Developing Metrics to Monitor Credit Performance

In today’s dynamic financial landscape, effective credit management is crucial for businesses aiming for sustainability and growth. Developing metrics for monitoring credit performance entails comprehensively understanding various factors that influence credit risk and liquidity. Organizations must establish robust metrics that can accurately gauge performance levels across all credit-related activities. Key metrics often include days sales outstanding (DSO), average collection period, and credit turnover ratio. These metrics not only provide insights into the efficiency of the credit management processes but also help in aligning credit strategies with cash flow objectives. Moreover, utilizing accrual metrics enables companies to closely track the health of their receivables, ensuring that timely payments are received. Implementing a regular review cycle of these metrics fosters informed decision-making, allowing businesses to mitigate risks associated with credit sales. By staying vigilant in monitoring these key indicators, firms can enhance their cash flow positions and reduce the likelihood of defaults. Ultimately, the right metrics can significantly impact the long-term viability and performance of the organization.

Another critical aspect of developing metrics to monitor credit performance involves adopting technological tools to streamline these processes. Implementing software or platforms designed for credit management can provide real-time insights and automate reporting, thus reducing the burden on finance departments. With such tools, organizations can set alerts for overdue accounts, ensuring that relevant stakeholders are promptly informed of potential issues. Leveraging technology facilitates the capture of accurate data, which is essential for analytics and benchmarking against industry standards. Additionally, integrating credit metrics with broader financial metrics can provide a more holistic view of an organization’s financial health. For example, relating credit metrics to liquidity ratios can help companies assess how credit policies impact cash flow. Encouraging cross-functional collaboration among departments, including sales and finance, can also enhance the effectiveness of credit management strategies. Frequent communication ensures alignment on policy changes and fosters a culture of accountability regarding credit performance. By embracing these practices, organizations can develop a more resilient approach to credit management that enhances cash flow sustainability and minimizes risks.

Setting Key Performance Indicators (KPIs)

Establishing clear key performance indicators (KPIs) is essential for monitoring credit performance effectively. KPIs provide specific, quantifiable measures that organizations can use to evaluate their credit management success. Common KPIs include customer credit limits, percentage of credit sales, and recovery rates. These indicators allow firms to identify trends, assess performance, and make data-driven decisions. For instance, a sharp increase in the aging of receivables might indicate the need for stricter credit policies or enhanced collection efforts. Additionally, tracking average payment terms against actual payment behavior can reveal potential issues in specific customer segments. Organizations should also consider segmenting their KPIs based on various factors like customer profile, industry, and credit risk level. This segmented approach can provide deeper insights into performance nuances. Moreover, regular benchmarking against industry standards can uncover areas for improvement within credit management practices. Identifying best practices from industry leaders can guide organizations in refining their strategies and enhancing their metrics framework. Setting and reviewing these KPIs consistently will allow businesses to maintain a proactive approach to managing credit risks effectively.

Furthermore, enhancing employee training and engagement is instrumental in the successful implementation of credit performance metrics. Employees who understand the significance of these metrics are more likely to commit to their roles in the credit management cycle. Training programs that emphasize the calculation and analysis of key credit metrics can empower staff to take ownership of their responsibilities. Integrating gamification techniques into training can also motivate employees to improve their credit management skills while fostering a competitive spirit among teams. Utilizing case studies of past successes or challenges related to credit management can illustrate the real-world application of metrics and best practices. By encouraging staff to consistently monitor credit performance metrics, organizations can create a culture of accountability regarding credit practices. Additionally, recognizing and rewarding teams that achieve or surpass credit performance targets encourages sustained improvement. Celebrating these successes fosters a positive environment that reflects the importance of effective credit management. Incorporating employee feedback into the development of metrics and processes can further enhance engagement and ensure that practices align with on-the-ground realities.

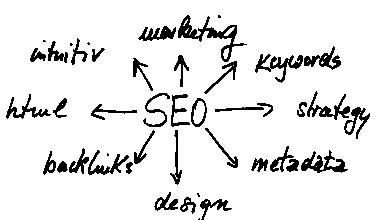

The Role of Data Analytics

Data analytics plays a pivotal role in refining the metrics used to monitor credit performance. By applying advanced analytical techniques, organizations can gain deeper insights into their credit portfolios. Analyzing historical data allows firms to identify patterns and forecast future trends in customer payment behaviors. Predictive analytics tools enable organizations to pinpoint high-risk accounts and assess creditworthiness more accurately. This proactive approach helps in adjusting credit limits and terms to mitigate potential risks. Additionally, modeling various scenarios can provide clarity on how different variables impact cash flow and credit performance. Organizations can implement machine learning algorithms to continuously improve their credit scoring systems, making them more robust over time. Furthermore, utilizing customer segmentation strategies based on behavioral data can optimize credit policies tailored to specific markets. This segmentation aids in identifying profitable customers while minimizing exposure to delinquent accounts. Consequently, data-driven decision-making can significantly enhance credit risk management and cash flow management strategies. The effective use of data analytics can provide competitive advantages in today’s fast-paced and increasingly complex financial environment.

Collaborating with external partners can also enhance the development of credit performance metrics. Establishing relationships with credit bureaus, financial institutions, and industry associations can provide organizations access to invaluable data and insights. These partnerships can aid firms in benchmarking their performance against industry norms, helping to identify areas that require improvement. For example, accessing credit reports from external agencies can provide a better understanding of the market’s health and competitors’ performance. It is also beneficial to participate in industry forums, which can foster learning and collaboration with other professionals facing similar challenges. These networks can be a source of best practices that organizations can incorporate into their credit management strategies. Moreover, engaging with customers to gain feedback on credit policies can help improve upon existing systems, ensuring they meet market needs. By leveraging external resources and insights, organizations can cultivate a well-rounded approach to developing credit performance metrics. These initiatives can provide deeper understanding, leading to better-informed decisions that drive credit and cash flow management.

Continuous Monitoring and Improvement

Lastly, implementing a culture of continuous monitoring and improvement is fundamental in credit performance management. Regular reviews of credit metrics ensure that organizations stay agile and can adapt to changing market conditions. Establishing a feedback loop where teams can regularly assess credit processes and suggest enhancements is vital for maintaining effectiveness. Utilizing dashboards and visual tools to display credit metrics allows stakeholders to quickly grasp performance levels and identify anomalies. Regular team meetings focused on reviewing credit performance should be encouraged, as they can provide an avenue for collaborative problem-solving. Organizations should establish timelines for revising metrics, ensuring they remain relevant and aligned with business objectives. Whether through quarterly assessments or annual strategic reviews, staying ahead of potential issues is crucial. Creating a structured process for updating policies in response to metric findings can empower businesses to take proactive actions before problems escalate. Overall, fostering a culture of responsiveness and continual improvement in credit management contributes to sustainable financial health and a resilient organizational framework.

Developing metrics to monitor credit performance is integral to successful credit management. By outlining key performance indicators, leveraging technology, and obtaining employee engagement, organizations can establish a robust monitoring framework. Continuous improvement practices ensure that firms adapt to the evolving market landscape, securing long-term stability and growth.