Digital Currency Market Strategies for Long-Term Investors

The evolution of digital currency markets has paved the way for innovative investment strategies, significantly impacting long-term investors. Understanding these emerging markets is essential to navigating the often turbulent landscape of digital currencies. Market volatility poses a considerable risk, yet it also offers exceptional opportunities for those who adopt a strategic approach. Analyzing market trends, investor sentiment, and technological advancements can furnish valuable insights into potential investment pathways. Additionally, long-term investors should remain informed about regulatory developments affecting the digital currency landscape. Staying abreast of changes in legislation, taxation, and compliance requirements can help mitigate risks associated with investments. By leveraging analytics tools and market research, investors can strategically position themselves to capitalize on growth potential within the digital currency markets. The objective is to build a diversified portfolio that can withstand fluctuations while maximizing potential returns. Emphasizing patience and discipline, investors should focus on research-driven decision-making to avoid pitfalls during market uncertainties. Ultimately, the emphasis should be on creating a resilient investment strategy that thrives in the volatile world of digital currencies. This article aims to uncover such strategies for sustained growth and success.

Understanding the underlying technologies behind digital currencies, particularly blockchain, is crucial for informed investment decisions. Blockchain technology serves as the foundation for most cryptocurrencies, enabling secure, decentralized transactions. Investors must familiarize themselves with various platforms and technologies, as each digital currency may possess unique traits influencing its market performance. For instance, Ethereum’s smart contract capabilities distinguish it from Bitcoin’s more straightforward transaction model. Conducting in-depth explorations of different blockchains, their use cases, and adoption rates will not only refine investment choices but also enhance the overall strategy in the long run. Consequently, potential investors should assess the longevity, scalability, and reliability of various currencies. Engaging with communities and forums can also provide firsthand insights into upcoming projects and developments. By staying informed about cutting-edge innovations and market shifts, long-term investors can effectively gauge which cryptocurrencies are poised for growth. This foundational knowledge ultimately empowers investors to make more strategic and educated decisions. As the industry evolves dynamic shifts, embracing technological literacy becomes increasingly essential for capitalizing on future developments within the digital currency market.

Diversification in Digital Currency Investments

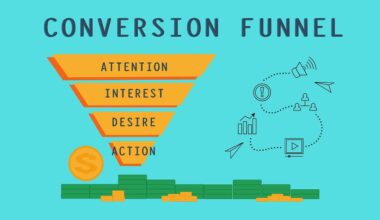

Diversifying an investment portfolio is a fundamental strategy for managing risk, especially in the volatile realm of digital currencies. A well-balanced portfolio consists of a range of assets across various sectors, minimizing the impact of poor-performing investments. While Bitcoin may dominate headlines, many altcoins are emerging with unique value propositions. Allocating a portion of capital to several promising cryptocurrencies can safeguard against sudden market declines. Investors should analyze potential candidates based on factors like market capitalization, technology, and community support. Additionally, exploring emerging trends, such as decentralized finance (DeFi) and non-fungible tokens (NFTs), could open new avenues for growth. The DeFi sector, for instance, offers innovative financial services without traditional intermediaries. NFTs represent a novel way to own and trade digital assets, featuring unique market dynamics. By allocating funds to a mix of established and emerging digital currencies, investors can better position themselves for long-term success. Further, staying updated on market trends helps to make informed decisions on asset allocation. Constantly reassessing portfolio allocations based on new information and market conditions is essential to maintaining a resilient investment strategy.

Technical analysis plays a vital role in identifying entry and exit points for long-term investors within the digital currency space. By analyzing price charts, patterns, and indicators, investors can gain insights into potential market movements. Key indicators like Moving Averages, Relative Strength Index (RSI), and Fibonacci retracements can help traders make informed decisions based on past performance and trading volume. While market fundamentals are essential, incorporating technical analysis complements overall investment strategies. Long-term investors can use this data to inform their decisions without becoming overly reliant on short-term trends. Furthermore, vigilance in ensuring that trading signals are accurate is critical. Relying on multiple indicators may help reduce false signals, enabling investors to make more timely and effective decisions. Keeping abreast of market news and external factors that may affect price movements is equally important. An integrated approach combining technical analysis, news sentiment, and fundamental insights is recommended for long-term investors aiming for sustainable growth. Subsequently, the ability to adapt to market changes becomes an indispensable skill in the rapidly evolving digital currency landscape. Periodic adjustments to strategies, based on fresh insights, ensure continued adaptability, resilience, and success.

The Importance of Security in Digital Currency Investments

Succeeding in the digital currency market requires a robust understanding of security measures to safeguard investments. The risk of hacking, scams, and loss of access to wallets can significantly impact long-term success. Investors should prioritize adopting best practices for securing digital assets, starting with the choice of wallets. Hardware wallets are highly recommended due to their superior security features compared to software options. Regularly updating security protocols and employing two-factor authentication (2FA) are additional safeguards that can significantly reduce risk exposures. Furthermore, educating oneself about phishing attacks and social engineering tactics is essential. Being cautious of unsolicited messages or offers can prevent potential pitfalls. Increasing reliance on exchanges can also expose investors to risks; thus, enabling withdrawal to personal wallets is advisable. Researching the reputation and security policies of exchanges further fortifies a secure investment strategy. Retaining a record of transactions, complying with regulations, and maintaining an overview of cryptocurrency holdings will enhance accountability and security. Ultimately, security is paramount in ensuring long-term viability and success in the complex digital currency market.

Long-term investors must remain vigilant to regularly reevaluate their strategies and investment choices based on prevailing market conditions. The digital currency landscape is characterized by rapid development and unforeseen events that can rapidly alter investment value. Periodically reviewing investments allows for timely adjustments that optimize performance. Investors should establish a routine of conducting thorough portfolio assessments and market analyses every few months. Reassessing risk tolerance levels aligned with personal financial goals is crucial for successful long-term investing. Additionally, monitoring the performance of individual assets within the portfolio will help identify underperformers, guiding informed decisions on whether to hold or divest. Keeping track of regulatory updates and market trends contributes to a holistic understanding of the evolving environment. This practice ensures investors remain agile and confident in their choices while drawing on historical data and best practices. Moreover, fostering a disciplined approach toward investing, complete with periodic evaluations, can yield significant dividends over the long term. Ultimately, a commitment to diligence and adaptability positions investors for enduring success in the unpredictable world of digital currency markets.

Staying Informed: A Key Factor

Successfully navigating the digital currency market requires a commitment to continuous learning and staying informed. As digital currencies are constantly evolving with new technologies, regulations, and market dynamics, investors must actively seek out reliable sources of information. Engaging in forums, reading news articles, following industry experts, and subscribing to relevant newsletters can enhance knowledge and help identify potential opportunities or threats on the horizon. Furthermore, attending conferences and webinars can provide valuable networking opportunities, in addition to sharing insights with peers. Long-term investors should be cautious about sensational news; it is crucial to verify claims through multiple sources to ensure accuracy. Developing a well-informed perspective not only strengthens decision-making but also enhances confidence during periods of volatility. Additionally, creating a personal reading list of reliable resources tailored to digital currencies can streamline access to pertinent information. Ultimately, prioritizing continuous education fosters a deeper understanding of the market and its nuances. By cultivating an informed mindset, investors can better adapt their strategies, manage risks, and stay ahead of trends in the ever-shifting digital currency landscape.

The journey of investing in digital currencies can be both exciting and challenging but requires a thoughtful approach to maximize rewards. Establishing clear financial goals is fundamental in shaping one’s investment strategy. For long-term investors, aligning investments with personal objectives enables a more focused assessment of performance and progress. Goals may range from wealth accumulation, retirement funding, or simply gaining exposure to innovative technologies. Investors should map out a timeline for achieving these objectives, helping to foster patience and steer away from impulsive decisions influenced by short-term market fluctuations. Additionally, employing a disciplined investment approach, characterized by regular contributions, can assist in capitalizing on market opportunities over time. This strategy also diminishes the emotional burden often associated with market volatility. Furthermore, implementing an ongoing reflection process ensures a mindful evaluation of successes and setbacks in achieving goals. Engaging in financial planning, incorporating diverse asset classes, and remaining committed to digital currencies cultivate a balanced, resilient investment strategy. By adhering to their financial goals and consistently investing, individuals can enhance the likelihood of long-term success in the digital currency market.