Power BI Tips for Efficient Cash Flow Analysis

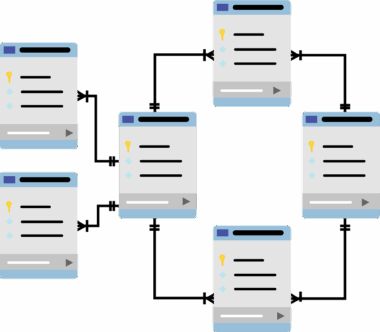

Power BI is a powerful tool for financial analysts aiming to enhance cash flow analysis. With its robust visualization capabilities, Power BI makes it easy to analyze and present financial data. To start effectively with cash flow analysis in Power BI, it is crucial to connect your financial data sources seamlessly. This allows you to pull data from various systems, ensuring accuracy and timeliness. Visual representations can be created by configuring dashboards that show trends, comparisons, and forecasts. Make use of built-in templates to save time and maintain consistency across your reports. Filtering options help hands-on in narrowing down data for focused insights. Additionally, establish clear financial metrics that are relevant to your goals. Metrics like net cash flow, operating cash flow, and free cash flow allow better tracking of cash movement. By translating raw data into visuals, financial analysts can share insights that drive decision-making. Moreover, consider automating data refresh cycles. This ensures that your reports are always displaying up-to-date information. Applying these tips can significantly improve cash flow analysis efficiency and effectiveness within Power BI.

The next crucial aspect of utilizing Power BI involves creating detailed reports that reflect cash flow scenarios accurately. Reports should highlight periods of surplus and shortfall, assisting in strategic planning. Interactive reports foster collaboration among stakeholders as they provide a real-time view of financial status. Leveraging the DAX (Data Analysis Expressions) language can create complex calculations for deeper data insights. These custom formulas allow analysts to model cash flow projections based on different scenarios. Besides that, implementing measures for variance analysis can reveal discrepancies between planned and actual cash flows. Such analysis is vital for understanding underlying issues and areas for improvement. Utilize Power BI’s features, such as drill-through, which allows users to explore report elements in greater detail easily. Another effective practice is to group financial data into categories, enabling easier comparison and trend analysis. Consider using bookmarks for guiding users through your reports, emphasizing critical areas of the analysis. Furthermore, ensuring that the visuals are intuitive will enhance user engagement. Prefer line charts for trends and pie charts for distributions. This approach maximizes the insights derived from cash flow data, creating comprehensive analytical reports.

Optimizing Power BI Visuals for Financial Insights

Optimizing visuals in Power BI is essential for effective financial storytelling. When presenting cash flow data, ensure that your visuals communicate insights clearly and swiftly. Utilize color coding effectively to differentiate between various cash flow segments—for example, using green to represent positive inflows and red for outflows. Always aim for simplicity in your visuals; cluttered dashboards can confuse users. Maintaining a consistent theme throughout your reports is advantageous as it enhances readability. Additionally, consider utilizing tooltips to provide additional context. Tooltips can display supplementary data without overcrowding the main visual. If using bar charts, sorting them based on cash flow magnitude can clarify priorities. Implementing conditional formatting can highlight critical values and anomalies, drawing attention to significant changes. Furthermore, including summary visuals such as key performance indicators (KPIs) provides immediate, digestible insights. These KPIs can facilitate quick decisions based on cash flow projections. Annotations can also be helpful for providing explanations and insights directly on the visuals. Consistently refining your visuals ensures that your cash flow analysis meetings are efficient and informative.

Another vital aspect is ensuring a smooth data refresh process in Power BI. Regular updates of your data sources guarantee that insights remain relevant. Scheduling refreshes during off-peak hours minimizes disruptions for users. Monitoring refresh failures can help ensure data consistency and reliability. Moreover, it is essential to set appropriate access levels for users interacting with your cash flow reports. Management will likely require different insights than operational teams; therefore, tailoring access enhances data security. Utilizing roles based on job functions can streamline this process. Furthermore, consider how you distribute reports. Power BI allows sharing through dashboards and mobile apps, promoting accessibility. Always get feedback from users regarding the report experience; this insight can help refine future iterations. Training sessions could also enhance user proficiency in navigating and utilizing the reports effectively. Adherence to best practices ensures that cash flow analysis achieves its intended objectives. Additionally, integrating Power BI with other Microsoft tools like Excel or SharePoint can improve collaboration and information sharing across departments. When used effectively, Power BI becomes an indispensable tool for financial analysis.

Enhancing Decision Making through Cash Flow Visibility

Enhancing decision-making capabilities revolves around increased cash flow visibility. Providing stakeholders with real-time insights fosters a proactive approach to financial management. Designing interactive dashboards with a clear overview of cash positions can facilitate timely decisions. Incorporating predictive analytics into your cash flow analysis can offer forecasts based on historical data. Identifying patterns in cash inflow and outflow can substantiate predictions, guiding strategic planning. Leveraging scenario analysis is also crucial; it allows analysts to assess how various factors impact cash flow. Creating multiple what-if scenarios will provide deeper insights for measuring potential risks. Always emphasize the critical cash flow metrics that align directly with business objectives. Regularly review these metrics, ensuring that they evolve with the company’s needs. Additionally, enhancing visualization of cash flow trends over time can provide clearer insights for decision-makers. Instituting a regular review process ensures that financial strategies remain aligned with actual performance. Collecting feedback from users on data interpretation can further guide improvements in report design. The ultimate goal is to empower teams with the right tools to drive informed decision-making based on cash flow analysis.

To maximize the benefits, consider integrating Power BI with other financial planning tools. This can ensure the cash flow analysis complements overall financial strategies effectively. The alignment between various financial functions creates a cohesive understanding of the business environment. Further, ensuring all involved parties are trained enhances collaboration. Workshops can help teams familiarize themselves with cash flow analysis tools and techniques. Regular updates can reinforce knowledge about system changes and new features. Furthermore, engaging external stakeholders, like investors, through shared dashboards can enhance transparency. Allowing them to view real-time financial insights promotes confidence and strengthens relationships. Ensure that dashboards designed for external stakeholders are tailored specifically for their needs, focusing on relevant data. Preparing customized presentations can also achieve this effectively. Additionally, consider setting aside time for strategic discussions based on cash flow data during team meetings. This regular review creates accountability and directs attention to areas needing improvement. Collaboration between departments is vital; each function should understand their role in maintaining strong cash flow. Ultimately, an integrated approach within Power BI streamlines financial operations while promoting accountability and better financial outcomes.

Future-Proofing Your Cash Flow Analysis Strategies

Future-proofing your cash flow analysis employs innovative strategies and tools. Stay updated with the latest technologies to enhance your Power BI capabilities continually. Embracing cloud services allows for flexible deployment and scaling as business needs evolve. It’s also beneficial to stay engaged in ongoing training and professional development related to financial analytics. This ensures that your skills remain relevant in an ever-changing landscape. Additionally, consider adjusting your financial models to accommodate fluctuations in the market. Performing regular scenario evaluations can prepare your team to adapt swiftly to changes. Including dashboards for risk assessments alongside cash flow analysis can streamline decision making during times of uncertainty. Collaborating with cross-functional teams ensures that diverse insights inform cash flow strategies. Always document processes and insights collected to improve upon future analyses. Moreover, integrate customer feedback into your financial analysis to reveal potential areas for additional cash inflow. When reviewing your reporting processes, adopting a continuous improvement mindset creates sustainable enhancement. Regularly revisit your financial goals to ensure alignment with the company’s vision. Keeping cash flow robust involves not just analysis but proactive strategic planning moving forward.

In conclusion, mastering Power BI for efficient cash flow analysis lays the groundwork for improved financial decision-making. By employing robust visualizations, streamlined data processes, and maintaining transparency, organizations can significantly enhance their cash management. The goal is not just to observe data but to derive actionable insights that drive financial strategy. Encouraging an analytical mindset within financial teams also promotes a culture of thorough analysis and informed decisions. As economic conditions fluctuate, having a powerful tool like Power BI at their disposal equips organizations to navigate challenges effectively. Leveraging its rich features expands possibilities for deep analytical insights that traditional methods lack. Therefore, continuous learning and adaptability are key. Nurturing skills in data analysis and visualization can position organizations favorably in competitive markets. The integration of Power BI into daily operations can yield long-term financial health and sustainability. So, invest time and resources into fully understanding this tool’s capabilities, ensuring that all stakeholders are aligned in their goals. Lastly, remember that the journey of financial analysis is continuous; the more familiar you are with Power BI, the more proficient your cash flow analysis will become.