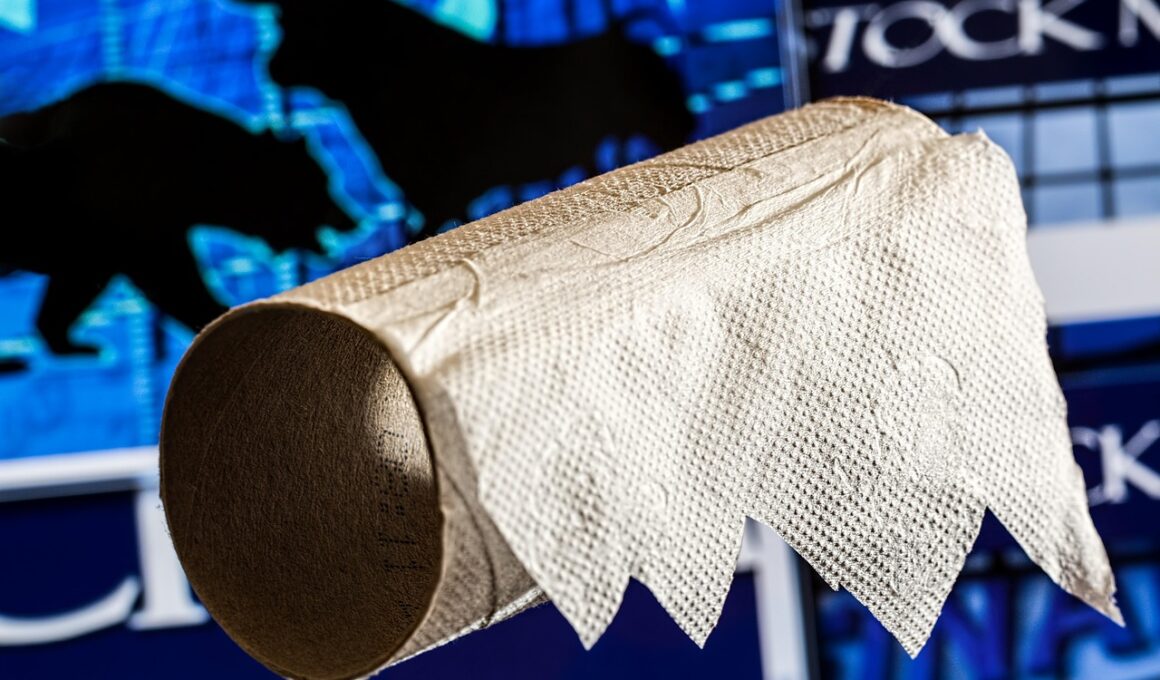

Surviving Bear Markets: Lessons from Past Downturns

In investing, understanding market cycles is crucial. Bull markets, characterized by rising prices, contrast sharply with bear markets where prices decline. A bear market typically indicates a downturn by at least 20% from recent highs. These cycles can evoke panic among investors, leading to emotional decision-making. However, absorbing lessons from historical bear markets can furnish valuable insights. One significant lesson from the Great Depression is the imperative of maintaining a long-term perspective; short-term losses can be weathered when focusing on overall investment goals. Moreover, diversifying investments can mitigate risk, as different asset classes behave uniquely during economic downturns. Allocating funds across stocks, bonds, and real estate can provide greater stability. Additionally, fostering an understanding of one’s risk tolerance aids in navigating bear markets with clarity. Investors who respond with a carefully structured plan rather than knee-jerk reactions often fare better. Ultimately, just as bull markets follow bear markets, recovery comes with time and disciplined investing. Leveraging past downturns as a learning opportunity enhances future decisions, leading to more resilient investment strategies and fostering confidence in the face of uncertainty.

Strategies for Weathering Bear Markets

One effective strategy during bear markets is to strengthen cash reserves. Having liquid assets can provide flexibility, allowing investors to capitalize on undervalued assets when market conditions improve. Implementing a systematic investment plan, such as dollar-cost averaging, can be advantageous. This approach involves investing a fixed amount regularly, regardless of market conditions, thereby smoothing the cost basis over time. Investors should also consider reallocating their portfolios towards defensive sectors that typically perform better during downturns. Sectors like utilities and consumer staples often sustain demand, providing a buffer against economic fluctuations. During such times, trimming exposure to high-risk assets can preserve capital. Furthermore, keeping abreast of macroeconomic conditions can inform better decision-making. For example, recognizing monetary policy shifts may signal upcoming market trends. Engaging with reliable financial sources ensures informed investments, while also networking with other investors can provide emotional support. Emotional resilience is vital in maintaining a course through volatility. Educating oneself continuously about market dynamics bolsters confidence in investing, enabling individuals to survive and thrive through bear markets while ensuring alignment with long-term objectives.

Bear markets often accompany economic recessions, leading to heightened fear and uncertainty. Understanding historical trends equips investors to manage such downturns more effectively. For instance, post-2008 financial crisis, many investors learned to identify critical signals for economic recovery. Instead of panicking, staying informed about key indicators, like unemployment rates and GDP growth, can enable investors to make rational decisions. Assessing company fundamentals remains paramount; those with solid financials and growth potential often rebound faster post-bear market. Additionally, examining past market recoveries reveals patterns helpful in predicting future performance. Implementing stop-loss orders can also safeguard portfolios during downtrends, minimizing losses by automatically selling assets when they fall to a preset price. Psychological factors play a significant role in bear markets; fear can lead to irrational selling. By acknowledging this reality, investors can adopt a rational mindset. Joining investor education programs and seminars can bolster skills and knowledge, helping individuals become both resilient and informed. Mastering emotional control paves the way towards strategic investing, transforming fears into proactive strategies that enable navigating bear markets with confidence and foresight.

Another element crucial in surviving bear markets is the power of patience. Investors who remain patient and wait for the market to recover typically enjoy substantial long-term gains. Holding onto investments instead of selling at low prices preserves capital and allows assets to benefit from eventual market rebounds. History demonstrates that many investors miss out on significant gains by exiting too early during downturns. Moreover, reinvesting dividends during bear markets can significantly enhance overall returns. Dividend-paying stocks can contribute to portfolio stability by providing income during challenging times. Many successful investors highlight the importance of maintaining a disciplined approach, which involves adhering to investment strategies and not succumbing to market noise. Establishing clear financial goals allows individuals to navigate through uncertainty with purpose. Setting realistic expectations for recovery timelines fosters resilience, keeping investors engaged and focused on long-term financial health. Consistency in reviewing and adjusting portfolio allocations can also help maintain investment performance while minimizing exposure to broader market declines. Eventually, patience, coupled with strategic financial planning, proves invaluable through bear markets, ensuring steady progress towards achieving wealth-building objectives.

The Importance of Emotional Intelligence in Investing

Emotional intelligence significantly affects investment decisions, especially during bear markets. The capacity to understand and manage emotions can lead to better decision-making in times of financial stress. For many investors, the thick of a bear market can incite anxiety and drive impulsive actions, such as panic selling. Developing emotional intelligence can equip investors with tools to recognize these feelings and mitigate their impacts. Mindfulness techniques, such as meditation or mindful breathing, can foster a sense of calm and clarity, reinforcing sound investment judgment. Additionally, cultivating a strong support network filled with knowledgeable investors can be invaluable. Engaging in discussions about market fluctuations can alleviate feelings of isolation commonly felt during downturns. Furthermore, pursuing continuous education helps bolster confidence in making informed investment choices during turbulent times. Analyzing various investment scenarios and participating in strategy discussions can prepare investors to respond effectively to inevitable market changes. Ultimately, incorporating emotional intelligence strategies into investment practices prepares investors to navigate bear markets with steadfast resolve, promoting assuredness in decision-making processes while remaining focused on long-term growth objectives.

Regular portfolio reviews are essential during bear markets, allowing investors to evaluate their asset allocations and adjust strategies. Assessing performance in light of market conditions ensures that investments align with individual goals and risk tolerances. This practice fosters an adaptive mindset, promoting a willingness to make changes when necessary to optimize investment outcomes. Maintaining an investment journal can also be advantageous; documenting thoughts and strategies encourages reflection and reinforces critical decision patterns. Additionally, leveraging modern technology can aid in portfolio management. Utilizing investment apps offers real-time insights and alerts, helping investors remain informed and agile. Collaboration with financial advisors who specialize in bear market strategies can also prove beneficial, providing insights tailored to current market conditions. Understanding historical performance data can unveil patterns that inform future strategies. Recognizing cyclical trends in market behavior equips investors with awareness as they navigate future uncertainties. These practices not only enhance investment acumen but also embed a strong sense of security during turbulence. Through regular assessment and education, one can maintain investment strategies aligned effectively with overarching goals.

In conclusion, surviving bear markets relies on a combination of financial knowledge, emotional intelligence, and strategic planning. Each market downturn offers a wealth of lessons that can ultimately bolster future financial success. Incorporating these principles into investment strategies equips individuals to face potential risks with confidence. Adopting a long-term perspective, maintaining patience, and continuously educating oneself are essential for successful navigation through bear markets. Furthermore, implementing practical strategies, like strengthening cash reserves and engaging in regular portfolio reviews, fortify resilience during challenging economic times. Emphasizing the psychological aspect of investing highlights the importance of emotional control and mental fortitude in decision-making. By understanding historical market behavior and applying these lessons, investors can transform adversity into opportunity, emerging more robust in their financial endeavors. Investing during bear markets isn’t merely about survival; it’s about leveraging challenges for growth and opportunity. Ultimately, adopting a holistic approach encompassing knowledge, emotional steel, and strategic planning sets a robust foundation upon which investors can thrive, no matter the economic climate.