How to Detect and Prevent Ethical Violations in Financial Modeling

Financial modeling is an essential component of the financial sector, allowing professionals to predict outcomes and make informed decisions. However, ethical violations can significantly undermine the integrity and reliability of these models. Detecting ethical lapses not only requires keen scrutiny of the model inputs and outputs but also involves a commitment to uphold transparency and accountability within the process. Models must be constructed using accurate assumptions and reliable data to ensure ethical integrity. One key method developed to prevent ethical breaches is the implementation of a clear ethical framework within which financial models operate. By establishing a code of conduct, financial analysts can guide their actions and decisions in a morally sound manner. Regular audits, peer reviews, and ethical training are crucial in fostering an environment where ethical conduct is valued and enforced. Additionally, promoting a culture of whistleblowing encourages employees to report unethical practices without fear of retaliation. This ongoing dialogue about ethics will ultimately lead to a more trustworthy financial modeling process that benefits all stakeholders involved.

One significant aspect of preventing ethical violations is the standardization of financial modeling practices. Best practices should be established and documented to ensure consistency across all models created. These practices can encompass data handling, model specification, and validation processes to reduce subjective interpretation. Additionally, using industry-standard modeling frameworks can provide a clearer ethical guideline for financial practitioners. Stakeholders need clarity in expectations regarding model usage, data sources, and periods of review to maintain the highest ethical standards. Financial institutions should impose regular training sessions to keep employees updated on ethical standards and model accuracy. Furthermore, awareness around biases that affect decision-making is crucial, as these can lead to ethical dilemmas. By integrating a bias-awareness component into training, analysts can develop a heightened sensitivity towards potential ethical dangers within their models. Financial practices must evolve continuously, adapting to new regulations and industry standards while keeping ethical considerations at the forefront. Thus, fostering a robust ethical framework ensures that financial modeling remains a reliable tool in navigating complex financial landscapes.

Recognizing Common Ethical Issues

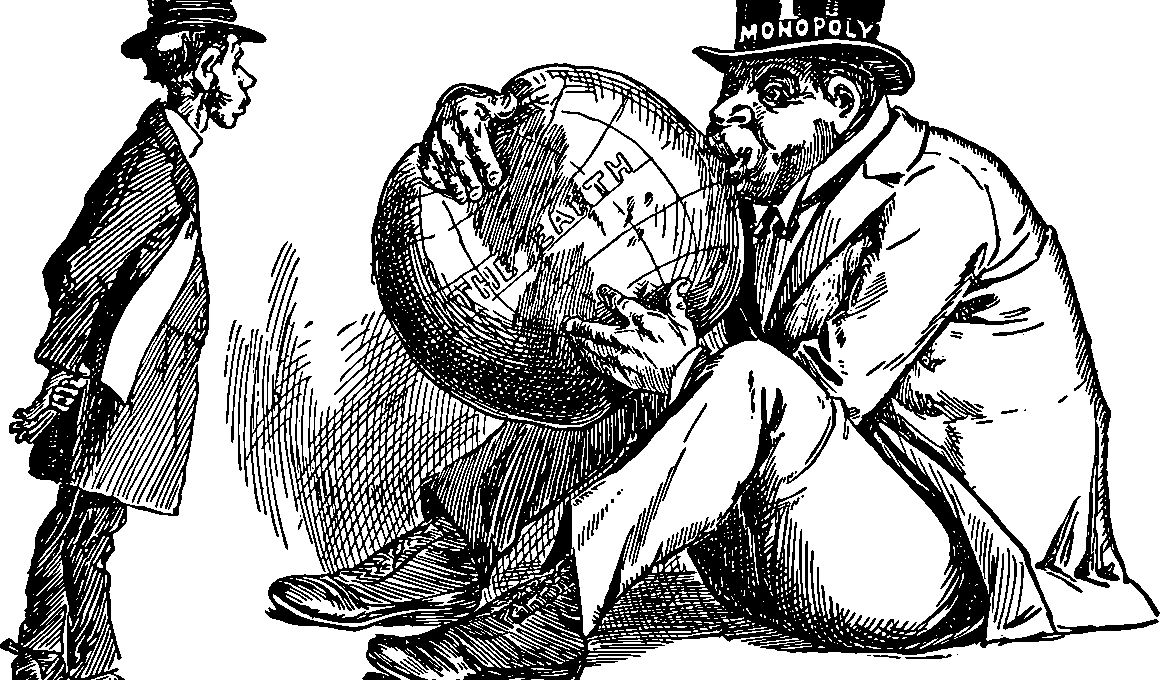

Throughout the financial modeling life cycle, analysts face various ethical challenges, including data manipulation, misinformation, and conflicts of interest. Data manipulation can occur when analysts cherry-pick information that supports their desired outcome while ignoring contradictory data. This selective use of information can mislead stakeholders, leading to unethical decision-making. Recognizing the harmful impacts of misinformation is crucial, as inaccurate models can result in significant financial repercussions for firms and investors alike. To combat these issues, establishing rigorous data integrity validation standards is essential. Comprehensive methods can flag discrepancies and ensure that data sources remain reliable and transparent. Furthermore, practitioners must disclose any potential conflicts of interest that could influence their modeling decisions. By openly communicating such conflicts to stakeholders, analysts can help mitigate ethical risks and maintain trust and integrity. Continuous monitoring and oversight mechanisms should be adopted to ensure ethical compliance as projects progress. Encouraging firms to nurture an ethical culture within their financial modeling teams facilitates open discussions about ethical boundaries and enhances overall compliance with established protocols.

Ethical violations can also arise due to misaligned incentives within financial modeling teams. When professionals are rewarded based on performance metrics that prioritize model accuracy over ethical considerations, they may feel pressured to compromise integrity. Thus, it is vital that compensation structures align with ethical outcomes, promoting responsible practices rather than merely producing the best financial figures. Organizations should emphasize the importance of compliance with legal and ethical standards, ensuring that employees understand the repercussions of unethical behavior. During performance reviews, ethics should be included as a criterion for evaluation to encourage accountability within teams. Integrating comprehensive ethical guidelines into everyday procedures creates a work environment where ethical conduct flourishes. Moreover, organizations should implement mechanisms for reporting unethical behavior, facilitating an environment where employees feel safe and supported should they need to speak out. A collaborative approach involving all team members can lead to greater ethical awareness and improved modeling processes. By taking these proactive steps, organizations can significantly mitigate ethical risks associated with financial modeling and foster a culture rooted in trust, accountability, and transparency.

Importance of Transparency

Another crucial factor influencing ethics in financial modeling is transparency. Transparency ensures that all stakeholders have access to the methodologies and assumptions that underpin financial models. Providing stakeholders with a clear understanding of how models were constructed helps eliminate confusion and fosters trust in the results. Analysts must document all processes thoroughly, detailing data sources, modeling techniques, sensitivity analyses, and potential risk factors. Such documentation will prove invaluable during reviews and audits, serving as a reliable reference for evaluating model integrity. Moreover, embracing transparent practices encourages interdisciplinary collaboration, allowing for the exchange of ideas and enhanced critical thinking around ethical implications. Different perspectives can illuminate potential biases or ethical risks that may have otherwise gone unnoticed. Promoting an open-door policy for feedback adds another layer of scrutiny to the financial modeling process. As models evolve over time, stakeholders should review them regularly and provide input to ensure that ethical standards remain high. Ultimately, transparency not only fosters ethical practices but also promotes the overall accuracy and reliability of financial models, benefitting all parties involved.

To enhance ethical awareness, organizations can benefit from establishing ethics committees or advisory boards focused on financial modeling practices. These teams would play a pivotal role in evaluating existing models and providing guidance on ethical dilemmas that may arise. Furthermore, the committees can help align financial modeling outcomes with broader organizational values and ethical guidelines. Engaging external auditors or involving third-party assessments can also provide additional layers of objectivity and ethical compliance. External reviews can uncover potential blind spots and ensure that ethical standards are not just met but exceeded. Regularly scheduled ethical audits will reinforce ethical commitment in financial modeling practices, encouraging an environment where upholding integrity becomes part of the organization’s culture. It is crucial to engage employees in meaningful conversations about how ethical practices benefit the organization as a whole. By illustrating the long-term advantages of ethical compliance, including risk management and enhanced brand reputation, employees can internalize the importance of ethical modeling. A proactive approach to ethics ultimately will help fortify organizations against ethical breaches and enhance their standing within the financial industry.

Conclusion and Call to Action

In conclusion, detecting and preventing ethical violations in financial modeling is a collective responsibility shared by all stakeholders. By cultivating a culture rooted in transparency, accountability, and ethical conduct, financial organizations can ensure that their modeling practices remain credible and dependable. Regular training, performance evaluations emphasizing ethics, and ongoing discussions can reinforce ethical awareness among team members. It is essential that organizations remain vigilant and proactive, adjusting their ethical guidelines as needed to adapt to changes in the regulatory landscape and industry dynamics. Encouraging open communication about ethical issues and providing safe avenues for reporting concerns are vital to fostering a supportive work environment. Additionally, financial modeling teams should seek to implement best practices, including using standardized frameworks and maximizing data integrity, to ensure ethical excellence in their modeling processes. Creating a clear ethical structure is paramount in navigating the complexities of financial modeling. Ultimately, it is the commitment to ethically sound practices that will yield positive outcomes, both for financial institutions and the clients they serve, enhancing trust and the overall integrity of the financial industry.

The role of leadership is also critical in setting the ethical tone for financial modeling practices. Leaders must embody ethical standards and practices, modeling expected behaviors for their teams. Through leadership commitment, organizations can foster an environment where ethical behavior is not just encouraged but celebrated. Regularly communicating the importance of ethics through town hall meetings or workshops can help solidify the message throughout the organization. Leaders can share stories of ethical successes or challenges, highlighting the need for constant vigilance against breaches. Furthermore, implementing mentorship programs allows experienced professionals to instill ethical values in newer team members, thereby creating a lasting culture of integrity. As leaders champion ethical practices, they should also demonstrate transparency in their operations, showing alignment between words and actions. An effective feedback loop that encourages suggestions from all levels of the organization will enhance buy-in and commitment to ethical standards. Emphasizing the visibility of ethical commitments reinforces the notion that everyone is accountable for maintaining ethical integrity. This leadership approach not only helps prevent ethical violations but also nurtures an organizational culture that prioritizes ethics, ultimately leading to robust financial modeling practices.