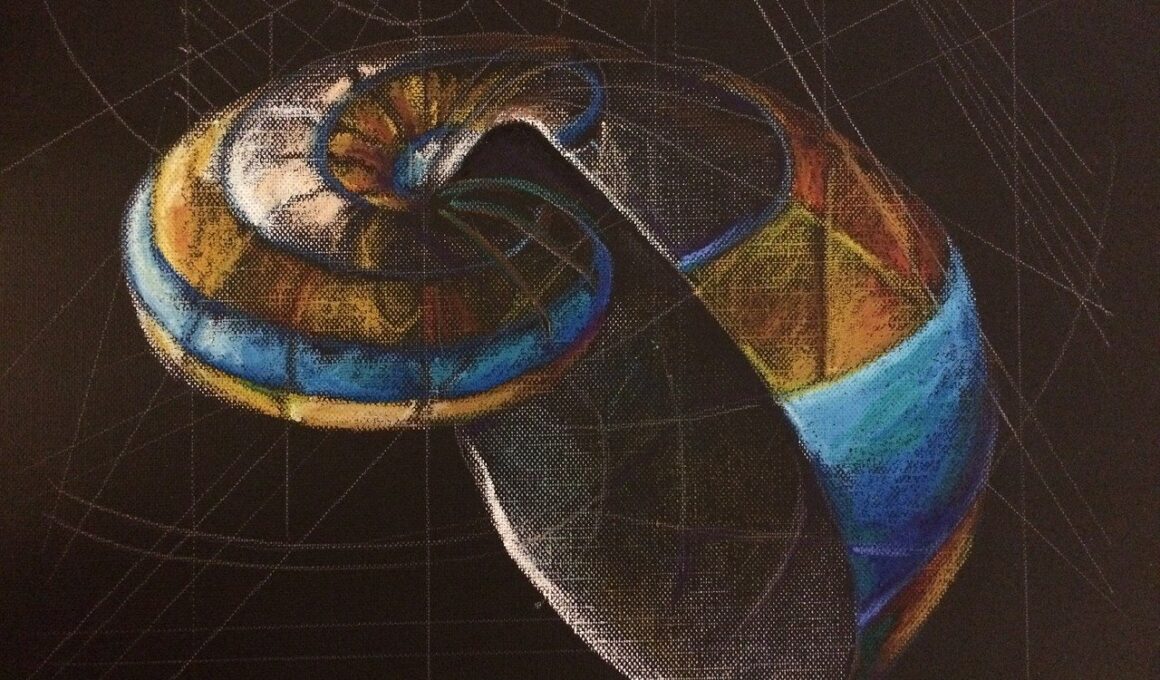

The Power of Fibonacci Retracement in Stock Trading

Fibonacci retracement is a significant tool in the stock trading world, gaining popularity among investors for its ability to help predict price reversals. By using Fibonacci levels, traders can identify potential support and resistance points in the market. The main Fibonacci levels that traders typically focus on include 23.6%, 38.2%, 50%, 61.8%, and 100%. These levels relate to the significant Fibonacci sequence, which informs traders about the natural rhythms within the market. Many investors believe that price reversals often occur around these key Fibonacci levels, allowing them to make educated trading decisions. It’s vital for traders to apply reliable methodologies when determining possible price movements. Fibonacci retracement can be effectively combined with other trading indicators to enhance its predictive power. Traders often utilize tools such as moving averages, trend lines, and oscillators alongside Fibonacci levels. This multifaceted approach allows investors to corroborate signals and make well-informed trading decisions. With proper application and understanding, Fibonacci retracement can serve as a beneficial asset in risk management, enabling traders to navigate the complexities of stock trading with greater confidence.

Applying Fibonacci retracement in stock trading requires fundamental knowledge of market behavior and patterns. When traders draw Fibonacci retracement levels after a notable price movement, they establish crucial reference points where trends might reverse. These points can signify potential buying or selling opportunities for investors. To draw Fibonacci retracement levels, traders begin by identifying pivotal high and low points in a chart. Many charts, such as candlestick and line charts, allow easy visualization of these trends. Once these points are established, the Fibonacci retracement tool can be employed to overlay the relevant levels. The levels highlight potential pauses or reversals in price movements. Moreover, Fibonacci levels can create a framework that supports risk management strategies, enabling traders to define stop-loss and take-profit points. This clarity is particularly important in volatile markets. Additionally, incorporating volume analysis with Fibonacci retracement can provide an extensive understanding of market behavior. By analyzing trading volumes at these key levels, investors gain insights into market strength or weakness. Therefore, combining Fibonacci retracement with additional analysis enhances overall trading effectiveness and decision-making. This practice allows traders to maximize potential gains while minimizing undue risk.

Understanding Market Psychology

One appealing aspect of using Fibonacci retracement is its basis in market psychology. Many traders share similar perceptions of market levels, leading to self-fulfilling prophecies. When a significant number of investors recognize the 61.8% retracement level, for instance, they will likely place buy or sell orders around this level, influencing the price direction. This phenomenon can amplify market reactions at these Fibonacci levels, making them particularly powerful for traders to watch. Psychology plays an essential role, as it fuels the market’s ebb and flow. Understanding how other traders are likely to act in certain situations can enhance the probability of successful trades. To capitalize on these collective behaviors, traders may look at additional indicators. Integration of momentum oscillators can enhance the accuracy of predictions based on Fibonacci levels. Indicators like the Relative Strength Index (RSI) or Stochastic oscillators provide insights into overbought or oversold conditions. By analyzing these factors in conjunction with Fibonacci levels, traders can make sound decisions that account for both individual analysis and broader market sentiment. Ultimately, this psychological aspect underscores the importance of executing informed trades.

Fibonacci retracement levels not only assist in determining potential price reversals but also provide insights into trade timing. Recognizing these levels offers traders valuable opportunities to enter positions effectively and manage their trades accordingly. For example, a trader observing a price retracement towards the 50% Fibonacci level might consider entering a position with a favorable risk-to-reward ratio. This allows them to align their trading strategy with the apparent market behavior. Subsequently, the use of trailing stops can lock in profits as the price moves favorably. Investors can also use Fibonacci levels to secure losses strategically through stop-loss orders. By placing stop-loss orders beneath the Fibonacci levels, traders limit their potential losses to manageable levels. Moreover, utilizing multiple timeframes is essential when analyzing Fibonacci retracements. A level that appears significant on a shorter timeframe may align with a higher timeframe’s technical pattern, reinforcing its validity. This approach fosters a comprehensive understanding of market dynamics, guiding traders in making decisions. Ultimately, timing trades correctly based on Fibonacci retracement can lead to enhanced profitability and greater trading success.

Common Mistakes When Using Fibonacci Retracement

Despite its popularity, many traders fall into common pitfalls when applying Fibonacci retracement in stock trading. One frequent mistake is relying solely on Fibonacci levels without confirming with additional indicators. While Fibonacci levels serve as vital reference points, it is crucial to examine the broader market context to gauge the trends effectively. Also, disregarding the importance of market news and events can lead traders to make uninformed decisions. Economic reports, earnings announcements, and geopolitical events can have profound impacts on stock movements, often overshadowing technical analysis. Another prevalent issue concerns the incorrect identification of peak and troughs. Traders must practice diligence in accurately selecting notable low and high points. Minor deviations from these pivotal points can significantly alter the Fibonacci levels and subsequently skew predictions. Moreover, a failure to adjust strategies as market conditions change can also magnify setbacks. Trading is an evolving landscape, and staying flexible is essential. Implementing robust risk management strategies is equally critical, as emotional decision-making can lead to detrimental outcomes. By recognizing and addressing these common mistakes, traders can enhance their proficiency in utilizing Fibonacci retracement effectively.

As with all trading strategies, practice is essential when it comes to mastering Fibonacci retracement techniques in stock trading. Investors should engage in paper trading or simulation environments to develop their skills before committing real capital. This practice allows traders to refine their strategies without emotional pressures, experimenting with Fibonacci retracement on various stock pairs. Furthermore, reviewing historical price charts can provide valuable experience in identifying valid trends and patterns. Over time, traders can develop their methodologies for drawing Fibonacci levels and assessing market reactions. Continuous education and staying abreast of market developments are vital for long-term success. Many resources exist, including books, online courses, and trading forums, which can help refine one’s understanding of Fibonacci retracement. Moreover, exchanging ideas with fellow traders fosters collaboration and learning through shared experiences. By nurturing an ongoing commitment to education, traders can adapt their practices to meet evolving market conditions. Ultimately, becoming proficient in Fibonacci retracement not only benefits traders but also contributes to a more robust and comprehensive trading strategy.

Conclusion: The Role of Fibonacci Retracement

In conclusion, Fibonacci retracement emerges as a powerful tool in stock trading, offering valuable insights into potential support and resistance levels. Through understanding market psychology, traders can enhance their decision-making when navigating various market conditions. Importantly, incorporating additional technical analysis methods further solidifies the predictive strength of Fibonacci levels, leading to more effective trading outcomes. Engaging in thorough research and honing one’s skills through practice, along with awareness of common mistakes, enables traders to wield Fibonacci retracement with confidence. As the financial landscape continues to evolve, adaptability and continued learning are crucial components of successful trading. Ultimately, those who master Fibonacci retracement can leverage this tool to optimize their trading strategy and potentially achieve heightened profitability. Embracing this methodology within the broader framework of technical analysis allows traders to make educated and informed decisions. The journey includes embracing challenges, leveraging insights, and developing a deep understanding of market dynamics. Through persistent effort and an engaged mindset, traders can ultimately maximize their success through Fibonacci retracement and beyond.

Overall, Fibonacci retracement is a beneficial strategy that empowers stock traders to enhance their analysis and decision-making processes. By integrating these strategies, traders can navigate the complexities of the stock market with greater insight. Furthermore, developing a thorough understanding of Fibonacci levels enables traders to anticipate price movements effectively, allowing for advantageous positions. In an ever-changing market environment, vigilance and education are vital for long-term success. Utilizing Fibonacci retracement appropriately can yield better trading results and create more structured approaches to trading. As the trading community continues to develop, resources and tools for mastering Fibonacci techniques become increasingly accessible. Traders who invest the necessary time to learn the art of Fibonacci retracement are likely to experience benefits that contribute to their long-term trading proficiency. Balancing technical analysis with market psychology forms a comprehensive approach that can lead to successful trading outcomes. Therefore, understanding Fibonacci retracement levels ultimately enhances the ability to analyze market conditions and align with favorable trading strategies. As traders refine their methods, they can effectively improve their overall performance and achieve financial goals with confidence.