Future Outlook: Digital Identity Trends in Financial Industry

The landscape of finance is rapidly evolving, and digital identity plays a pivotal role in this transformation. Traditional methods of identity verification are becoming outdated due to the increasing demand for efficiency, security, and usability. Digital identity solutions utilize advanced technologies such as biometrics and blockchain to streamline Know Your Customer (KYC) processes. Customer experience is enhanced as digital identities allow for faster onboarding while minimizing the chances of fraud. Organizations are aiming to build systems that can verify identities seamlessly, which is essential in today’s fast-paced financial environment. Moreover, regulatory changes are forcing financial institutions to rethink their compliance strategies, further emphasizing the need for robust digital identity frameworks. Companies are investing in technologies that not only meet current compliance but also anticipate future requirements. This forward-thinking mindset is vital for staying competitive in an industry where trust and security are paramount. Understanding customer behavior and preferences also informs the design of these digital identity solutions, ensuring they cater to user needs. Consequently, financial institutions must prioritize developing adaptable digital identity systems as a keystone for future growth and security.

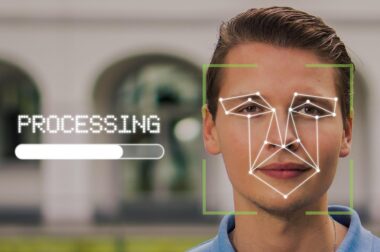

Adoption of artificial intelligence is transforming KYC processes in finance. AI delivers insights swiftly, streamlining the verification process and significantly reducing manual workload. Financial institutions are leveraging AI to analyze data and identify potential risks efficiently. By utilizing machine learning algorithms, entities can predict and mitigate fraud attempts proactively. The implementation of AI-driven solutions not only improves accuracy but also enhances compliance with regulatory standards. Moreover, the integration of AI speeds up the processing of customer information, enabling rapid decision-making while maintaining high security. Biometrics, including facial recognition and fingerprints, are increasingly being woven into the fabric of digital identity verification. These advanced technologies provide a secure and user-friendly way of confirming identities, reducing reliance on outdated methods. As a result, clients benefit from an improved experience, characterized by lower waiting times and seamless interactions. Additionally, AI can personalize services, adapting recommendations based on individual customer profiles. This personalization enhances customer loyalty and satisfaction, vital for financial institutions aiming to thrive in a competitive market. Ultimately, AI is reshaping KYC processes, making them more efficient, secure, and accommodating for financial sector participants.

The Role of Regulatory Compliance in Digital Identity

Governments and regulatory bodies worldwide are increasingly recognizing the critical importance of electronic identity verification. As digital transactions become more prevalent, they are establishing frameworks that mandate robust KYC processes across financial institutions. Compliance is no longer a mere checkbox; it is integral to business strategy. Organizations must establish measures to align digital identity systems with varying regulations and standards. Failing to comply can result in severe penalties and reputational damage. Financial institutions must invest in compliance technologies, ensuring their digital identity solutions evolve alongside regulatory advancements. Companies are exploring partnerships with technology providers that offer compliance-oriented solutions that integrate seamlessly with their existing processes. Ensuring compliance not only protects consumers but also fortifies the integrity of the financial ecosystem. Furthermore, organizations that prioritize compliance can differentiate themselves from competitors, building trust and credibility with clients. This trust is increasingly critical as financial services evolve toward a more transparent model. As such, the synergy between digital identity solutions and regulatory requirements is not just necessary but a driving force for innovation in the finance sector.

Privacy concerns are at the forefront of discussions surrounding digital identity in finance. As organizations collect and store vast amounts of personal data, protecting this information from unauthorized access is paramount. Users today are more aware of their privacy rights, making transparency a critical factor in the adoption of digital identity solutions. Financial institutions must implement protective measures that not only adhere to regulatory guidelines but also foster consumer trust. Educating clients about how their data is managed is essential in alleviating privacy concerns. Secure data storage, encryption, and controlled access are vital elements of a robust digital identity framework. Additionally, organizations must regularly audit their security protocols to identify potential vulnerabilities and address them promptly. This proactive approach serves to maintain customer confidence in the trusted handling of their information. Moreover, developing easy-to-understand privacy policies can further enhance this relationship, ensuring clients feel informed and secure. As digital identity trends continue to evolve, the challenge remains for institutions to balance innovation with the critical need for data privacy and consumer consent.

Future Trends in Digital Identity

The future of digital identity in financial services will likely see continued innovation driven by emerging technologies. One promising area is the use of decentralized identity solutions, powered by blockchain technologies, to enhance security and user control over personal data. Such platforms can allow individuals to manage their own identity without relying solely on centralized systems, which reduces the risk of data breaches. Additionally, trend indicators suggest a rise in the adoption of self-sovereign identity (SSI) solutions, enabling users to create and maintain control over their digital identities. These developments will enhance consumer autonomy while creating a more secure financial landscape. Financial institutions will also explore integrating enhanced biometric solutions for additional layers of security. Moreover, the inclusion of augmented reality (AR) and virtual reality (VR) may revolutionize the way identities are verified and interacted with. Such technologies can provide immersive experiences, promoting greater understanding and user engagement. As the digital identity landscape matures, collaboration among financial institutions, regulatory bodies, and technology vendors will be vital. Together, they can address challenges and cultivate a sustainable environment for innovative identities.

The rise of global digital identity frameworks will significantly impact how financial institutions operate. As nations adopt interoperable identity systems, cross-border financial transactions will become simpler and more secure. This evolution is essential, especially in a globalized economy where seamless transactions are necessary for growth. Institutions will benefit from reduced compliance burdens, as standardized procedures can streamline operations across jurisdictions. Furthermore, robust identity frameworks can enhance anti-money laundering (AML) efforts and enable better fraud detection, promoting a safer financial ecosystem. Consequently, businesses will be equipped to serve a broader client base while minimizing risks associated with identity fraud. Such frameworks also pave the way for fintech innovations to flourish, as developing countries adopt and adapt these systems, enhancing their financial inclusivity. With improved access to banking and finance, marginalized populations can leverage digital identities to enter the economic mainstream. This shift not only empowers individuals but also stimulates economic growth. As the landscape evolves, it is crucial for financial institutions to remain adaptable, continuously innovating to align with these global trends while ensuring security and compliance.

Conclusion: Embracing Digital Identity

The financial industry is at a crucial juncture regarding digital identity adoption. Organizations must embrace innovative solutions to enhance customer experiences and maintain competitiveness. As technology evolves, so do customer expectations for seamless, secure, and efficient services. Adapting existing systems to incorporate these trends will be critical for financial institutions looking to thrive. Collaborating with technology partners will help implement robust digital identity frameworks that meet regulatory demands and customer needs. Financial institutions that successfully integrate digital identity solutions can achieve operational efficiency while reducing fraud risks. The journey towards comprehensive digital identity systems is essential for ensuring robust KYC processes, safeguarding consumer trust, and fostering innovation. Investing in technology now will ensure institutions are prepared for the rapidly changing landscape of finance. Therefore, financial organizations must stay attuned to emerging trends and proactively adapt to change. The future holds immense potential for those willing to embrace progress, utilizing digital identity as a cornerstone for transforming their operations. Ultimately, the embrace of digital identity will shape the future of finance, paving the way for effortless transactions while reinforcing security and compliance.

Lastly, ongoing education and training about digital identity for employees in the financial sector are paramount. Keeping staff informed about the latest technologies and regulatory developments will ensure compliance, security, and customer satisfaction. Digital identity solutions depend on a well-informed workforce capable of navigating the complex landscape of regulations and technologies. Institutions must develop educational programs that focus on privacy, security, and technological advancements in identity verification. This focus will equip employees with the knowledge and skills to lead initiatives that improve indoor processes and enhance the overall customer experience. Ensuring all team members are well-versed in the implications of digital identity fosters a culture of responsibility and innovation. Furthermore, ongoing assessments of organizational practices can help identify weaknesses and opportunities for improvement in digital identity approaches. Engaging staff in these processes cultivates an environment of continuous learning and adaptation. As the landscape evolves, regular updates and workshops can help staff remain informed of best practices in digital identity management. By prioritizing education, financial institutions can not only secure compliance but also empower employees to champion innovative solutions that address customer needs effectively. Creating a learning-focused culture will bolster the institution’s ability to compete in an ever-changing industry.