Improving Compliance with Automated KYC Processes

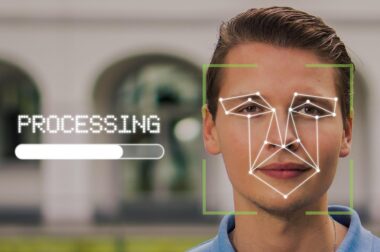

In the financial industry, Know Your Customer (KYC) processes are critical for compliance with regulatory requirements. Companies face increasing pressure to verify customer identities accurately and efficiently. Automated KYC processes streamline compliance by utilizing advanced technologies. These technologies include artificial intelligence (AI), machine learning, and biometric verification. Automated systems can quickly gather and analyze customer data from multiple sources. They enhance the accuracy of identity verification while significantly reducing manual errors. This shift towards automation leads to quicker decision-making in customer onboarding. Financial institutions can mitigate risks associated with fraud and money laundering through enhanced identity verification solutions. As regulators impose stricter guidelines, automated KYC processes become invaluable for staying compliant. Moreover, they help companies to provide better services by reducing onboarding times. Customers appreciate fast and seamless experiences without compromising security. In conclusion, embracing automated KYC processes allows financial institutions to strike a balance between compliance and customer satisfaction. Adopting robust technologies will ensure they are equipped to navigate regulatory complexities while improving overall efficiency in their operations.

Understanding the significance of KYC compliance is vital for financial institutions. Failure to adhere to guidelines can result in severe penalties or reputational damage. Financial organizations must ensure they have reliable methods for verifying customer information. Automated KYC solutions help reduce the workload for compliance officers. They provide real-time assessments of customer data from global databases and public records. Incorporating automated systems leads to better risk management strategies over time. The ability to quickly and accurately gather customer information enhances institutional reputations. Automated verification processes increase the likelihood of flagging suspicious activities early. The integration of machine learning algorithms allows these systems to adapt constantly to evolving threats. Moreover, automated solutions generate detailed reports for auditors. These reports can help simplify the entire audit process by maintaining comprehensive records. By adopting these innovative systems, companies can strengthen their compliance posture and regulatory adherence. Fulfilling KYC requirements becomes a streamlined process rather than a burdensome task. As the finance sector undergoes digital transformation, investing in automation establishes a competitive advantage.

Benefits of Automated KYC Processes

Automated KYC processes provide numerous benefits beyond compliance. These systems can significantly enhance operational efficiency by minimizing manual tasks. Institutions can reallocate employee focus to higher-value responsibilities, further boosting productivity. Enhanced customer experience is another major advantage of automation. Clients prefer frictionless experiences when establishing new accounts. Automated KYC solutions expedite the onboarding process by swiftly verifying identities. Consequently, customers appreciate the convenience of quicker service delivery. Technologies such as biometric verification assure customers of their data security. Moreover, customer trust increases knowing their identities are safeguarded. Institutions can adopt a seamless digital transformation strategy with automated compliance tools. This transition promotes innovation through smarter decision-making based on reliable data. Automated processes allow for better analytics that can inform strategic actions. Streamlining KYC compliance enables firms to meet market demands with agility. Additionally, automating tedious tasks reduces the potential for human error, further strengthening compliance efforts. Another stacked benefit involves cost savings that result from efficiency gains. Ultimately, focusing on customer satisfaction while ensuring compliance creates a robust foundation for long-term success.

Implementing automated KYC processes requires a strategic approach. Financial institutions must evaluate their existing compliance frameworks first. Understanding technology integration capabilities is essential before deploying new systems. Additionally, firms should assess the regulatory landscape affecting their operations in specific markets. This knowledge enables the selection of automated solutions that comply with regional guidelines. Engaging with vendors who specialize in KYC automation can provide better results. Organizations must look for providers with a proven track record of effective integrations. Furthermore, a phased implementation approach can help mitigate operational disruption. This way, institutions can assess the performance of new systems while ensuring continuous compliance. Continuous monitoring and adjustment of the automated KYC processes become necessary to stay relevant in an ever-evolving regulatory environment. Establishing a feedback loop with employees involved in the KYC process can offer valuable insights. They can identify areas needing improvement and optimization efficiently. Training staff on new systems also plays a vital role in seamless adoption. A workforce equipped with relevant knowledge ensures smooth transitions toward automated solutions. Ultimately, investing time and resources into effective implementation fosters a culture of compliance and innovation.

Challenges in KYC Automation

Despite the advantages of automated KYC processes, challenges persist. Integrating new systems with legacy infrastructure often poses significant hurdles. Many financial institutions still rely on outdated technology, which complicates transitions to automated solutions. Additionally, privacy regulations, such as GDPR, can impact how customer data is collected and processed. Institutions must navigate these privacy concerns while implementing automation tools. Regulators expect financial businesses to prioritize customer data security by design. Furthermore, inaccuracies in customer data sourced from third-party providers can hinder automation efforts. Inconsistent data quality may lead to inefficiencies and compliance setbacks. Engaging directly with customers during the onboarding process is critical for obtaining accurate information. Misinterpretation of regulatory requirements can also lead to compliance gaps. Institutions must invest in ongoing training and education for staff to avoid these pitfalls. Lastly, maintaining automated systems calls for continuous updates and maintenance. Regular system evaluations are necessary to ensure optimal functionality. Overall, overcoming these challenges is vital for achieving the desired level of efficiency and compliance. Organizations that prioritize innovations while managing challenges will reap long-term benefits from automating their KYC processes.

In the future, the role of automated KYC processes is likely to evolve. Emerging technologies, such as blockchain, hold significant potential in enhancing identity verification systems. Blockchain technology can provide a secure way to manage customer identities and transactions. This innovation can streamline KYC processes by allowing secure sharing of data among authorized parties. Financial institutions have already begun exploring blockchain applications for enhanced data security. Moreover, the incorporation of AI can improve the ability to detect suspicious activities in real time. As automated KYC processes advance, companies will prioritize creating a smoother user experience. Increased emphasis on customer-centric approaches will be essential for building lasting relationships. Integrating omnichannel solutions can appeal to a broader range of customers. The combination of personalized services with automation can result in a unique competitive advantage. Collaborative approaches involving regulators and the industry can further shape the KYC landscape. Partnerships can lead to improved standards and frameworks for effective compliance practices. In conclusion, staying ahead in the financial sector necessitates a focus on innovative technologies. Investing in automated KYC processes will ensure compliance while enhancing customer satisfaction.

The Future of KYC Compliance

As we look ahead, the evolution of KYC compliance will continue to be influenced by global trends. The push towards digitalization and regulatory changes necessitate innovative approaches. Financial institutions must remain adaptable to keep pace with these developments. Embracing technologies such as artificial intelligence and machine learning will enable more intelligent compliance systems. Automated KYC processes will evolve to include predictive analytics, enhancing risk assessment capabilities. Customers will demand greater transparency around data usage, highlighting the need for ethical practices in compliance. Ongoing investments in technology will create opportunities for streamlined interactions. Regulatory bodies will likely create frameworks that encourage innovation while safeguarding consumers. The importance of collaboration among financial institutions will become paramount to share revelations about best practices. Additionally, real-time identity verification will reshape compliance processes to become more robust. Overall, organizations that embrace changes in KYC compliance will gain a competitive edge. By fostering a culture of innovation and adaptability, financial institutions can thrive amidst evolving challenges. Compliance will not merely be a requirement but a strategic differentiator moving forward.

In summary, embracing automated KYC processes offers substantial benefits for financial institutions. Increased efficiency, improved accuracy, and enhanced customer experiences result from automation efforts. As the regulatory landscape grows increasingly complex, advanced technologies provide solutions to ensure compliance. Financial organizations must prioritize innovation to stay competitive. The commitment to integrating automated solutions will lead to long-term success and sustainability. A forward-thinking approach toward KYC compliance will mitigate risks while enhancing customer trust. By utilizing advanced technologies, institutions can navigate the complexities of financial regulations. Companies that prioritize comprehensive KYC automation solutions will triumph in fostering compliance. In conclusion, as we look at the journey of digital transformation in finance, staying informed about best practices will be crucial. Continuously embracing automation while overcoming challenges ensures not only compliance but also enhances customer relationships. Adapting to the rapidly changing environments will ensure that institutions are well-prepared to face future challenges. Overall, the evolution of KYC processes will play a pivotal role in shaping a more secure financial landscape for all parties involved.