Analyzing Trends in Credit Growth Across Economies

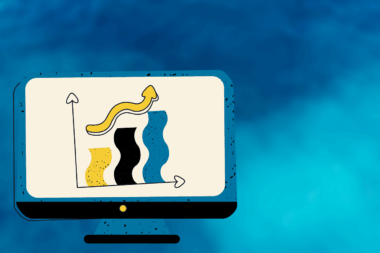

Credit growth is a critical indicator of economic vitality, reflecting the health of both lenders and borrowers. As economies evolve, analyzing the credit growth trends can unveil insights into consumer confidence, investment strategies, and overall fiscal status. Optimum levels of credit growth ensure liquidity, aiding both business expansions and personal expenditures. During periods of rapid credit growth, the economy generally experiences robust activity, characterized by heightened consumer spending and increased business investments. However, this growth must be monitored carefully to prevent overheating of the economy which can lead to potential financial crises. Credit growth analysis assists policymakers in making informed decisions to balance interest rates, inflation, and other economic factors. Understanding these trends is crucial for both domestic and international investors who seek opportunities for expansion in various markets. In many cases, central banks respond to shifts in credit growth by adjusting monetary policy. Therefore, examining and contextualizing credit growth across economies foster a deeper understanding of global economic dynamics. Additionally, different sectors experience varying credit growth rates, influenced by industry-specific factors, which support targeted investment approaches to maximize returns.

To effectively analyze credit growth, one must first delineate various factors that influence lending. Regulatory environments, for instance, play an essential role in determining how much credit can be extended by institutions. Guidelines set by central authorities can either encourage or restrain lending, affecting overall credit dynamics. Moreover, consumer confidence and economic forecasts contribute significantly to credit provisions. When tailored assessment practices are employed by lending institutions, more accurate predictions regarding credit growth can be made. Furthermore, analyzing historical data helps identify patterns, thereby supporting future forecasts. Quantitative measures such as the loan-to-deposit ratio and capital adequacy ratios are often employed to gauge a bank’s capacity for additional lending. Additionally, macroeconomic indicators like GDP growth, employment rates, and inflation provide context for interpreting credit trends. The interplay of these indicators creates a comprehensive picture that aids economic agents in tailoring their strategies. Thus, understanding how these variables coalesce assists in making sound financial decisions both at individual and institutional levels. Continuous monitoring and analysis of these indicators ultimately foster sound credit growth conducive to sustainable economic development.

Regional Variations in Credit Growth

Regions across the globe showcase distinct credit growth patterns, influenced by socioeconomic characteristics and cultural factors. In advanced economies, credit growth often stabilizes at lower rates, reflecting accessible credit systems and existing consumer debt saturation. Contrastingly, emerging markets frequently exhibit high credit growth, driven by under-utilized lending potential and a burgeoning middle class eager to finance consumption. Credit booms in these regions can spur economic development, but they also necessitate caution to mitigate risks associated with over-lending. Monitoring regional credit dynamics is vital for international investors aiming to identify lucrative opportunities and remain cautious of potential pitfalls. Risk assessments in various regions differ, shaped by local market behaviors, legal frameworks, and financial infrastructures. The credit growth pattern in Europe has its unique challenges amidst economic uncertainties, whereas Asia’s dynamism reflects robust growth rates propelled by innovative fintech solutions. Understanding the regional credit landscape allows stakeholders to leverage specific opportunities and tailor financial products according to local needs. Thus, unearthing the regional variations in credit growth forms a crucial component of broader economic analysis that transcends mere statistics, impacting financing strategies.

The relationship between credit growth and household debt levels offers another pivotal lens for analysis. As consumer credit expands, households tend to take on more debt, which can stimulate the economy through increased consumption, fostering a cycle of growth. However, excessive household debt poses risks, particularly if growth substantially outpaces income. As such, responsible lending practices become paramount for sustaining economic health. Understanding credit growth in relation to overall debt levels enables lenders to adopt preventive measures against potential defaults and financial crises. Balancing credit expansion with sustainable debt levels mitigates the risk of household financial stress, thereby stabilizing the economy. Credit literacy should also be prioritized in aligning credit growth with households’ repayment capacities. Consequently, as individuals and families become more educated about financial products, their borrowing choices improve, and the likelihood of default reduces. Integrating educational programs into lending operations facilitates responsible borrowing and contributes to healthier credit ecosystems. This holistic approach supports the overall economic landscape by fostering a culture of sound financial practices, easing transitions during economic fluctuations, and enhancing consumer resilience against unforeseen financial challenges.

The Role of Technology in Credit Growth

Technological advancements have revolutionized credit growth analysis, introducing new paradigms in efficiency and accessibility. The integration of fintech solutions has transformed traditional lending processes, offering seamless access for consumers and faster decision-making for lenders. Machine learning algorithms and data analytics provide enhanced insights into creditworthiness by analyzing diverse data points, leading to more informed lending practices. Thus, fintech not only optimizes credit growth but also broadens access, particularly for underbanked populations. As a result, more inclusive financial ecosystems evolve, providing opportunities for those previously excluded from traditional systems. Additionally, digital platforms facilitate peer-to-peer lending, further democratizing credit access and diversifying risk amongst investors. Ensuring cybersecurity and privacy remains pivotal as technology reshapes credit landscapes; thus, investors must adopt best practices. Moreover, the regulatory frameworks are evolving to catch up with these rapid technological changes, ensuring consumer protections remain a priority while encouraging innovation. As technology continues to advance, continuous adjustments to credit analysis practices will be essential to adapt and thrive in an ever-changing financial environment. Forward-thinking stakeholders will proactively engage with these trends to harness technology’s potential effectively.

Policy responses to credit growth require constant assessment and adaptation to align with evolving economic landscapes. Central banks, for instance, utilize specific tools to guide credit growth within sustainable limits and ensure market stability. Adjustments in interest rates can incentivize or deter borrowing, directly impacting credit levels across economies. Furthermore, regulatory changes can influence lending practices, reinforcing the importance of prudent lending standards to safeguard against excessive credit expansion. It is essential for policymakers to engage in comprehensive dialogue with financial institutions, as collaborative partnerships can facilitate efficient communication regarding market trends and potential risks. As countries strive for economic stability, aligning fiscal and monetary policies with credit growth objectives ensures adaptability and preparedness for unforeseen shocks. Maintaining a keen understanding of consumer behaviors and macroeconomic indicators empowers policymakers to craft proactive measures against cycles of boom and bust. Therefore, credit growth analysis serves as a foundation for responsive regulatory frameworks, safeguarding against potential vulnerabilities throughout economic fluctuation periods. In keeping with the objective of developing sustainable economies, understanding credit growth is crucial for sound decision-making in both public and private sectors.

Future Outlook on Credit Growth

As we look towards the future, credit growth holds both opportunities and challenges that must be navigated with care. With technological evolution, financial literacy, and regulatory considerations playing crucial roles, stakeholders must remain informed about changing dynamics. As digital currencies and decentralized finance (DeFi) gain traction, their influence on credit availability is expected to evolve significantly. New financial instruments arising from technological advancements can either facilitate growth or introduce new risks, warranting cautious analysis. Policymakers and financial institutions will need adaptive strategies that anticipate shifts in consumer preferences and technological innovations. Furthermore, understanding demographic changes and their impact on borrowing behaviors will be vital in predicting future credit trends. Stakeholders must focus on sustainability—ensuring that credit growth supports environmental and social projects promoting overall economic wellbeing. Collaboration between private and public sectors will foster resilient financial habits, driving inclusive credit systems poised for the future. As these elements converge, credit growth will continue to shape economic landscapes, highlighting the importance of diligent analysis in pursuing economic stability and sustainable development.