Mobile Payment Solutions Driving Economic Participation in Developing Regions

Mobile payment solutions have emerged as a transformative force in promoting financial inclusion throughout developing regions. These technologies enable individuals without direct access to traditional banking systems to engage in economic activities. For many, mobile payments serve as a gateway to financial services that were previously unavailable. By allowing users to transfer money seamlessly and conduct transactions via their mobile devices, these solutions facilitate daily commerce and entrepreneurship. Statistics show that regions with robust mobile payment infrastructures witness increased economic participation, with small businesses flourishing as a result. Consumers prefer these services due to their convenience, lower transaction costs, and reduced dependence on cash. Moreover, mobile payments have proven critical in crisis situations, such as natural disasters, enabling quicker financial assistance delivery. The ripple effect of these solutions on local economies is significant. They empower users financially, enhance access to markets, and stimulate job creation. Consequently, mobile payments are not merely a trend; they represent a fundamental shift in how people interact with money and economic systems, pushing towards a more inclusive global economy.

With the rising popularity of mobile payment solutions, it is essential to discuss their advantages. First and foremost, these systems simplify financial transactions for millions of individuals, leading to greater economic participation. In areas where banking infrastructure is limited, mobile payments bridge significant gaps. Users can easily download applications to send money, pay bills, or receive payments directly from their smartphones. This accessibility is vital for small business owners, as it enables them to accept payments, regardless of location. Furthermore, reduced transaction costs compared to traditional methods make mobile payments appealing to consumers and merchants alike. By providing better access to credit and financial resources, these solutions foster entrepreneurship and investment in various sectors. Mobile payment services often include features that allow users to save, invest, and insure, creating a well-rounded financial service ecosystem. As the technology evolves, partnerships with local governments and organizations aid in expanding these services further. Thus, the benefits extend beyond convenience; they contribute to the overall economic resilience in developing regions, allowing communities to thrive amidst challenges and uncertainties.

The Role of Technology in Financial Inclusion

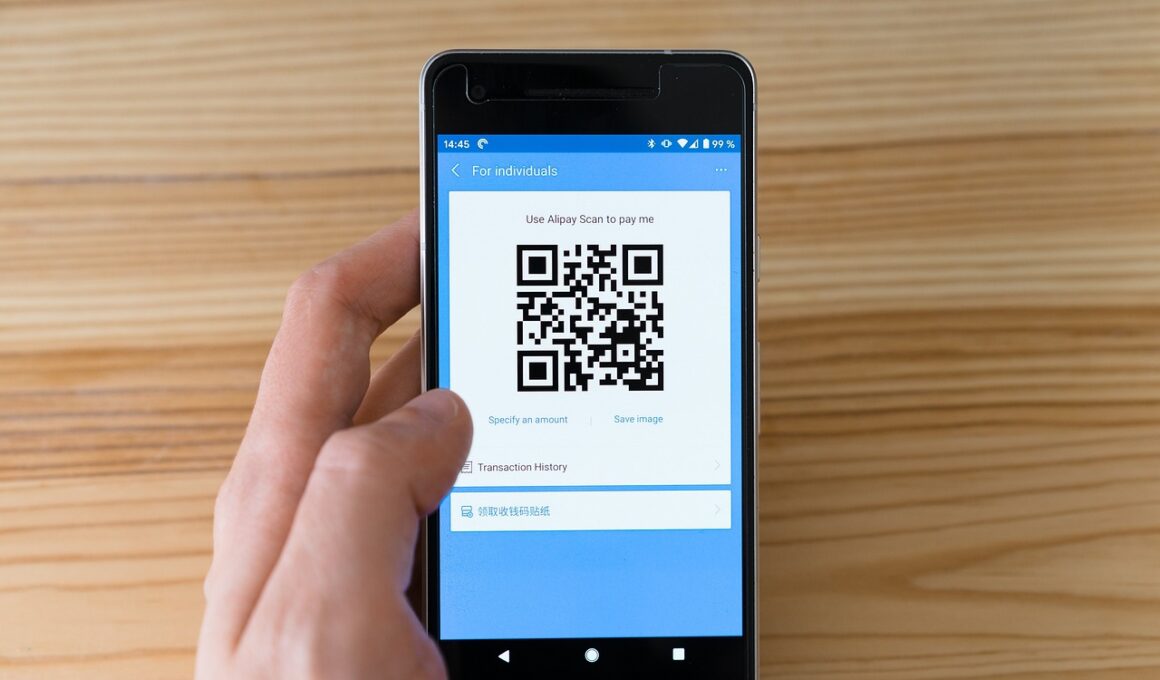

Technology plays a pivotal role in facilitating mobile payment solutions, driving financial inclusion in developing regions. Innovations such as smartphone applications and near-field communication have made it easier for people to conduct financial transactions securely and efficiently. The rise of internet connectivity, along with affordable smartphones, has broadened access to mobile payment systems. Peer-to-peer sharing apps, QR code payments, and digital wallets have created various ways for individuals to engage in financial activities. As technology evolves, it becomes increasingly vital for service providers to address security concerns. Consequently, robust encryption measures and fraud prevention protocols have become standard practice, fostering user trust. Furthermore, numerous companies are innovating solutions like biometric authentication, which enhances user security and accessibility. Such advancements not only bolster user confidence but also promote wider adoption among different demographics. The interplay between technology and financial inclusivity highlights the importance of collaboration between tech companies and local stakeholders. Such partnerships can identify specific needs, tailor offerings, and ensure sustainable growth in mobile payment adoption throughout these underserved regions.

Despite the growth of mobile payment solutions, challenges remain that must be addressed to deepen financial inclusion. Some users face barriers such as a lack of digital literacy, which can hinder their ability to navigate and utilize mobile payment platforms effectively. Educational initiatives that promote financial literacy and technology usage therefore become integral in overcoming these obstacles. Furthermore, regulatory frameworks must evolve to keep pace with the rapid development of digital finance. Policymakers need to establish conducive environments that support innovation while protecting consumers. As mobile payment ecosystems expand, issues related to privacy, data protection, and cybersecurity will also demand attention. Local governments should collaborate with private sector players to create stronger regulations that safeguard users. In addition, the geographic diversity of developing regions presents unique challenges, from varying infrastructure quality to differing cultural attitudes toward mobile technology. Tailored approaches that consider regional characteristics will be paramount in achieving widespread adoption and success. By addressing these challenges proactively, stakeholders can unlock the full potential of mobile payment solutions and empower millions to participate in the global economy.

Case Studies of Successful Implementation

Various case studies showcase how mobile payment solutions have successfully driven economic participation in developing regions. For instance, in Kenya, M-Pesa has revolutionized financial services, allowing millions to send and receive money via mobile devices. This platform has significantly enhanced access to banking services, particularly in rural areas, hurting high populations without bank branches. Similarly, in India, platforms like Paytm enable users to make payments, transfer funds, and access microloans. These services have empowered small entrepreneurs and boosted local economies significantly. These success stories highlight the indispensable role of trust in user adoption. Users need to feel confident in the security and reliability of mobile payment systems. Therefore, companies must prioritize safeguarding user data and providing excellent customer support. Moreover, these models illustrate the importance of fostering partnerships between mobile service providers, businesses, and local governments. Collaboration can help ensure accessibility, affordability, and responsiveness to consumer needs. As these examples demonstrate, effective implementation of mobile payment solutions can lead to significant economic benefits, improved livelihoods, and enhanced financial inclusion for underserved populations.

The future of mobile payment solutions in fostering financial inclusion looks promising, driven by continued innovation. Emerging technologies such as artificial intelligence, blockchain, and machine learning are set to reshape the landscape even further. These advancements can enhance security, automate fraud detection, and streamline user experiences. AI can personalize marketing strategies, identifying potential users more effectively, while blockchain technology offers transparent and secure transactions. Additionally, as internet access improves across developing regions, wider adoption of mobile payments is expected. Investment in digital infrastructure, supported by governments and private entities alike, will be critical. Furthermore, innovations in digital currency, like cryptocurrencies, have the potential to introduce alternative payment systems that could improve financial access. These changes will undoubtedly impact how individuals, especially in developing regions, interact with finances. By harnessing these trends and incorporating user feedback, mobile payment platforms can evolve to meet the needs of their users. The collective goal should be clear: to create an inclusive financial ecosystem that facilitates growth, empowers citizens, and fosters dynamic local economies.

Conclusion

In conclusion, mobile payment solutions are driving economic participation in developing regions, transforming financial landscapes. Their impact on financial inclusion cannot be overstated, as these technologies provide previously excluded populations access to essential financial services. By bridging gaps in traditional banking, mobile payments empower users, enhance economic resilience, and promote entrepreneurship. However, to build on this momentum, collaborative efforts among stakeholders are essential. Factors such as improved education, regulatory support, and technological advancements must be prioritized to address remaining challenges. By ensuring that mobile payments are secure, accessible, and user-friendly, the potential for these solutions to drive sustainable economic development will only increase. As we move forward, it is crucial to recognize the profound social and economic effects of mobile solutions in fostering inclusive growth. Looking ahead, the combination of innovative technologies and concerted community efforts will lead to empowered individuals who can participate fully in their economies. Therefore, the commitment to advancing mobile payment systems serves not just the individual but promotes the collective prosperity of communities in developing regions.

Mobile Payment Solutions Driving Economic Participation in Developing Regions