How Ethics Influence Corporate Financial Policies

The financial sector plays a crucial role in maintaining economic stability, and integrating ethical practices into corporate governance is essential to uphold integrity and transparency. The importance of ethics in finance cannot be overstated, as it not only impacts the company’s reputation but also affects stakeholder trust. Ethical finance practices in corporate governance lead to well-defined policies, ensuring adherence to regulatory frameworks and enhancing accountability. Moreover, organizations that prioritize ethical behavior often experience improved employee morale and retention, as a strong ethical foundation fosters a positive work environment. By implementing comprehensive training programs focused on ethics, businesses can empower employees to make informed decisions aligned with the organization’s values. This process cultivates a culture of ethics that resonates throughout the organization, encouraging everyone to uphold integrity. Such a landscape not only mitigates risks but also positions the company as a responsible entity in the eyes of consumers and investors. With the growing expectation for corporations to demonstrate social responsibility, ethical finance practices are increasingly crucial to long-term success and sustainability in today’s competitive market.

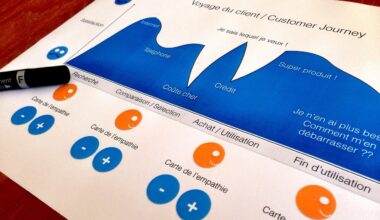

One key aspect of ethical finance is its influence on investment decisions and capital allocations. Ethical considerations shape organizational frameworks, leading to enhanced corporate governance policies that integrate sustainability and social responsibility. Investors today are more inclined to support companies that prioritize ethical standards without compromising return on investments. By aligning their financial objectives with societal values, organizations can attract a dedicated pool of investors focused on ethical practices. Furthermore, integrating Environmental, Social, and Governance (ESG) criteria ensures that corporate policies reflect a broader commitment to making a positive impact on society. Companies that engage in responsible investment behaviors report higher levels of engagement from stakeholders, which can translate into increased overall profitability. Therefore, organizations must not only embrace ethical finance but also transparently communicate their values and practices to the public, ensuring that stakeholders are well-informed. Effective communication surrounding ethical policies can build trust and promote a sense of partnership between companies and their investors. This shared vision can ultimately lead to more sustainable financial growth and further reinforce ethical practices in the corporate finance landscape.

The Role of Regulation in Ethical Finance

Regulatory compliance is integral to the implementation of ethical finance practices in corporate governance. Governments and regulatory bodies have laid out frameworks designed to maintain transparency and accountability in financial practices. Organizations that fail to comply with regulations risk facing legal repercussions, financial penalties, and reputational damage. Regulations help define ethical standards and establish best practices across the finance sector, providing a guideline for organizations to follow. Additionally, adhering to these regulations fosters goodwill among stakeholders as it demonstrates a company’s commitment to ethical governance. Corporate governance codes, which vary by region, emphasize the importance of ethical conduct in finance while outlining specific expectations. Compliance with such codes can signal to investors and the public that organizations prioritize ethics in their financial dealings. Furthermore, as stakeholders increasingly call for accountability, regulatory frameworks will likely evolve, demanding heightened commitment to ethical finance. Companies must stay ahead of these trends by fostering a proactive approach to compliance and aligning their corporate governance policies with the latest regulatory guidelines, thus enhancing their long-term viability.

The commitment to ethics in finance should not just reflect compliance with regulations but also encompass a genuine desire to promote fairness and equity. Companies must establish a strong ethical culture, encouraging employees across all levels to uphold these values in their daily activities. By doing so, organizations can inspire a sense of responsibility and ownership, which can lead to improved overall performance. Furthermore, organizations that invest in corporate social responsibility initiatives exemplify their dedication to ethical practices by demonstrating a willingness to contribute positively to society. These initiatives can take various forms, including community investment, sustainable sourcing, and employee volunteer programs. Such actions not only benefit society but also create a more engaged workforce, which translates into better customer service, innovation, and ultimately greater profitability. Encouraging ongoing education and dialogue around ethics can further reinforce the importance of maintaining high ethical standards in finance, fostering an environment where best practices are the norm. Business leaders play a pivotal role in driving this change, paving the way for a more ethical financial landscape that values integrity and social responsibility.

Challenges in Upholding Ethical Finance

Despite the recognized benefits of ethical finance practices, organizations often face significant challenges in their pursuit. The pressure to deliver short-term financial results can lead to ethical dilemmas, where companies may be tempted to prioritize profit over ethical standards. Additionally, the complexity of financial products and regulations can create confusion, leading to unintentional non-compliance or unethical behavior. Companies must navigate these complexities while remaining true to their values and commitment to ethical governance. Furthermore, the competition in today’s financial landscape can drive organizations to adopt aggressive strategies that might compromise ethical practices. To overcome these challenges, it is vital for organizations to engage in continuous reflection and reassessment of their corporate governance strategies, ensuring they remain aligned with ethical values. Regular training for staff on ethical standards and decision-making can reinforce this commitment. Moreover, fostering an environment where employees feel safe to voice concerns or report unethical behavior without fear of retribution is crucial. Addressing these challenges can ultimately enhance an organization’s ability to maintain ethical finance practices, contributing to a sustainable and credible financial ecosystem.

Incorporating stakeholder input is essential in establishing a robust ethical finance framework for corporate governance. Engaging with various stakeholders, including customers, employees, and communities, can provide valuable insights into their expectations and concerns regarding ethical practices. This input can help organizations tailor their financial strategies to align with stakeholder values, thereby fostering trust and loyalty. Technology advancement is another key factor in promoting ethical finance, as it offers tools for increased transparency in financial transactions and decision-making. Leveraging technology, such as blockchain or digital platforms, can lead to greater accountability in financial practices. Additionally, the integration of data analytics allows organizations to monitor performance against ethical standards while identifying areas for improvement. By embracing a stakeholder-oriented approach and utilizing technological advancements, companies can effectively enhance their commitment to ethical finance. Ensuring that voices from diverse backgrounds are heard in finance-related decisions can further enrich discussions and minimize potential pitfalls. Ultimately, empowering stakeholders contributes to a more comprehensive understanding of ethical finance considerations, fostering a sense of shared responsibility for financial governance.

Conclusion

In summary, integrating ethics into corporate financial policies is not merely a regulatory necessity; it is a strategic imperative. Organizations that prioritize ethical finance and governance are more likely to foster trust among stakeholders, which can lead to long-term growth and sustainability. The positive impact of ethical finance practices resonates across the entire organization, influencing decision-making at all levels. Furthermore, as consumers increasingly demand accountability and transparency, companies cannot afford to overlook the integration of ethics into their financial strategies. The intersection of ethics and finance requires ongoing commitment and adaptation to changing market conditions and stakeholder expectations. Businesses need to nurture an ethical culture and continuously engage stakeholders to refine their practices. Ultimately, organizations can achieve superior performance by leveraging ethical finance as a guiding principle in corporate governance. By striving to adhere to ethical standards, companies can position themselves as leaders in a rapidly evolving financial landscape, ultimately contributing to a more sustainable and equitable future for all. The journey towards ethical finance is complex but essential for fostering a resilient financial ecosystem.

In conclusion, ethical finance practices are imperative in shaping corporate governance and ethics in finance, and their impact extends far beyond compliance. By embedding ethical values into financial policies and practices, organizations can ensure accountability, transparency, and trust while promoting responsible corporate behavior. The role of ethics in finance facilitates a conscious dialogue about the responsibilities of businesses towards society, motivating companies to adhere to high standards. As the financial landscape continues to evolve, the emphasis on ethical governance will only intensify. Stakeholders will increasingly hold companies accountable for their actions, making it essential for organizations to prioritize ethical standards in all areas. This focus on ethics will ultimately prove beneficial not only for the organizations themselves but also for society at large. The future of finance lies in striking a balance between profitability and purpose, and businesses that successfully navigate this balance will thrive in an increasingly scrutinized environment. Ultimately, the journey of ethical finance is ongoing, and companies must remain vigilant in their commitment to integrity, sustainability, and social responsibility to forge a brighter economic future.