigating these areas, Often, mentors can help you avoid pitfalls others have faced. Clear, achievable goals serve as benchmarks for measuring success, ensuring you stay on track with your plans. Avoid unrealistic expectations, as passive income takes time to build. By focusing on strategic planning and expert guidance, you can create a robust foundation for your passive income endeavors, effectively minimizing risks while maximizing potential rewards.

One of the prevalent errors is neglecting diversification in passive income strategies.

Many individuals put all their funds into one or two investment avenues, hoping for high returns. This overly concentrated approach can backfire spectacularly if that specific source underperforms. A diversified portfolio is crucial for spreading risk across various assets. Therefore, consider a mixture of real estate, stocks, and bonds. For example, if one investment fails to produce income, others may compensate for it. Additionally, evaluate the stability of your income sources. Reliable platforms reduce the likelihood of income interruptions that can occur from economic fluctuations. Establish automated processes for monitoring and maintaining each income stream. Continually reviewing your financial objectives helps in adapting to changing market conditions. Embrace a mindset of long-term commitment rather than quick wins to see your investments thrive. If you encounter setbacks, do not be disheartened. Learn from your experiences and remember that the path to financial independence often requires persistence and resilience. Be prepared to adjust your strategies accordingly. Thus, a thorough approach will lead to better results and increased satisfaction with your passive income journey.

The Importance of Setting Realistic Goals

Setting realistic financial goals is paramount in passive income planning, contributing significantly to long-term success. Optimal goal-setting can clarify your vision and create measurable targets. Thus, it allows you to track and celebrate mini-milestones. This practice not only builds confidence but also keeps motivation high throughout your journey. Review and refine your aspirations regularly. Being adaptable and willing to change directions in response to new information or market shifts will serve you well. For instance, consider any unexpected events like market downturns, which can necessitate adjustments in your strategy. Additionally, ensure your goals align with your risk tolerance and financial capability. Undue pressure from ambitious targets may lead to poor decision-making. You might find yourself straying from a calculated path. Instead, concentrate on achievable income percentages that suit your lifestyle and commitments. Along with setting financial goals, ensure you account for self-care and work-life balance throughout this process. Establish timelines for your goals, but remain flexible to accommodate changing circumstances. A well-thought-out strategy will significantly enhance your chances of achieving your desired outcomes.

Understanding Taxes Related to Passive Income

When planning for passive income, understanding related tax implications is critical to effective management. Income derived from various sources will often be taxed differently, impacting your overall earnings. For example, rental income may be subject to property taxes that can significantly reduce your cash flow. On the other hand, capital gains taxes apply to profits made when selling investments like stocks. It’s essential to seek advice from qualified tax professionals to navigate these complexities. This professional insight can save you money and help you develop tax efficiencies. Look into tax-advantaged accounts where permissible, like IRAs or 401(k)s, that can facilitate your investment growth without immediate taxation. Additionally, familiarize yourself with the specific regulations governing the income sources. Ignorance of the rules can result in penalties, diminishing your profits. Many people overlook reporting obligations, increasing the likelihood of audit risk. Keep organized records of your transactions, providing clarity during tax season. Emphasize maintaining compliance with all tax laws and regulations, allowing you to enjoy the fruits of your labor without unnecessary obstacles.

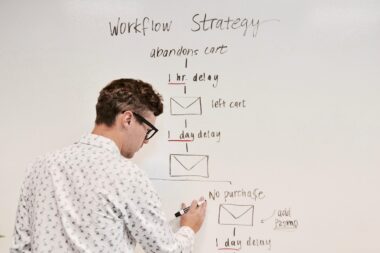

The role of proper budgeting in your passive income strategy cannot be overstated.

Budgeting develops a clearer understanding of cash flows, allowing you to see where your money is going. This practice becomes vital when managing ongoing expenses associated with your income streams. Without a suitable budget, unforeseen costs may arise unexpectedly, causing financial strain. For instance, property maintenance or sudden market fluctuations can impact your earnings. Always allocate funds for emergencies that may disrupt your cash flow. Effective budgeting also helps identify opportunities to reinvest profits. Reinvesting can accelerate your income growth, helping you reach your financial goals quicker. Additionally, set clear parameters around your spending to ensure you do not deplete your passive income sources too rapidly. Utilizing budgeting apps can streamline this process, providing instant insights on where adjustments are needed. Regularly review your expenditures against your projected budgets, ensuring you are on target. Adopting disciplined spending habits and sticking to your plan can contribute significantly to achieving financial independence while maintaining a healthy balance across all aspects of your life.

Another common mistake is failing to continually educate yourself about investment opportunities.

The financial landscape is ever-evolving, influenced by global trends and economic conditions. Investors who remain stagnant in their learning risk losing out on valuable shifts and updates. Therefore, commit to lifelong learning, whether through seminars, online courses, or investment clubs. Keeping informed ensures that your strategies are relevant and firm. Additionally, networking with other passive income investors can provide fresh insights and exposure to unique opportunities. Subscribe to industry newsletters as a valid method for receiving regular updates. Participate in forums and different communities dedicated to passive income to engage with like-minded individuals. Surrounding yourself with knowledgeable peers can inspire innovative ideas, encouraging growth in your investments. Assessing various investment strategies will allow you to perceive patterns or potential trends before they become mainstream. Equipped with this knowledge, you can act more decisively. Finally, consider following experts on social media platforms that specialize in income generation. These varied sources will broaden your awareness, allowing you to adapt to the constantly changing financial environment effectively.

Conclusion: Long-Term Perspective is Key

Ultimately, successful passive income planning hinges on maintaining a long-term perspective. Avoid the traps of impatience and the allure of quick wealth that may threaten your overall strategy. Building a passive income stream takes time, discipline, and resilience amidst challenges that accompany investment journeys. Moreover, continually evaluating the performance of your investments reinforces your commitment. If you find a particular strategy ineffective, remain open to adapting your approach rather than feeling condemned to a previous decision. Ultimately, a mindset geared toward steady growth is essential for savoring the rewards of passive income flows. Allocate time monthly to assess your progress, considering how far you have come and what adjustments may facilitate future success. Lastly, ensure that your investments align with your personal values and motivations. Passive income should ultimately support your lifestyle, contributing to your sense of fulfillment. By maintaining a clear, strategic approach devoid of stress, embracing learning opportunities, and establishing realistic goals, success is achievable. Your journey toward financial freedom can become not just a pursuit but an enriching experience.