Enhancing Customer Onboarding with Digital Identity Solutions

In the rapidly evolving landscape of financial services, digital transformation is now a necessity rather than a choice. One significant aspect of this transition is the implementation of digital identity solutions, which enhance customer onboarding processes. By utilizing advanced technologies, institutions can streamline the verification process while maintaining compliance with regulatory requirements. Moreover, implementing digital identity solutions ensures that customer experiences are seamless and efficient. They significantly reduce wait times associated with manual verifications, making financial services more accessible. Through automated identity verification, financial institutions can ensure accurate and efficient processing of new customers. This technology addresses key challenges, such as fraud prevention, while fostering trust between customers and providers. Another advantage is the ability to integrate these solutions across multiple platforms and systems. This integration not only improves operational efficiency but also enhances customer convenience. Ultimately, digital identity solutions play a vital role in expediting customer onboarding and optimizing the overall customer experience in the finance sector, thus paving the way for improved engagement and satisfaction. Institutions leveraging these solutions will likely lead the future landscape of financial services.

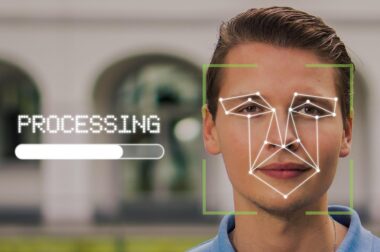

As digital identity solutions gain momentum, financial institutions must prepare for the wide range of benefits they offer. One such advantage is enhanced security. Traditional methods of identity verification often rely on physical documents that can be forged or lost. In contrast, digital solutions utilize advanced encryption and biometric technologies, ensuring that the identity verification process is more secure and reliable. By utilizing biometric data such as fingerprints or facial recognition, financial institutions can significantly reduce the risk of identity fraud, thus protecting both customers and the organization. This increased security not only builds customer trust but also strengthens the institution’s reputation. Furthermore, digital identity solutions enable institutions to authenticate customers across various channels – whether online, via mobile apps, or in-person. The consistency of identity verification helps to establish stronger relationships between customers and their banks. In a post-pandemic world, where online interactions have surged, the demand for secure, efficient, and user-friendly digital onboarding processes has never been higher. By adopting these solutions, organizations can position themselves as leaders in the digital finance sector, ready to meet the demands of modern consumers.

Another key aspect of enhancing customer onboarding through digital identity solutions is the importance of multi-channel accessibility. Customers today expect seamless interaction across different platforms, whether they are using mobile apps, websites, or even visiting physical branches. By implementing solutions that support multichannel verification, financial institutions can meet these diverse needs more effectively. Digital identity solutions allow customers to verify their identities through various means, reducing friction during the onboarding process. This flexibility results in a more user-friendly experience, allowing institutions to cater to a broader demographic. An inclusive approach ensures that users from different technological backgrounds can access financial services. Moreover, offering multiple channels can also enhance customer engagement, as institutions are better positioned to provide tailored offerings based on user preferences. Moreover, these capabilities help drive organizational efficiency, as resources can be allocated to ensure that service channels remain active and responsive. Financial institutions embracing a multi-channel approach to customer onboarding are likely to build brand loyalty and trust among customers. This, in turn, translates to increased retention and growth in customer acquisition, benefiting the overall organization.

The Role of Regulatory Compliance

Regulatory compliance is a crucial factor to consider when implementing digital identity solutions in finance. Financial institutions are subject to stringent regulations governing identity verification and anti-money laundering (AML) practices. Therefore, it is essential to choose identity solutions that adhere to both local and international regulations. By integrating compliance checks into the digital identity verification process, organizations can automate the monitoring of customer information against various watchlists and databases. Furthermore, implementing these solutions reduces the potential for human error, ensuring that organizations maintain a high level of accuracy. Compliance not only helps prevent financial penalties but also enhances customer confidence, reassuring clients that their financial institutions prioritize security. Adopting ethical practices within customer onboarding builds trust and advances the overall customer relationship. Additionally, digital identity solutions that include real-time monitoring can assist financial institutions in continuously assessing the risk associated with individual customers. This level of vigilance is vital as it allows organizations to respond quickly to potential risks or changes in client behavior, ensuring that they remain compliant with regulatory expectations, ultimately fostering a secure financial atmosphere.

Technology continues to advance, and financial institutions must adapt accordingly to maintain a competitive edge. The integration of artificial intelligence (AI) and machine learning (ML) into digital identity solutions is proving to be a game changer. These technologies enable systems to analyze vast amounts of data, identifying patterns and anomalies that may indicate fraudulent activity. By incorporating AI and ML, financial institutions can prioritize their resources toward higher-risk clients while performing more efficient identity verifications. Additionally, the predictive capabilities offered by these technologies help institutions stay ahead of potential security threats, ultimately safeguarding both the organization and its customers. The use of AI and ML also enhances customer experience by automating mundane tasks and minimizing redundancies in the onboarding process. This approach allows teams to focus on higher-value activities, such as building relationships with customers and developing personalized financial products. The ongoing evolution of technology necessitates financial institutions embracing these digital identity solutions. Those who do so will not only enhance their customer onboarding but ultimately contribute to the industry’s growth and resilience.

Customer Experience Optimization

Enhancing customer onboarding through digital identity solutions ultimately revolves around optimizing the customer experience. Customers today expect a smooth and responsive onboarding process that respects their time and privacy. Institutions need to prioritize user experience in their digital identity solutions, ensuring that the onboarding journey is straightforward and seamless. Simplifying the process while employing robust verification procedures ensures that customers feel valued and secure in their financial choices. Providing clear communication and guidance throughout the onboarding process can significantly improve customer satisfaction. Moreover, financial institutions must be transparent about how they use customer data and the benefits of digital identity verification. By addressing customer concerns about data security, organizations can foster trust and loyalty. This level of transparency encourages clients to feel more comfortable sharing sensitive information during onboarding. Furthermore, engaging with customers after the onboarding process and requesting feedback can help institutions continuously optimize their digital identity solutions. Institutions committing to improving customer experience will stand out in a competitive market, and ultimately drive greater retention and loyalty.

Measuring the success of enhanced customer onboarding through digital identity solutions is one of the critical factors that financial institutions need to address. Establishing performance metrics and benchmarks is essential for tracking the effectiveness and efficiency of these new processes. Key Performance Indicators (KPIs) can include time taken for customer verification, accurate identification rates, and customer satisfaction scores. Gathering this data allows organizations to assess the impact of digital identity solutions on their onboarding processes. Furthermore, analyzing this data supports the continuous improvement of services and processes, enabling adjustments based on real-time customer feedback and experiences. Regularly reviewing these performance metrics can help institutions identify areas of improvement and respond proactively to address issues. Additionally, data analytics can facilitate deeper insights into customer behavior, preferences, and emerging trends. By leveraging this information, financial institutions can better tailor their onboarding processes to meet customer expectations and drive engagement. Ultimately, commitment to measuring performance is crucial for ensuring that digital identity solutions contribute positively to financial institutions’ objectives, paving the way for ongoing success and innovation in the finance sector.