Mobile Payment Systems Revolutionizing Brand Loyalty

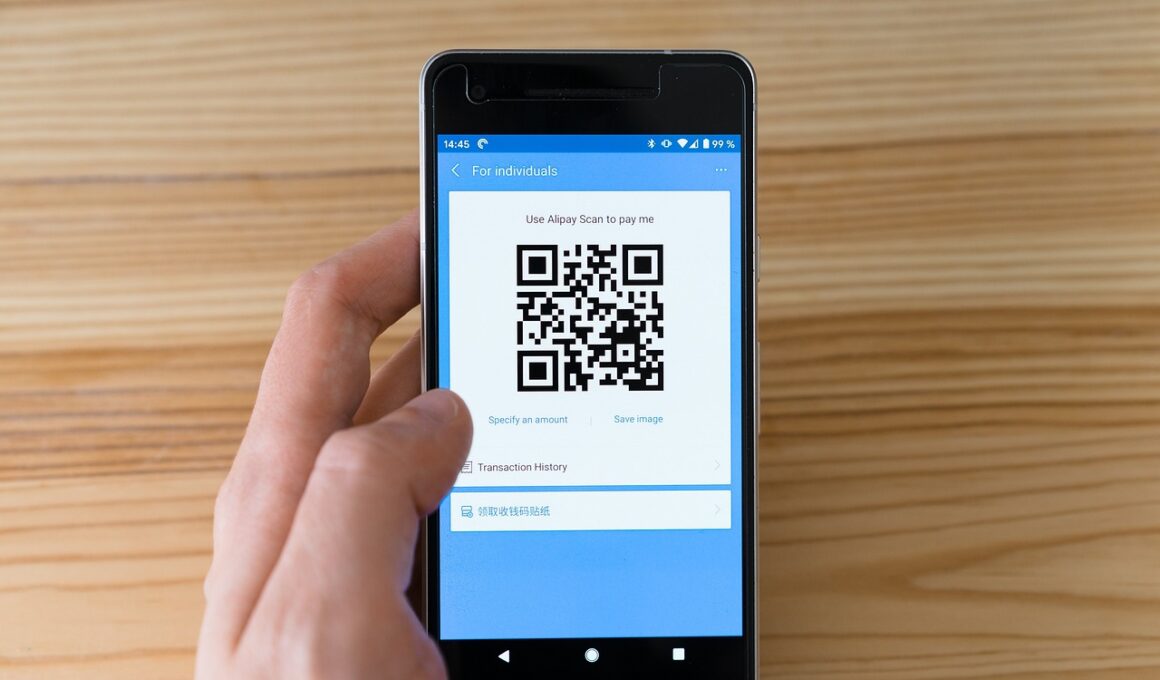

Brand loyalty is evolving significantly with the rise of mobile payment systems, which are driving new dynamics in consumer engagement. As the global market embraces technology, brands must adapt to remain competitive. Mobile payments offer convenience, security, and speed, which are essential factors in enhancing customer experiences. As customers increasingly favor brands that provide seamless transaction processes, companies are encouraged to integrate these payment systems into their strategies. For instance, brands utilizing digital wallets can create personalized shopping experiences, which further deepens customer relationships. Additionally, the use of loyalty rewards programs linked to mobile payments can increase brand affinity, encouraging repeat purchases. It’s significant to understand how convenience impacts shopping behaviors. A satisfied customer is more likely to return, reinforcing loyalty. Research indicates that when consumers find payment methods easy to use, their likelihood of brand loyalty significantly increases. Brands that can navigate these changes effectively will cultivate lasting relationships with customers. In turn, the focus will shift from merely attracting new customers to nurturing existing ones. Therefore, businesses must embrace innovation to ensure longevity in brand loyalty amidst the rise of mobile payment systems.

The effectiveness of mobile payment systems can greatly influence perceived brand loyalty. As consumers increasingly engage with brands through their smartphones, payment processes must align with their expectations. A consistent experience across various platforms fosters loyalty, while any hiccup may lead to frustration. For many users, a smooth checkout process has become a critical factor in their purchasing decisions. Brands that integrate mobile payment systems into their marketing strategies can gain insights into consumer behaviors and preferences, thereby tailoring offerings to enhance engagement. Furthermore, platforms facilitating instant payments can also support personalized promotions and discounts, which cater to individual preferences, appealing to consumers’ desires. Such personalization can significantly increase overall satisfaction levels. Data collected from mobile transactions can inform brands about customer trends, allowing them to respond proactively. By offering customer convenience and recognizing purchasing habits, brands can reinforce loyalty. Moreover, creating an intuitive user interface is essential; a complicated payment process can deter potential customers. Thus, for brands aiming for growth, adopting effective mobile payment systems is not just advisable, it’s essential for maintaining brand loyalty in today’s competitive market landscape.

Customer Engagement and Loyalty Programs

Innovative mobile payment systems are reshaping customer engagement, enabling more robust loyalty programs. In the competitive landscape, brands leverage mobile technologies to create tailored loyalty initiatives. By integrating rewards directly into payment processes, businesses can incentivize shopping behaviors and repeat transactions. For instance, customers can earn points, discounts, or exclusive offers seamlessly through mobile payments. This integration not only increases the convenience but also reinforces emotional connections between brands and consumers. Furthermore, as consumers become accustomed to earning rewards for using specific payment methods, brand loyalty strengthens. It is crucial that businesses clearly communicate the value of these loyalty programs to consumers to enhance participation and engagement. Additionally, mobile applications can track user spending more efficiently, allowing brands to reward customers more effectively. Continuous analysis of data gleaned from mobile transactions can offer insights into purchasing trends, enabling brands to adjust their strategies accordingly. Thus, cultivating loyalty through engaging mobile payment experiences becomes a vital aspect of competitive advantage. Companies that understand the importance of these aspects will likely thrive in building long-lasting customer relationships.

Analyzing consumer behavior reveals critical insights into brand loyalty dynamics influenced by mobile payment systems. Today’s consumers expect instant gratification, which directly impacts their loyalty to brands that can meet this demand. With mobile payments, consumers can purchase products easily and efficiently, leading to a heightened sense of satisfaction. Brands that utilize these systems effectively often see an increase in both customer retention and acquisition rates. Trust plays a significant role in brand loyalty; hence, providing secure payment options enhances consumer confidence. Customers are likely to return to brands they trust. Moreover, innovative marketing strategies generated through data analytics pave the way for creating personalized shopping experiences. Customers appreciate tailored offers; thus, personalization becomes a significant aspect of cultivating loyalty. By making consumers feel valued through personalized interactions, brands can stand out in the saturated market. Furthermore, consistency in customer experience across all platforms solidifies their commitment to brands integrating mobile payment systems. This close analysis not only identifies opportunities for improvement but also highlights potential obstacles brands might face in meeting consumer expectations in loyalty.

The Role of Data Security in Building Trust

As mobile payment systems grow in popularity, data security becomes a significant concern for consumers valuing brand loyalty. Customers want assurance that their financial information is safe when engaging with brands. Thus, building a secure payment infrastructure is crucial for businesses wishing to foster loyalty. Integrating advanced security technologies, such as encryption and biometric authentication, can significantly enhance customer trust. When consumers feel safe during transactions, they are more likely to engage and develop brand preferences. Furthermore, transparent communication regarding privacy policies helps alleviate concerns while bolstering trust. Companies that prioritize consumer security can set themselves apart from competitors who may neglect these important factors in brand loyalty. Engaging consumers on various platforms allows brands to assert their commitment to security actively. Maintaining a strong security presence online aids consumer confidence, which leads to long-term loyalty. Initiating educational campaigns about safe payment practices can also encourage consumers to use mobile systems without hesitation. Therefore, investing in data security strategies will not only protect customers but will strengthen brand loyalty in an increasingly digital marketplace.

The impact of mobile payments on customer experience further emphasizes the connection to brand loyalty. Consumers are drawn to brands that prioritize seamless experiences, particularly during the checkout process. If a customer can complete transactions with minimal effort while earning incentives, they are likely to return. Simplified processes reduce the likelihood of cart abandonment, which is a major concern for today’s retailers. Additionally, consumers favor brands that offer multiple payment methods, as it caters to their preferences. Adapting to various payment options enhances flexibility and appeals to a larger customer base. Moreover, engaging users through mobile applications can facilitate instant feedback, allowing brands to rectify issues promptly. Consumer insights gained through analytics can help create tailored experiences. Brands can offer personalized recommendations based on purchasing history, which boosts customer satisfaction. Consequently, brands that adapt to this evolving landscape are better positioned to retain clientele. Understanding the crucial role of customer experience in relation to mobile payments becomes essential for fostering brand loyalty. Hence, prioritizing such initiatives leads to a competitive edge in attracting and retaining loyal customers.

Future Trends in Brand Loyalty with Mobile Payments

Looking ahead, the intersection of mobile payment systems and brand loyalty is set to expand continuously. With advancements in technology, such as artificial intelligence, personalized experiences will become more refined. Customers will expect brands to anticipate their needs based on historical interactions, thus elevating loyalty to new heights. Furthermore, integrating loyalty programs with social media is expected to enhance brand engagement. It could allow customers to share their experiences and rewards with their peers, promoting organic brand loyalty. Additionally, as digital currencies become more mainstream, brands must adjust to these payment alternatives to remain relevant. The introduction of loyalty initiatives tailored for users of cryptocurrencies could reshape traditional loyalty programs. Moreover, augmented and virtual reality experiences linked to mobile payments may offer immersive buying experiences that significantly influence brand loyalty. Therefore, businesses must remain agile, adapting to these emerging technologies. The ability to harness such technologies will determine how they interact with customers, ultimately influencing loyalty levels. As brands prepare for these changes, cultivating a customer-centric approach will ensure success in maintaining loyalty while utilizing cutting-edge mobile payment systems.

In conclusion, the future of brand loyalty is intrinsically linked to the rise of mobile payment systems. As consumers continue to favor convenient purchasing methods, brands must prioritize these systems to remain relevant. The ease of transaction, security, and ability to foster personalized customer experiences are key drivers of loyalty in this evolving landscape. Businesses that effectively integrate mobile payments into their marketing strategies will be better positioned to cultivate long-term relationships with customers. Furthermore, leveraging data analytics will allow brands to adapt their offerings to meet consumer expectations, reinforcing loyalty. Understanding the dynamic between consumer behavior and mobile payments is vital for sustaining brand loyalty. Moreover, brands that prioritize customer feedback and adapt to changing demands will have a competitive edge. In an age where consumer preferences are continually evolving, it is essential for businesses to stay one step ahead. Future trends suggest that as technology advances, mobile payment adoption will become more widespread, further intertwining with brand loyalty initiatives. Thus, brands must embrace innovations to cultivate lasting loyalty amid the shifting landscape of consumer expectations and preferences in brand loyalty.