Integrating IoT Devices for Real-Time Financial Monitoring

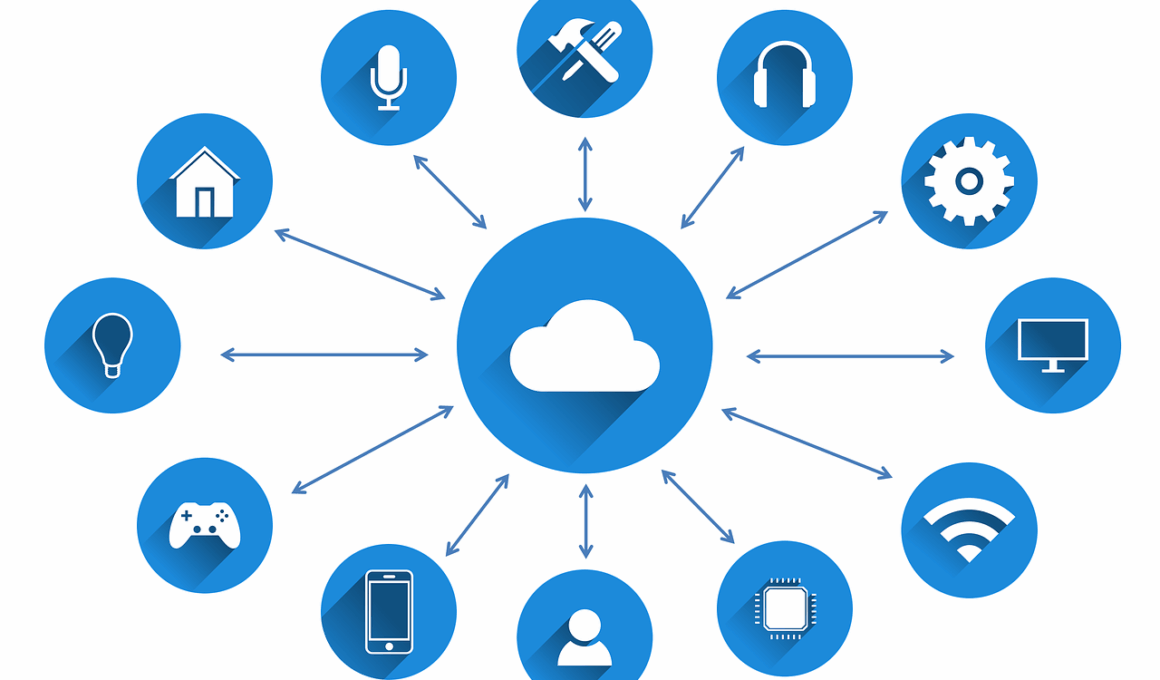

The Internet of Things (IoT) has revolutionized various industries by enabling real-time data collection and analysis. In the finance sector, the integration of IoT devices is increasingly being utilized to enhance real-time financial monitoring. These connected devices gather vast amounts of data that can be analyzed to make informed decisions. Financial institutions can implement IoT to track assets and monitor transactions. For example, smart sensors can be employed to keep track of inventory levels, ensuring timely replenishment and preventing stockouts. Additionally, wearable IoT devices can offer personalized financial insights to users. By leveraging data analytics, financial organizations can gain insights that were previously difficult to obtain. This shift is driving innovation and efficiency, enabling better budgeting and resource allocation. Moreover, IoT technologies improve customer engagement through tailored services and proactive solutions. The adoption of IoT in finance is thus not merely an upgrade but a significant transformation. By understanding how these technologies work together, firms can stay ahead of competitors and meet evolving market demands.

The integration of IoT devices also brings about enhanced security measures for financial institutions. As the industry grapples with increasing cyber threats, real-time monitoring powered by IoT can significantly mitigate risks. Connected devices can be used to detect unusual activities and potential fraud in real-time. For instance, smart security cameras equipped with AI capabilities can monitor physical locations and alert personnel to suspicious behavior. Furthermore, biometric verification methods through IoT devices add an extra layer of protection against unauthorized access. It creates an environment where only verified users can execute transactions, thus safeguarding sensitive financial data. Financial organizations can also utilize IoT to monitor the health of their servers, ensuring that they are functioning optimally without any failures. Maintenance and troubleshooting can be performed proactively, reducing downtime. This operational efficiency ultimately enhances customer trust and satisfaction, as reliable service is critical in the finance sector. As companies begin to adopt these technologies, investment in security protocols becomes essential to protect sensitive data from common vulnerabilities that exist.

The Impact of IoT on Financial Decision-Making

One of the most substantial benefits of integrating IoT devices in finance is their impact on decision-making processes. Real-time data analytics allows finance professionals to make educated choices swiftly. For example, spending habits collected through IoT wearables can be analyzed to provide users with better financial insights for budgeting purposes. Businesses can promptly respond to market trends and adjust their strategies based on concrete data. Moreover, by utilizing machine learning algorithms, financial entities can predict future purchasing behaviors and tailor their products accordingly. This helps to increase customer satisfaction and loyalty. Additionally, automated financial advisories powered by IoT can guide users in real-time, offering recommendations based on up-to-date data. This leads to improved portfolio management and optimized trade execution. The ability to have a holistic view of financial activities enhances transparency and accountability within organizations. Companies can also optimize cash flow management through precise tracking of receivables and payables, enhancing liquidity. As organizations become more data-driven, those implementing IoT solutions will have a competitive edge in the rapidly evolving finance landscape.

Furthermore, IoT’s role in enhancing customer experience within the finance sector is remarkable. Financial institutions can leverage data captured from connected devices to personalize their services. Tailored interactions foster better relationships between customers and financial advisors, leading to loyalty and retention. For instance, banks can utilize data from customers’ IoT transactions to offer personalized financial products, such as tailored investment options. With real-time insights, financial organizations can proactively provide relevant services, such as alerts for unusual spending or savings suggestions. Additionally, the use of IoT devices enables seamless payment processes. Customers can make transactions using their connected devices securely and quickly, enhancing user convenience. Digital wallets integrated with IoT technology facilitate quicker payment options, reducing transaction processing times significantly. The increased convenience provided to customers often results in higher satisfaction levels and trust in these institutions. By fostering a customer-centric approach through technological innovation, finance companies can ensure a superior competitive advantage. As this trend evolves, organizations will need to continuously assess and refine their offerings to keep pace with customer expectations.

Challenges of IoT Integration in Finance

Despite the numerous advantages, integrating IoT devices in the finance sector poses significant challenges that must be carefully managed. Data privacy and regulatory compliance are paramount concerns as financial organizations collect and analyze extensive data sets. With the increasing use of IoT devices, the potential for security breaches escalates, exposing sensitive financial information. Organizations must invest in robust cybersecurity measures to protect against unauthorized access. Furthermore, they face the challenge of ensuring that data integrity is maintained during the transfer process. Ensuring these devices are secure and compliant with financial regulations can also require considerable resources. Moreover, integrating IoT with legacy systems presents compatibility issues that can deter comprehensive implementation. Organizations need to adopt compatible technologies and invest in training employees on new systems. Additionally, the implementation phase can be time-consuming, as organizations must carefully deploy the technologies without disrupting ongoing operations. Budget constraints can also limit the extensiveness of IoT adoption, particularly for smaller institutions. In the long run, overcoming these challenges is essential for unlocking the full potential of IoT in finance.

To ensure successful integration of IoT devices, financial organizations must develop a strategic roadmap that outlines their objectives. Establishing clear goals will streamline the implementation process and help measure success. Adopting a phased approach to integration allows institutions to manage risks better while progressively enhancing their digital capabilities. Training employees on the use and benefits of IoT devices is also crucial for fostering a culture of innovation within the organization. Regular workshops and seminars can educate staff about the technologies and their potential impact on operations. Additionally, collaborating with experienced IoT technology providers can help organizations navigate the complexities associated with integrating these systems. Partnering with seasoned professionals enables access to insights and best practices that limit the challenges faced. It also ensures that the technological infrastructure aligns with industry standards and regulations. Establishing a comprehensive feedback loop is essential for continuous improvement, enabling organizations to refine their strategy and enhance performance. As financial institutions embark on this journey, adaptability must be at the forefront of their strategic initiatives.

The Future of IoT in Finance

Looking ahead, the future of IoT technology in finance appears promising, with emerging developments on the horizon. The continued advancement in Artificial Intelligence and Machine Learning will further optimize IoT devices, enhancing their functionality in financial monitoring. As predictive analytics becomes more sophisticated, organizations will benefit from improved forecasting and trend analysis, enabling better strategic planning. Additionally, the integration of blockchain technology alongside IoT devices will create unprecedented security for financial transactions. Smart contracts tied to IoT devices could automatically execute transactions upon predefined conditions, streamlining operations and ensuring accountability. Furthermore, the proliferation of 5G technology will enhance the connectivity and speed of IoT devices, allowing near-instantaneous data processing. This rapid access to real-time insights will provide financial institutions with a solid foundation for informed decision-making. As the importance of sustainability grows, IoT can aid in measuring environmental impacts and compliance with regulations. Ultimately, organizations that embrace IoT technology will remain relevant and competitive in a fast-evolving financial landscape. The emphasis will be on innovation, security, and customer-focused services as financial sectors advance.

Additionally, financial institutions might use IoT-enabled devices to create loyalty programs that reward customers for their transactions and behaviors. This kind of engagement will foster stronger relationships between customers and financial entities. Developing adaptive systems that learn from user interactions will create an attractive financial ecosystem that meets various needs. Moreover, augmented reality applications powered by IoT can provide customers with immersive experiences that help them understand their financial health. For instance, users can visualize spending habits and savings goals interactively, making financial literacy more engaging. To continue thriving amidst technological advancements, financial institutions must remain agile and forward-thinking. As they adopt these innovations, organizations will also need to invest in regulatory compliance to avoid potential pitfalls. Collaborating with regulatory bodies will ensure that new technologies align with existing laws while also influencing future regulatory landscapes. In conclusion, the integration of IoT devices into finance presents both exciting opportunities and substantial challenges. By addressing concerns through strategic planning and innovation, the financial sector can look toward a more connected and financially savvy future.