Integrating Biometric Authentication into KYC Processes

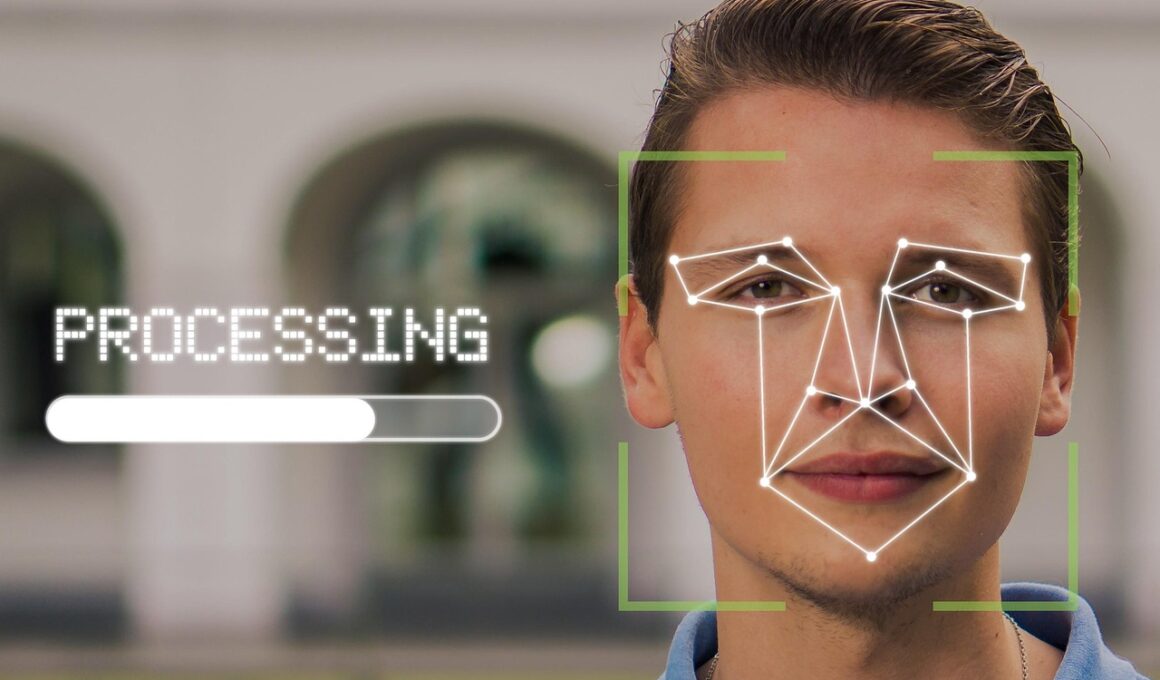

In the modern finance landscape, ensuring customer trust and security is more critical than ever, particularly with the rise of digital transactions. Biometric authentication can provide an innovative solution to streamline Know Your Customer (KYC) processes, enhancing customer experience. By using unique biological traits such as fingerprints or facial recognition, financial institutions can quickly verify identities, reducing the risk of fraud. This approach aligns with regulatory requirements while also offering customers a more convenient way to access services. Traditional identification methods often require customers to present multiple documents and go through a lengthy verification process. However, biometric systems revolutionize this by enabling instant recognition and validation. Financial institutions should invest in robust biometric systems and integrate them within their existing infrastructure. Education regarding biometric technology and its benefits to clients is also essential in fostering user acceptance. Furthermore, collaboration with technology providers can help create secure platforms that respect privacy concerns while delivering efficient services. Ultimately, adopting biometric authentication will likely pave the way for a new era in customer verification and identity management in finance, benefiting both institutions and their clients by promoting efficiency and security.

Furthermore, the integration of biometric authentication into KYC processes presents several tangible benefits. For instance, it significantly reduces the possibility of identity fraud, an increasing concern in today’s digital transactions. By leveraging advanced biometric recognition technologies, financial institutions can rely on unique physical traits that are much harder to replicate than traditional identification documents. Consequently, customers feel more secure knowing that their sensitive information is well-protected. Additionally, biometric data is often encrypted and stored securely, minimizing potential breaches. Enhanced compliance with regulatory standards is another key advantage. Financial institutions are required to adhere to strict KYC regulations, and the adoption of biometric solutions aids in fulfilling these obligations efficiently. Moreover, the implementation of biometric authentication can lead to faster onboarding processes for new clients, improving overall customer satisfaction. As a result, businesses can enjoy higher retention rates, as clients appreciate seamless interactions. Furthermore, many institutions report reduced operational costs associated with traditional identity verification methods, making biometric solutions cost-effective in the long term. This shift creates opportunities for banks and financial services to invest in other critical areas while reassuring clients about their security.

Challenges in Implementation

Despite the numerous benefits that biometric authentication offers in KYC processes, there are challenges that institutions must navigate during implementation. Privacy concerns are often at the forefront, as customers may hesitate to share their biometric data due to fears regarding misuse. Financial organizations must prioritize transparency by clearly communicating how data will be used and safeguarded. Establishing comprehensive privacy policies that adhere to regulations is essential for addressing these concerns. Technical reliability is another significant hurdle; biometric systems can sometimes fail, leading to frustration among customers. Any inconvenience in accessing services can deter users from embracing technology. Therefore, institutions need reliable backup processes to handle exceptions effectively. Furthermore, ensuring compatibility with existing systems can pose integration issues. Integrating advanced biometric authentication technologies may require substantial investments in technology and infrastructure upgrades. There is also a need for cross-border compliance, as different countries impose various regulations regarding biometrics. Institutions operating in multiple regions should remain aware of these differences and adapt accordingly to avoid legal pitfalls. Therefore, understanding and addressing these challenges is vital for successful integration of biometric authentication into KYC processes in finance.

Another essential aspect of integrating biometric authentication into KYC processes is ensuring customer education and adoption. Users must be familiar with the technology and understand its functionalities to feel secure using biometric methods. Financial institutions can play a pivotal role by creating informative resources, including webinars, tutorials, and FAQs, that address potential user questions and concerns. A proactive approach can facilitate smoother transitions to new systems while fostering trust. Building a robust support system is equally crucial; customers should feel confident that assistance is readily available if challenges occur. Conducting regular feedback sessions can help institutions gather insights to improve implementations. Moreover, continuous monitoring and upgrades help maintain system security and performance. It’s vital for institutions to remain vigilant and responsive to emerging threats. As innovations in biometric technology evolve, incorporating enhancements will ensure efficacy and security are prioritized. Industry collaboration can provide insights and innovative solutions tailored for seamless transitions. Overall, a well-thought-out strategy focusing on user education, comprehensive support systems, and ongoing updates will significantly impact successful biometric authentication in KYC processes within finance.

Future Trends in KYC Biometric Solutions

This innovative landscape will continue to evolve in the coming years, particularly in the realm of KYC processes. Emerging technologies, such as artificial intelligence and machine learning, are poised to enhance biometric authentication further. These advancements will enable financial institutions to analyze biometric data more efficiently, allowing for real-time fraud detection and improved accuracy. Additionally, multi-modal biometric systems that utilize a combination of distinguishing features can increase recognition effectiveness and include voice and iris recognition. As competition among financial institutions intensifies, those embracing cutting-edge biometric solutions are likely to differentiate themselves in the market. Moreover, increased regulatory scrutiny may push institutions toward adopting biometrics to meet KYC compliance effectively. Consumers will likely demand more secure solutions, leading to even broader acceptance of biometric verification. Partnerships between banks, fintech companies, and technology firms will also be critical for advancing KYC biometric systems. Collaborative innovations will lead to more effective and secure solutions tailored to specific customer needs. Ultimately, these trends signify a move towards a more secure, efficient, and user-friendly financial ecosystem that prioritizes identity verification and customer satisfaction through advanced biometric technologies.

In summary, the integration of biometric authentication into KYC processes heralds a transformative shift within the finance sector. By addressing challenges related to implementation, privacy, and user education, financial institutions can significantly enhance their customer verification methods. Biometric solutions not only streamline operations but also improve compliance with regulatory standards while fostering customer trust. As technology continues to evolve, keeping pace with innovations is vital to ensure institutions remain competitive and secure. The future will likely see increased adoption of biometric methods, along with reliable systems and processes to mitigate risks. Embracing this transition requires an investment in people, technology, and strategic partnerships, all focused on maximizing efficiency and security. Through these efforts, financial institutions can navigate the complexities of modern identity management more effectively. Additionally, the collaborative approach of various stakeholders, including technology vendors and regulatory bodies, will significantly impact the establishment and growth of biometric solutions in KYC processes. Overall, the positive trajectory towards more secure identification methods will benefit both financial institutions and their customers, creating a safer and more efficient landscape for digital transactions and relationships.

Conclusion

The integration of biometric authentication into KYC processes is no longer a luxury but a necessity for financial institutions looking to thrive in a digital age. The security, efficiency, and user-friendly nature of biometric solutions are reshaping how financial organizations approach identity verification. As we move forward, it is crucial for institutions to remain agile, adapt to emerging trends, and embrace innovations that enhance trust and satisfaction. Stakeholders must collaborate to foster a shared vision of a more secure financial landscape, where identification processes are streamlined without compromising customer safety. Continuous education and open communication with customers will be pivotal in building a culture of acceptance and understanding regarding biometric technologies. Financial institutions should actively monitor and refine their biometric systems, incorporating new features and addressing concerns responsibly. Ultimately, success in adopting biometric authentication will not only strengthen KYC processes but also contribute to higher retention rates and customer loyalty. As technology continues to advance, the potential for biometric solutions in finance is limitless. The industry’s focus must remain committed to a future where security and convenience harmoniously coexist for all stakeholders in the financial ecosystem.

In conclusion, the integration of biometric authentication into KYC processes is no longer a luxury but a necessity for financial institutions looking to thrive in a digital age. The security, efficiency, and user-friendly nature of biometric solutions are reshaping how financial organizations approach identity verification. As we move forward, it is crucial for institutions to remain agile, adapt to emerging trends, and embrace innovations that enhance trust and satisfaction. Stakeholders must collaborate to foster a shared vision of a more secure financial landscape, where identification processes are streamlined without compromising customer safety. Continuous education and open communication with customers will be pivotal in building a culture of acceptance and understanding regarding biometric technologies. Financial institutions should actively monitor and refine their biometric systems, incorporating new features and addressing concerns responsibly. Ultimately, success in adopting biometric authentication will not only strengthen KYC processes but also contribute to higher retention rates and customer loyalty. As technology continues to advance, the potential for biometric solutions in finance is limitless. The industry’s focus must remain committed to a future where security and convenience harmoniously coexist for all stakeholders in the financial ecosystem.