Analyzing the Effectiveness of Reserve Requirements in Managing Inflation

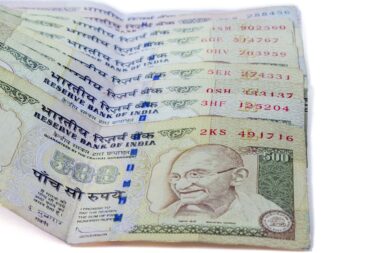

Reserve requirements, established by central banks, are crucial for controlling money supply and inflation. These regulations mandate financial institutions to hold a specific percentage of deposits as reserves, impacting their lending capabilities. When reserve requirements increase, banks have less money available to loan, leading to a potential decrease in overall spending by consumers and businesses. This mechanism is an essential tool employed by policymakers to combat inflation. By adjusting these requirements, central banks aim to influence economic growth by constraining or stimulating credit availability. Furthermore, understanding the implications of reserve requirements on inflation provides insights into macroeconomic stability. Economists debate the efficacy of this approach, comparing it with interest rate adjustments. While both strategies affect inflation rates, reserve requirements directly target liquidity and banking operations. Therefore, it’s imperative that stakeholders monitor how these changes translate into broader economic conditions. Both banking stability and regulation enforcement are pivotal for effective implementation. Reserve requirements also instill public confidence in the banking system, ensuring that institutions maintain sufficient liquidity. A balanced approach is necessary for successful monetary policy while understanding market dynamics.

Historical Context and Modern Implications

Throughout history, reserve requirements have evolved as essential components of monetary policy in response to economic challenges. Initially developed during the Great Depression, these requirements aimed to stabilize financial institutions and protect depositors’ funds. In recent decades, numerous central banks have refined their reserve requirements to enhance monetary policy effectiveness. This evolution reflects broader changes in the financial landscape, including the rise of digital banking and shadow banking systems. As economies become more interconnected, the importance of maintaining effective reserve levels cannot be overstated. Central banks now analyze not only domestic economic indicators but also global financial situations. Consequently, adjusting reserve requirements has become a nuanced challenge, especially in uncertain economic climates. The effectiveness of reserve requirements in curbing inflation remains a subject of active research and debate. Modern technology enables quick data analysis, providing policymakers with tools to make informed decisions. Engaging with new financial instruments and innovations, reserve requirements must also accommodate varying economic phases, addressing both inflationary pressures and potential recessions. Thus, a modern perspective on these requirements sees them as adaptable mechanisms which must align with current economic realities.

One major perspective on reserve requirements is their direct influence on inflation control. Adjusting these requirements can help central banks regulate the money supply effectively. During periods of high inflation, increasing reserve ratios can result in diminished bank lending capacity, leading to less money circulating through the economy. By tightening the money supply, central banks attempt to lower inflation, which can stabilize prices and enhance the purchasing power of currency. Conversely, decreasing reserve requirements can promote economic growth by allowing banks to lend more, stimulating consumer spending and investment, thus reducing the risk of deflation. The challenge lies in timing the adjustments correctly, as the effects of these changes do not occur immediately. Furthermore, the relationship between reserve requirements and inflation can be complicated by external factors, including global economic conditions, fiscal policies, and market reactions. Understanding this intricate interplay is vital for policymakers tasked with maintaining economic stability. Notably, changes in reserve requirements can also influence interest rates and overall economic confidence. Ultimately, the effectiveness of leveraging reserve requirements to manage inflation hinges on a comprehensive assessment of prevailing macroeconomic conditions.

Comparative Approaches to Monetary Policy

In monetary policy discussions, reserve requirements are often compared with interest rate adjustments. Both approaches aim to control inflation and ensure economic stability, but they operate through different mechanisms. While changing interest rates influences borrowing costs, reserve requirements directly affect the availability of funds within the banking system. Some economists argue that reliance on interest rate mechanisms alone could lead to unintended consequences, particularly in volatile or uncertain markets. Consequently, integrating reserve requirements into monetary policy discussions remains essential for comprehending broader economic impacts. Emerging economies often face distinct challenges regarding reserve requirements, necessitating specific adaptations unique to their circumstances. As these nations grapple with inflationary pressures, policymakers must consider the potential repercussions of their strategies. Furthermore, assessment of international practices reveals insightful strategies employed in different contexts. Understanding how other nations leverage reserve requirements can provide valuable lessons for tackling inflationary challenges. Central banks must remain alert, as failure to adapt their policies could hinder economic growth or exacerbate instability. Thus, exploring diverse monetary strategies enriches the policy toolbox available to combat inflation across various economies.

The impact of reserve requirements extends beyond mere economic metrics. They also play a significant role in shaping public trust in the financial system. Effective reserve requirements ensure liquidity, providing stability within the banking sector. When people recognize that banks can meet their withdrawal demands, it bolsters confidence in these institutions, encouraging savings and investments. Public perception of banking reliability forms an essential foundation for economic growth and prosperity. In times of financial downturn, maintaining adequate reserves can prevent crises and minimize panic among depositors. Additionally, government policies must focus on fostering transparency within the banking environment. Procedures surrounding reserve requirements should be clearly communicated to the public. This transparency empowers individuals to make informed financial decisions, enhancing institutional credibility. Another critical aspect is the coordination among various regulatory bodies, which can effectively monitor the implementation of reserve requirements. With efficient market practices, these regulations can proactively address emerging financial risks. Thus, fostering a cohesive approach among regulators and banks is crucial. Maintaining essential balances can strengthen the system’s resilience, offering lawmakers tools to manage economic fluctuations effectively.

Challenges and Future Considerations

While reserve requirements are fundamental to monetary policy, several challenges arise in their implementation. Rapid technological advancements, particularly within financial technology, have shifted how money flows and how institutions operate. Digital currencies and fintech solutions can bypass traditional banks, complicating the effectiveness of reserve requirements as a tool for monetary control. Policymakers must adapt regulations to encompass the evolving financial landscape, ensuring these requirements remain relevant. Moreover, the COVID-19 pandemic revealed vulnerabilities within the financial system, raising questions about the resilience of reserve requirements during crises. Central banks globally have had to reassess their approaches in light of unprecedented economic scenarios. Future considerations also include assessing the balance between stability and growth. Ensuring that monetary policy supports economic expansion without fostering excessive inflation presents ongoing challenges. Collaboration among international financial institutions is critical, particularly in addressing cross-border financial implications. Tackling these global issues requires coordinated efforts to develop robust frameworks for managing reserves effectively. Stakeholders must remain vigilant and flexible, continually assessing the impacts of reserve requirements in increasingly dynamic economies. Therefore, proactive adjustments are essential for maintaining confidence and stability.

In conclusion, reserve requirements play a vital role in managing inflation and maintaining economic stability. Their effective implementation requires a delicate balance between restraining excessive liquidity and ensuring sufficient lending capabilities. Central banks must be adaptable and responsive to evolving economic conditions and external pressures. As we move into a more digitized financial era, understanding the impacts of innovations on reserve requirements will be crucial for policymakers. Moreover, engaging stakeholders, including banks and consumers, enhances the overall effectiveness of monetary policies. Continued research into the relationship between reserve requirements and inflation will provide valuable insights and strategies for refining financial regulations. Ultimately, the challenge remains in leveraging this tool effectively amid an ever-changing economic landscape. Policymakers must maintain flexibility while ensuring that reserve requirements align with broader economic objectives, striking a balance necessary for sustainable growth. As monetary policy tools are recalibrated, the lessons learned from previous adjustments will inform future decisions. Continuous dialogue and collaboration between regulators and financial institutions can yield innovative policies to address inflationary concerns. This comprehensive approach will pave the way for more resilient financial systems that can effectively navigate uncertainties.