How to Distinguish Between Legitimate and Fraudulent ICOs

In the ever-evolving world of cryptocurrency, Initial Coin Offerings (ICOs) have captured the imagination of investors seeking new opportunities. However, alongside the genuine projects are countless fraudulent ventures designed to exploit unsuspecting investors. As an investor, it is crucial to develop the ability to distinguish between legitimate and fraudulent ICOs. The first step is to perform thorough due diligence to verify the authenticity of the project. Check the team behind the ICO; credible experience and established expertise in blockchain technology should ideally characterize them. Additionally, reviewing the project’s whitepaper is essential, as it outlines its objectives and technical details. Look for completeness and clarity in the whitepaper, avoiding vague language or unrealistic promises, which can signal a potential scam.

Another vital step in assessing an ICO is to analyze the project’s roadmap, which outlines short-term and long-term goals, as well as projected timelines. A well-structured and realistic roadmap can indicate commitment and transparency from the team. In contrast, overly ambitious or confusing timelines may raise red flags. Moreover, evaluating the community engagement surrounding the ICO can provide valuable insights. Reputable projects usually maintain active social media channels and communicate openly with potential investors. Be cautious of projects with limited or no online presence or those that do not engage in discussions regarding their development. Checking whether the ICO is compliant with the regulatory requirements in your jurisdiction is also imperative, helping to protect your investment. Many scams will avoid necessary legal compliance, which should heighten your awareness of potential risks.

It is also essential to scrutinize the marketing materials used to promote the ICO. Scam projects often employ aggressive marketing tactics filled with exaggerated claims and unrealistic returns on investment. A legitimate ICO should provide realistic expectations based on sound economic principles. Look for clear explanations of how funds will be utilized to ensure project development and sustainability. A transparent financial breakdown indicates a trustworthy project, while a lack of clarity may suggest deceptive practices. In addition to marketing tactics, be wary of incentives offered for early participation, such as bonuses or discounts. While some bonuses can be legitimate, excessive offers, or those without clear justification, could point to red flags. Never rush into investments without fully understanding the implications and rationale behind incentives.

Conducting Background Checks

Conducting background checks on the ICO’s team members is another critical aspect of distinguishing legit projects from fraudulent ones. Look for transparency on the individuals involved, including their faces, names, and professional backgrounds. Established experts in the blockchain space should have a verifiable history, and it is advisable to check their past projects for credibility. If their online profiles lack academic and professional detail, skepticism may be warranted. Additionally, consider finding independent opinions and reviews or testimonials regarding the project to help gauge its credibility. Engaging with various online forums and communities can offer insights into the project’s reputation and enable investors to share personal experiences, fueling informed decisions.

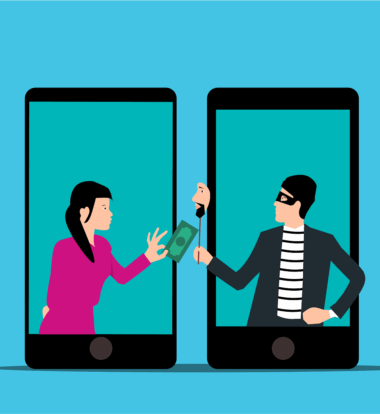

Furthermore, familiarizing oneself with common scam tactics can enhance your ability to identify fraudulent ICOs. Scammers often employ tactics like phishing attacks, fake websites, and impersonating credible personalities to gain trust. Lure tactics such as high-pressure sales, exclusive offers, and unrealistic projected profits are frequent methods used by fraudsters. Never feel pressured to invest hastily, as legitimate projects allow for time to research and consider investment decisions. Always verify the website URL, as scammers frequently create fake sites that closely resemble legitimate ones. By taking the time to research thoroughly, scrutinize claims, and remain vigilant against potential red flags, investors can protect themselves from falling victim to scams.

In the realm of ICOs, investor education plays a crucial role in preventing fraud. Understanding key terms and concepts related to blockchain technology and cryptocurrency can significantly reduce risks. Familiarize yourself with the differences between various tokens and their underlying technology. Many investors may fall victim to scams due to a fundamental lack of knowledge about the subject matter. Investing time and effort into becoming well-informed raises the chances of recognizing genuine projects over fraudulent schemes. Also, consider utilizing reputable resources and educational platforms such as online courses or webinars. Engaging with the broader investing community can also provide support and enhance understanding of the complexities surrounding ICO investments.

Lastly, as you navigate the ICO landscape, it’s vital to develop a healthy skepticism. While many genuine projects aim to revolutionize industries through blockchain technology, fraudulent ones aim to exploit potential investors’ enthusiasm. Trust your instincts if something appears too good to be true—it probably is. Look out for signs like promises of guaranteed returns, excessively lofty goals, or an unreasonable lack of transparency. Building relationships with other investors and discussing insights can also help identify trustworthy projects over time. Staying connected with industry news and developments will further guide your investment decisions and improve your ability to recognize fraudulent ICOs. With diligence and preparation, you can confidently engage in the world of ICOs.

In conclusion, distinguishing between legitimate and fraudulent ICOs involves thorough research, a proper understanding of the industry, and skepticism towards unrealistic claims. By following the pointers outlined in this article, investors can protect themselves and increase their chances of success in the ICO market. Researching team backgrounds, analyzing whitepapers and roadmaps, engaging with communities, and educating oneself are vital strategies in this journey. Always prioritize personal research and due diligence over promotional materials. Investing in ICOs can be fruitful, but doing so wisely ensures that you stay ahead of the risks. Remember that scammers prey on enthusiasm, so maintaining a cautious and informed mindset is key. Protecting your investment and making sound decisions starts right here.