Mobile Commerce Optimization for Financial Services: Challenges and Solutions

In recent years, mobile commerce has become an essential avenue for financial services to engage with customers. As more consumers utilize mobile devices for banking and transactions, companies in the financial sector face the challenge of optimizing mobile commerce environments effectively. Optimizing these environments requires an understanding of user experience, security, and the behavioral patterns of consumers who prefer mobile platforms. Financial organizations must prioritize creating intuitive interfaces that ensure easy navigation while offering comprehensive functionalities. Moreover, it’s crucial to maintain high-security standards to protect sensitive financial data from potential threats. Integrating advanced analytics tools can also help identify user trends and preferences, allowing companies to tailor their offerings accordingly. Therefore, investing in mobile commerce optimization not only enhances customer satisfaction but also aids in sustaining a competitive edge in a rapidly evolving digital ecosystem. A focused strategy is vital, as the returns on investment can translate to increased revenues and customer loyalty over time. Hence, a proactive approach can help financial services harness the full potential of mobile commerce, transforming challenges into lucrative opportunities for growth and innovation.

One major challenge in mobile commerce optimization for financial services is ensuring data security and privacy. With the increase in cyber threats, financial institutions are under constant pressure to safeguard customer information while conducting transactions through mobile platforms. Implementing robust security measures like encryption, multi-factor authentication, and continuous monitoring has become paramount. Customers are increasingly aware of the risks associated with mobile banking and demand reassurance that their data is secure. Financial organizations must invest in advanced technologies that not only enhance security but also provide seamless user experiences. Moreover, compliance with regulations such as GDPR and PCI DSS is critical in maintaining user trust and meeting operational standards. By prioritizing customer privacy, financial institutions can create a secure environment that encourages mobile commerce adoption. Furthermore, transparent communication regarding security measures can foster customer confidence. Tailored marketing strategies focused on privacy and security can also positively influence customer perceptions. Emphasizing these aspects can mitigate the risk of data breaches, helping companies maintain their reputations and build lasting relationships with their clientele. Consequently, effective security measures can enhance customer satisfaction and drive engagement across mobile commerce platforms.

The Role of User Experience

Optimizing user experience is another critical factor impacting mobile commerce in the financial services sector. A poorly designed mobile application can result in significant losses due to high abandonment rates. Financial services must focus on creating a user-friendly interface that simplifies the transaction process. This involves intuitive navigation, clear call-to-action buttons, and a visually appealing layout to engage users effectively. Conducting usability testing can reveal pain points and areas for enhancement, allowing organizations to refine their user interfaces. Additionally, incorporating features such as personalization and customizability can significantly boost user satisfaction. Customers appreciate tailored experiences, and utilizing analytical insights can help craft personalized solutions. Apart from aesthetics, ensuring fast-loading times and optimized performance across various devices is essential for retaining users. Frequent updates reflecting user feedback can also improve the app’s performance while showcasing the company’s commitment to user-centered design. Therefore, prioritizing user experience in mobile commerce adds substantial value and can set a financial service apart from its competitors in the crowded marketplace.

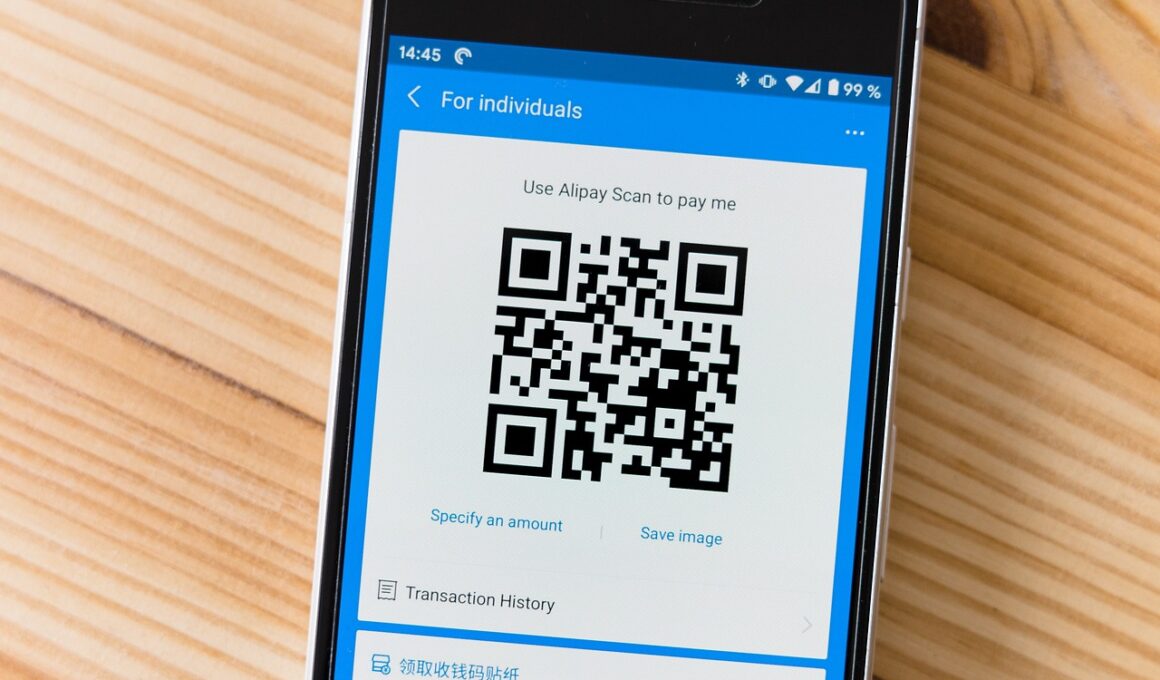

In addition to user experience, another aspect that financial institutions must consider is the integration of mobile payment systems. With a diverse range of payment options available, it’s essential to offer users flexibility when performing transactions. Financial services can optimize their applications by incorporating popular mobile wallets, contactless payments, and peer-to-peer transfer options for greater convenience. Furthermore, establishing robust partnerships with payment gateways can facilitate smoother transactions and reduce processing times. As consumers increasingly rely on digital financial solutions, developing an adaptable payment infrastructure is vital for creating a seamless experience. Weighing the benefits of new and emerging technologies, such as biometric payments, can also enhance security while catering to modern consumer preferences. An evaluation of these options can reveal which solutions effectively meet the needs of the target audience. Continually monitoring user engagement can provide vast insights into transaction preferences and help adjust offerings accordingly. This holistic approach enables financial services to remain competitive and innovative, strengthening their market presence and attracting tech-savvy customers looking for efficient mobile commerce solutions.

Challenges with Customer Trust

Building and maintaining customer trust in mobile commerce represents another challenge that financial institutions must address. Given the sensitivity of the financial information shared via mobile platforms, customers can be apprehensive about the security of their data. To cultivate trust, financial organizations need to prioritize transparency within their operations. Clear communication regarding privacy policies and how customer data is utilized can empower consumers to feel more confident while using mobile applications. Customer-centric approaches that emphasize security features can also influence purchasing decisions positively. Incorporating consistent and proactive customer support mechanisms provides reassurance that assistance is readily available when needed. It’s essential to educate users about the measures taken to protect their information and mitigate potential risks while transacting. Additionally, effective response strategies to data breaches can create an atmosphere of reliability and professionalism. Regular audits and security assessments can further reinforce confidence in a financial institution’s practices. By navigating these challenges, organizations in the financial sector can create loyal relationships with customers, translating into enhanced mobile commerce success and growth over the long term.

Effective marketing strategies form an essential component in optimizing mobile commerce for financial services. Engaging and targeted marketing campaigns can drive user acquisition and retention significantly. Utilizing data-driven techniques to analyze customer behavior can help tailor marketing messages that resonate with the audience. Multichannel marketing that encompasses social media, email, and in-app promotions increases visibility, ensuring the brand remains top of mind. Implementing gamification techniques within mobile applications can further encourage user interaction and enhance customer journeys. Furthermore, incentivizing customers through loyalty programs can also drive engagement and motivate them to use mobile services more frequently. Developing high-quality content that educates users about mobile commerce benefits can enhance awareness, fostering a community of informed users. Continuous evaluation of marketing strategies based on performance metrics allows financial institutions to adapt and optimize campaigns to their specific target demographic continually. Investing time in understanding market dynamics will contribute to creating effective marketing strategies that promote user loyalty and improve overall service efficiency. Thus, by leveraging these marketing practices, financial services can enhance their mobile commerce presence substantially.

Future Trends in Mobile Commerce

Looking ahead, anticipating future trends in mobile commerce will be crucial for financial services seeking sustained growth. Trends such as artificial intelligence, machine learning, and chatbots will offer innovative solutions to streamline customer interactions. The integration of AI can help financial institutions provide personalized experiences while enhancing their automated functionalities. Moreover, as mobile technology rapidly advances, adapting to new payment methods, including cryptocurrency, may become vital for ongoing relevance in the market. Financial organizations must remain agile and proactive in leveraging technological advancements to optimize their offerings continually. Implementing augmented reality features within mobile applications can provide users with a unique and immersive banking experience, paving the way for deeper engagement. Additionally, trends indicating a shift toward social shopping may present opportunities for financial services to explore partnerships with e-commerce platforms. Staying informed about evolving consumer behavior, preferences, and technological advancements will empower financial institutions to embrace changes and position themselves effectively for increased mobile commerce success. Committing to innovation will ensure financial services remain competitive in the ever-changing landscape of mobile commerce optimization.

In conclusion, mobile commerce optimization presents both significant challenges and immense opportunities for financial services. By addressing issues related to data security, user experience, customer trust, effective marketing, and future trends, financial organizations can thrive in the mobile commerce space. The continuous evolution of technology and changing consumer behaviors demands that financial institutions remain agile and adaptive to market conditions. Establishing comprehensive strategies that encompass these diverse aspects can help organizations respond effectively to the complexities of mobile commerce. As a result, incorporating analytics tools and leveraging data insights can enable organizations to understand user preferences better and streamline their offerings accordingly. Furthermore, creating a customer-centric approach will help financial services build trust, ultimately fostering loyalty and enhancing user satisfaction. Investment in both technology and human resources to improve mobile commerce frameworks is essential. Consequently, financial institutions that embrace the principles of optimization will be better prepared to navigate the competitive landscape and align their offerings with customer needs. Therefore, prioritizing these aspects will not only benefit organizations in terms of growth but also enhance the overall customer experience in the mobile finance domain.