Crowdfunding Investments as a Source of Passive Income

Crowdfunding investments have emerged as a viable and exciting way to generate passive income. By pooling small amounts of money from several investors, innovative projects can secure funding while providing potential returns for contributors. This approach democratizes investment opportunities, enabling individuals to support various initiatives ranging from startups to real estate developments. One of the most appealing aspects of crowdfunding is the accessibility; even those with limited resources can participate in diverse projects. Investors can choose from platforms that focus on different sectors including technology, sustainable energy, and community services. Moreover, with careful research and planning, investors can tailor their portfolios to align with their interests and risk tolerance. It’s essential to analyze the projects before investing, considering the credibility and track record of the platform and its creators. As passive income sources continue to evolve, crowdfunding platforms present an attractive option due to the potential for significant returns. Thus, understanding how to navigate these investments and identify promising opportunities can lead to financial growth and diversification of one’s income stream.

Passive income is often described as earning money without active involvement after the initial effort. In the context of crowdfunding, it involves investing in projects that generate ongoing revenue streams. These can take various forms, including equity stakes in companies or contributions to real estate developments. By holding equity in a startup, investors may receive dividends or profit-sharing when the business thrives. Similarly, real estate crowdfunding allows individuals to invest in rental properties, sharing in the rental income generated over time. Many crowdfunding platforms provide tools to track and manage your investments, allowing for a simple way to monitor your financial involvement. While the potential for passive income is tempting, it comes with inherent risks. Not all projects succeed, and some may even fail, leading to a total loss of investment. Therefore, due diligence, thorough research about the projects, and understanding market trends are crucial to mitigate risks effectively. Overall, investing in crowdfunding ventures can foster a more diversified portfolio, combining traditional investments with innovative, growth-focused opportunities that suit various risk appetites.

Types of Crowdfunding Platforms

There are several types of crowdfunding platforms tailored for different types of investors. Each platform serves a diverse purpose, whether it be for launching new products, supporting creative endeavors, or funding real estate projects. Equity crowdfunding platforms allow investors to buy shares in startups for a portion of future profits. Reward-based platforms provide unique perks alongside investments, such as early access to products or special experiences. In contrast, lending platforms focus on consumer or business loans with set interest rates and terms, providing predictable returns. Real estate crowdfunding gives access to property markets without the need for large capital investments, often allowing investment in various property developments across multiple locations. Beyond established platforms, new models continue to evolve, fostering niche projects from art funding to social cause initiatives. Investors should explore these types to determine which aligns with their goals by researching platform credibility and sector performance. Understanding how different platforms operate is pivotal in developing a successful passive income strategy. This knowledge positions investors to make informed decisions about which crowdfunding opportunities are most likely to yield favorable financial outcomes.

The legal considerations of crowdfunding investments cannot be overlooked, as regulations evolve to protect both investors and entrepreneurs involved in these transactions. Depending on the country, different laws govern equity crowdfunding and securities offerings, impacting how funds can be raised and distributed. In the United States, the JOBS Act relaxed rules allowing startups to access public investors. However, platforms must still comply with appropriate regulations, including risk disclosures and reporting requirements. By familiarizing themselves with these legalities, investors can better safeguard their interests. It’s also critical for investors to review any contracts or agreements related to the crowdfunding projects they are interested in. Transparency and trustworthiness of the platform play an essential role in successful crowdfunding investments. Therefore, investors should cautiously examine the terms of engagement and seek platforms offering clear communication regarding project progress. Understanding these legal dimensions enables effective risk management, reducing exposure to potential fraud or mismanagement. When engaged responsibly, crowdfunding investments can significantly increase passive income while supporting innovative projects poised for growth in various sectors.

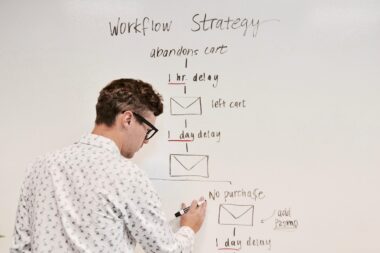

Evaluating Investment Opportunities

Evaluating investment opportunities in crowdfunding is vital for success in building a passive income portfolio. The first step is to thoroughly research the project and its creators, assessing their experience, track record, and business plan. Most crowdfunding platforms provide detailed information regarding projects, including financial projections, market analyses, and use of funds. Scrutinizing these documents allows investors to gauge potential risks and returns. A solid business model should combine a well-defined target audience with a unique selling proposition to differentiate itself. Additionally, monitoring market trends for the sectors involved can reveal the broader environment influencing success. Investors also benefit from reading reviews and testimonials regarding the platform’s reputation, which can indicate its reliability and integrity. Other factors like exit strategies, liquidity, and overall purpose of the project are also essential. Finding balance among these diverse assessments will help investors build a stronger understanding of what constitutes a worthwhile investment opportunity. By being diligent and applying critical thinking, crowdfunding investors can enhance their potential for achieving wealth through strategic, passive income sources.

Communities around crowdfunding projects often play a pivotal role in the success of investments. Engaging with other investors allows individuals to share insights and perspectives, drawing from others’ experiences. Many platforms foster community interactions through forums and networking events, enhancing collaboration among investors and creators alike. By establishing a sense of trust and camaraderie, backers may feel more compelled to contribute, increasing the likelihood of project success. Crowdfunding offers a unique opportunity for investors to play an active role in shaping business directions while still enjoying the benefits of passive income. Furthermore, staying involved in the creative process and following the project’s development may provide rewarding feelings aside from financial returns. Investing in crowdfunding typically requires patience, as returns may take time to materialize successfully. Cultivating relationships and trusting community feedback enhances the overall experience and creates opportunities for continuous learning. Investing wisely, combined with the input from knowledgeable peers, positions investors for long-term financial growth through superior passive income channels. Understanding community dynamics contributes significantly to overall investment strategy effectiveness.

Challenges and Risks in Crowdfunding

Crowdfunding investments undeniably come with challenges and risks that investors should consider carefully. As much as crowdfunding can lead to exciting avenues of passive income, it is not without its pitfalls. Market fluctuations, project failures, and changes in investor sentiment can influence the viability of crowdfunding investments. Many projects may not achieve their financial goals, leading to losses for investors who expect a return. Additionally, scams and fraudulent initiatives have been reported, making it essential to choose trustworthy organizations and platforms. As a safeguard, investors should not allocate more funds than they can afford to lose. Diversifying across several crowdfunding projects can reduce overall risk exposure. Moreover, investor patience is paramount, as passive income from crowdfunding initiatives may not be immediate. Understanding the timeframes involved in seeking returns and assessing the financial health of ongoing projects can be a complex undertaking. Therefore, developing a sense of market timing and realistic expectations based on thorough investigation is essential for successful outcomes. Overall, investors must be both proactive and prudent when pursuing passive income through crowdfunding to ensure sustainable financial growth.

In conclusion, crowdfunding investments can be a fruitful source of passive income for investors willing to navigate the complexities involved. By embracing the diverse opportunities available, individuals can mix their portfolios with unique projects, maximizing their potential for returns. Emphasizing thorough research, understanding project viability, and building community connections will increase the chances of finding sustainable income streams. Those interested should diligently pursue learning about various platforms, their regulatory landscape, and approaches for evaluating investment opportunities. Investors should also remain alert to the risks and challenges associated with crowdfunding investments, ensuring their strategies remain effective while mitigating exposure to potential losses. By fostering informed decision-making and engaging with like-minded investors, one can enhance potential returns. As the crowdfunding landscape continues to grow and diversify, it reinforces the need for adaptive investment strategies to keep pace with this dynamic market. Therefore, remaining educated and proactive is key to turning crowdfunding investments into sustainable sources of passive income that contribute positively to one’s overall financial well-being.