Integrating Keyword Research with PPC Campaigns in Financial Marketing

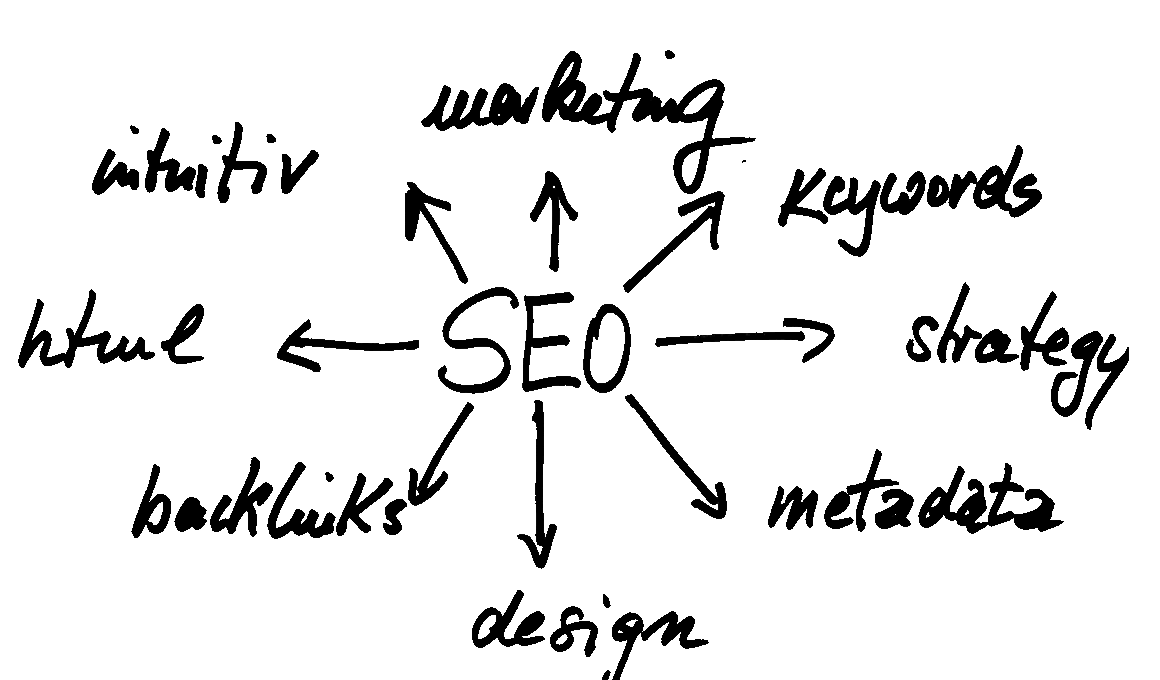

In the evolving world of digital finance, integrating keyword research with PPC campaigns is crucial. Proper keyword research enables marketers to identify and capitalize on opportunities that align with their target audience’s search intent. By focusing on specific financial terms, marketers can refine their ads to attract potential clients and funnel them towards conversion. It’s essential to gather insights into common queries and pain points prospective clients may have. In doing so, marketers can construct optimized ad groups that resonate with users, thereby increasing click-through rates (CTR). Employing tools like Google Keyword Planner, SEMrush, or Ahrefs can help identify high-volume, low-competition keywords. Furthermore, analyzing competitors can provide valuable insights to understand what works in the current landscape, allowing marketers to adjust their strategies accordingly. Each ad should utilize these targeted keywords naturally within the copy, creating a more engaging user experience. As keywords evolve, continuous monitoring and adjusting will keep campaigns aligned with industry trends and user preferences. Utilizing these strategies ensures that financial marketers stay ahead in a competitive market, maximizing their ROI and overall impact.

Understanding what works best in various financial niches is vital as well. Recognizing the differences between local and global targeting can help in executing a successful PPC campaign. For example, investment advising may resonate differently in urban areas versus rural ones. Localized keywords can increase relevance, attracting the right audience to specific financial products and services. Using geo-targeted keywords like ‘financial advisor in [City]’ can immensely improve visibility among local clients. Moreover, segmenting financial services offered, like mortgages, insurance, or retirement planning, allows for tailoring of keywords and ads that address the specific needs of customer segments. By crafting relevant ad copy that aligns with chosen keywords, businesses can enhance their message’s effectiveness. The use of negative keywords also plays a critical role, allowing marketers to filter out irrelevant traffic that could dilute ad performance. By doing so, budgets are used more efficiently, ensuring that funds are allocated to reach genuinely interested prospects. Optimizing landing pages with targeted keywords ensures a seamless experience, increasing conversion rates among prospects who click on the ads. Therefore, keyword research is not merely a starter in PPC campaigns; it is a strategic pillar influencing success outcomes.

The Role of Metrics and Analytics in PPC Campaigns

Metrics and analytics serve as the backbone of effective PPC campaigns in financial marketing, providing insights crucial for success. By utilizing tools such as Google Analytics, marketers can understand visitor behavior and measure their campaigns’ effectiveness. Monitoring click-through rates, conversion metrics, and cost-per-acquisition are essential. Additionally, the use of conversion tracking can provide insights into which keywords drive the most traffic and resulting leads. This data analysis allows marketers to shift budgets dynamically to high-performing campaigns, ensuring optimal resource allocation. Over time, analyzing this data leads to a deeper understanding of customer preferences and trends. This analysis should include negative keyword performance, identifying ineffective keywords that could drain resources without yielding valuable returns. Keeping an eye on metrics enables rapid adjustments to enhance ad copy and landing pages, ultimately improving user engagement. Regular testing, such as A/B testing, allows for the optimization of ad copy, ensuring relevance and effectiveness. In this light, metrics inform future keyword research, aiding in the refinement of ad strategies, and increasing the likelihood of achieving business objectives seamlessly within the financial sector.

Another important consideration in the integration of keyword research into PPC campaigns is the impact of seasonal trends in finance. Financial advisors and institutions can leverage seasonal keywords that reflect the cyclical nature of the industry, such as tax-related terms during tax season or investment keywords aligned with stock market trends. This proactive approach ensures the ads resonate during periods when potential clients actively search for financial services. By planning ahead and conducting thorough keyword research, marketers can prepare PPC campaigns to target these seasonal opportunities effectively. Furthermore, competing with other financial firms necessitates a solid understanding of content strategies that pair well with PPC. Well-researched keywords should guide content strategy, ensuring consistency across blogs, landing pages, and social media posts. The uniform approach not only enhances brand authority but creates a cohesive user experience that guides potential clients seamlessly from ads to useful information. Creating valuable, informative content capitalizes on trending financial queries and includes targeted keywords that drive both organic and paid traffic. As such, a streamlined content strategy is instrumental in increasing user trust and establishing industry presence.

Ad Copy and the Art of Keyword Integration

The essence of effective PPC campaigns in financial marketing also lies in the art of ad copy creation paired with keyword integration. Crafting compelling, succinct ad copy is critical for captivating an audience’s attention. The strategic placement of keywords in ad headlines and descriptions aids in maximizing visibility and engagement. Additionally, the use of emotional trigger words or call-to-action phrases can enhance conversion potential, motivating users to click. Utilizing keywords in a way that feels natural within the context maintains quality and relevance, improving ad quality scores on platforms like Google Ads. Underutilizing keywords could lead to poor performance, while overstuffing them could transform the copy into an awkward read. Therefore, finding that sweet spot for keyword usage is paramount. It may help to test various versions of ad copy to ascertain which combination performs best. Marketers should not hesitate to revise initial approaches based on performance data. The fine balance between keyword optimization and compelling messaging is crucial for ensuring ads stand out in saturated financial markets where competition is fierce.

Furthermore, maintaining an adaptive approach in PPC campaigns driven by continuous keyword research aligns closely with the dynamic financial landscape. Changes in regulations, consumer behavior, and market conditions require marketers to keep their keyword strategies fresh. Regularly revisiting their keyword list enables marketers to discard outdated terms while incorporating emerging ones. Attending industry webinars or financial market analysis can provide insights that shape keyword strategies effectively. Also, staying active in the financial community can unveil trending terms that resonate with today’s audience. Social listening tools can also play a pivotal role, gathering real-time insights and feedback from potential customers regarding their interests and concerns. Responding quickly to emerging trends ensures PPC campaigns are relevant and maximize reach. Deployment of new keyword sets based on these insights strengthens brand authority and builds trust within the community. Continuous experimentation through various ad formats, placements, and budgets enhances the responsiveness of campaigns to shifting market nuances. Adapting to these shifts is essential for maintaining competitiveness in the ever-evolving world of financial marketing, where businesses strive to stand out.

Conclusion: The Future of Keyword Research in Financial PPC

The future of integrating keyword research within PPC campaigns in financial marketing looks promising, characterized by increased personalization and sophisticated data utilization. Digital transformation is revolutionizing how financial services approach marketing, requiring real-time adjustments and deep data dives into customer behavior. As artificial intelligence and machine learning tools evolve, analyzing vast sets of keywords will become increasingly efficient and insightful. Predictive analytics may also play a role, highlighting emerging financial topics and consumer interests. Such advancements allow marketers to stay ahead of the curve by identifying lucrative opportunities even before they become mainstream. Furthermore, the emphasis on localized strategies will continue to grow, enhancing the relevance of marketing efforts across various demographics. Marketers that leverage these innovations will likely build more meaningful connections with their audiences, fostering trust and loyalty. The collaborative effort between keyword research and PPC will remain fundamental in creating high-performance campaigns. Those adapting and evolving their strategies with market demands will succeed in this competitive digital space. Emphasizing a cohesive approach across channels ensures sustained growth and long-term success in the financial marketing domain.

This is another paragraph with exactly 190 words…