Key Trends in Mobile Consumer Behavior Affecting Financial Services

The rise of mobile devices has fundamentally altered consumer behavior, particularly in the financial services sector. Consumers are increasingly turning to their smartphones for a variety of banking and financial transactions. With mobile wallets and banking applications, tasks like checking account balances, transferring money, and applying for loans can be done at any time and from anywhere. This shift means financial institutions must adapt accordingly or risk losing relevance. Providing user-friendly interfaces and ensuring security are paramount in fostering customer trust. Additionally, the convenience of mobile banking has led to an expectation for quick and efficient service. Financial services must keep pace with these expectations through innovative solutions that enhance the user experience, such as personalized notifications for banking activities. Moreover, integrating AI and machine learning can help predict consumer needs, leading to more tailored services. As mobile technology continues to evolve, so too will the expectations of consumers. Institutions must not only react but anticipate these shifts to remain competitive in an ever-changing market. Staying ahead requires continuous engagement with emerging trends and understanding consumer behavior on a deeper level.

The impact of social media on mobile consumer behavior is significant. Platforms like Instagram and Twitter have transformed how consumers interact with brands, including financial service providers. Many consumers now expect to engage with their banks and financial institutions through social media channels. This shift provides opportunities for increased brand loyalty and awareness, as companies can communicate directly with their audience in real time. Additionally, social media influencers can play a crucial role in shaping perceptions about financial products. With endorsements and authentic reviews, influencers can help demystify complex financial services for younger audiences. Moreover, customers often consult social media before making financial decisions, whether purchasing insurance or investing. The immediate access to reviews, comparisons, and advice from peers creates a need for financial institutions to maintain a positive online presence. To succeed, companies need a strategic approach that includes active social media engagement and consistent messaging. They must also be equipped to handle customer inquiries and feedback effectively. The integration of user-generated content can further enhance engagement, making financial services more relatable and accessible to clients across demographics.

The Role of Personalization

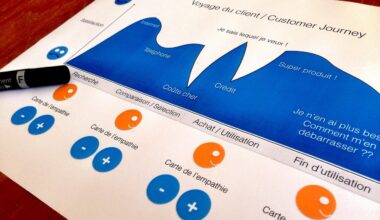

Personalization in mobile marketing is becoming increasingly crucial for financial services. Consumers now demand unique experiences that cater specifically to their needs and preferences. By utilizing data analytics and artificial intelligence, financial institutions can collect information about users’ spending habits and preferences to provide personalized offers and recommendations. This could include tailored interest rates, custom investment opportunities, or exclusive promotions. Moreover, personalized notifications can enhance user experience by reminding customers of payment due dates or suggesting savings plans based on their financial behavior. The importance of communicating through mobile apps cannot be overstated, as it fosters a sense of connection and loyalty. Customers are more likely to engage with brands that understand their preferences and anticipate their needs. Additionally, creating a seamless cross-channel experience further enhances personalization efforts. Financial institutions can leverage data gathered from multiple touchpoints to ensure consumers receive consistent and relevant communication across platforms. As personalization technology continues to advance, it will be easier for banks to provide customers with valuable insights and tailored services, ultimately driving customer satisfaction and increasing loyalty.

Security and privacy concerns are paramount when it comes to mobile consumer behavior in financial services. As mobile banking expands, so do the risks associated with mobile transactions. Consumers are increasingly aware of the potential cyber threats impacting their financial data. Therefore, building strong security measures is crucial for financial institutions to retain consumer trust. Multi-factor authentication, encryption, and regular security updates are essential to safeguarding sensitive information. Additionally, educating consumers about security best practices can empower them to protect their assets effectively. Financial institutions must ensure that their mobile platforms comply with data protection regulations and maintain transparency regarding data usage. Offering clear privacy policies can help alleviate fears and encourage customers to use mobile services more frequently. A user-friendly and secure mobile interface enhances overall customer experience while fostering brand loyalty. Furthermore, financial institutions that prioritize security will likely gain a competitive edge as cautious consumers opt for more secure mobile service providers. As the digital landscape evolves, continuous investments in security and technology will be key to sustaining consumer confidence and encouraging mobile adoption.

The Importance of User Experience

User experience (UX) plays a pivotal role in mobile consumer behavior within financial services. A seamless and intuitive app design can significantly influence consumer satisfaction and long-term engagement. Users expect to navigate smoothly through banking applications without facing frustrations or unnecessary steps. Simple interfaces and easy access to essential features can enhance customer retention. In contrast, poorly designed apps may discourage users from engaging, leading to higher abandonment rates. Financial institutions should invest in user interface (UI) testing to ensure their apps meet consumer expectations effectively. Additionally, gathering feedback from users can provide valuable insights into improving functionality and design. Utilizing advanced technologies such as voice recognition and chatbots can further streamline interaction, making financial services more approachable for users. A robust user experience also translates into increased loyalty, as satisfied customers are more likely to recommend services to family and friends. Therefore, prioritizing UX as a core aspect of mobile strategy will yield positive results for financial institutions, boosting both customer satisfaction and engagement while contributing to overall brand reputation.

Mobile payment systems are revolutionizing consumer behavior regarding financial transactions. The adoption of digital wallets and contactless payments is growing rapidly, influenced by convenience and speed. Users appreciate being able to complete transactions with just a tap or scan, significantly improving the overall shopping experience. Additionally, the COVID-19 pandemic accelerated the transition towards contactless payments as consumers sought safer transaction methods. As more people become familiar with digital payment systems, financial service providers must ensure compatibility with various formats, such as Apple Pay and Google Wallet. This flexibility promotes user adoption and allows consumers to choose their preferred payment methods. Moreover, the integration of loyalty programs into mobile payment platforms further enhances consumer engagement. By rewarding users for transactions, brands can encourage repeat business and foster customer loyalty. It’s essential for financial institutions to prioritize seamless integrations that not only enhance user experience but also encourage greater participation in digital payment ecosystems. The ongoing trend towards mobile payments indicates that consumers increasingly value convenience, meaning financial services must evolve to meet these rising expectations while promoting secure and efficient transaction methods.

Conclusion and Future Outlook

In conclusion, understanding mobile consumer behavior is vital for financial services to adapt and thrive in an increasingly digital world. As technology progresses, consumers will continue to expect personalized, secure, and efficient experiences. Financial institutions must remain agile, embracing new technologies to meet changing consumer demands. The importance of mobile marketing strategies cannot be understated, as they directly impact consumer engagement and loyalty. By leveraging data analytics, organizations can gain insights into user behavior and tailor services accordingly. Engaging consumers through social media and providing robust customer support will enhance relationships and satisfaction. Ultimately, success hinges on the ability to innovate and deliver value continuously. As the financial landscape evolves, organizations that prioritize mobile consumer behavior will position themselves well for future growth. Additionally, collaboration with fintech companies and technology providers can further drive innovation and enhance service offerings. The commitment to understanding and responding to consumer needs will be the distinguishing factor in a competitive market. Financial institutions that embrace these trends will successfully navigate the complexities of mobile consumer behavior and secure a sustainable future.

Please refer to relevant sources or research to stay informed about evolving trends in mobile consumer behavior in financial services.