Scenario Analysis and What-If Models in Power BI for Finance

Financial analysts are increasingly using Power BI to conduct scenario analysis and create what-if models. These tools provide a dynamic way to visualize financial data, lay out various scenarios, and allow users to assess potential outcomes. Scenario analysis helps organizations anticipate how variables can affect financial health, thereby enabling informed decision-making. In Power BI, analysts can model complex financial scenarios by leveraging DAX (Data Analysis Expressions) to create calculated columns and measures. This ability to manipulate data is vital when exploring hypothetical events such as market fluctuations and regulatory changes. By adopting these functionalities, analysts can transform raw data into actionable insights. Users also gain the flexibility to input different assumptions into models, allowing various outcomes based on changing circumstances. Furthermore, by incorporating rich visualizations such as graphs and charts, analysts can present their findings effectively to stakeholders. Ultimately, utilizing Power BI for financial modeling not only simplifies data analysis but also improves the overall accuracy of forecasts. This integration of scenario analysis in financial planning opens new avenues for strategic thinking and responsive business strategies, providing competitive advantages in a volatile market.

Incorporating what-if analysis into financial planning enhances the ability to manage risks effectively. By creating different scenarios in Power BI, organizations can better understand the effects of potential uncertainties in various metrics, including revenues, expenses, and investments. What-if models allow them to visualize extreme cases through sliders or input boxes that adjust key variables. This immediate feedback can unveil insights that would otherwise remain hidden with static data analysis methods. For instance, analysts can adjust product pricing scenarios to evaluate profit margins or simulate changes in operational costs. These interactions make the analysis intuitive, enabling finance teams to engage with the data more dynamically. Additionally, Power BI makes it easy to automate these scenarios, producing regular reports that continually update with new data. This functionality not only saves time but also ensures that the analysis remains relevant as conditions in the market evolve. Furthermore, integrating the generated insights into strategic meetings can drive accountability and foster cross-departmental collaboration. Ultimately, a proactive financial management approach powered by what-if analysis significantly boosts a company’s capacity to make strategic moves amidst uncertainty.

Building What-If Scenarios in Power BI

To create effective what-if scenarios in Power BI, financial analysts begin by defining critical variables influencing business outcomes. Analyzing historical data plays a crucial role in understanding trends, risks, and opportunities. Therefore, establishing a foundation of reliable data is essential for creating relevant scenarios. Analysts use DAX formulas to construct dynamic measures that react to user inputs, providing instant feedback based on hypothetical situations. For example, by creating a measure that calculates profit based on changing sales figures allows decision-makers to visualize how their choices impact the bottom line. Users can easily set parameters and see how shifts in revenue or costs affect overall performance through intuitive dashboards. Moreover, Power BI supports advanced visualization features that enhance scenario comparison, such as synchronized slicers and drill-down capabilities. Analysts can slice through various metrics, revealing correlations and insights for scenarios side by side. This visibility drastically improves both the forecasting process and the ease of understanding complex financial data. Therefore, adopting these strategies in the budgeting process can empower organizations to make informed, data-driven decisions ensuring long-term sustainability.

Moreover, utilizing Power BI also allows organizations to streamline their reporting processes. Traditional financial reports often lack interactivity, making it challenging for stakeholders to grasp the implications of data. In contrast, interactive what-if models in Power BI facilitate discussions by elucidating different possible futures in real-time. These capabilities encourage deeper engagement with team members during planning sessions, leading to collaborative growth. Additionally, analysts can share their models with stakeholders easily through Power BI’s intuitive sharing functionalities, ensuring that relevant parties are on the same page. With cloud-based options available, users can access these reports and dashboards from anywhere, promoting flexibility in finance discussions. Furthermore, leveraging Microsoft integration allows for smarter summaries through tools like Excel, enhancing overall productivity. Ultimately, embracing Power BI not only modernizes financial reporting but also enables timely adjustments to corporate strategies as new data emerges. The visual and collaborative aspects of Power BI enrich financial analysis activities, granting finance teams a superior tool to navigate an inclusive and informative decision-making process. Companies employing these techniques can find themselves better equipped to respond to the fast-paced nature of today’s market.

The Role of Dashboards in Scenario Planning

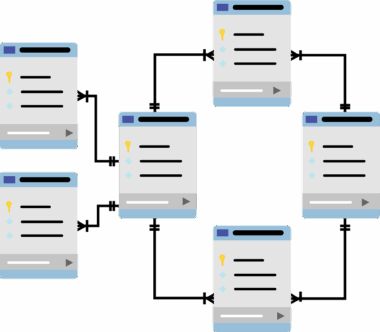

Dashboards in Power BI play a pivotal role in scenario planning by providing a holistic view of core financial metrics. When creating what-if scenarios, these visual tools offer a centralized platform for tracking essential performance indicators. Analysts utilize dashboards to merge data sets from different sources, aiding in comprehensive analysis. They can display key metrics such as cash flow, expenses, and profit margins simultaneously, allowing stakeholders to draw connections between various scenarios effectively. Well-designed dashboards summarize complex data into easily digestible visuals, showcasing trends and outliers that require attention. By crafting various views, users can toggle between scenarios effortlessly, making comparative analysis simple. Moreover, dashboards can integrate KPIs that auto-update based on changes in underlying assumptions, ensuring stakeholders are always working with the latest data. By presenting forecasts visually, finance teams can enhance their storytelling capabilities, thus initiating more productive conversations around resource allocation, strategic investments, or risk management. As scenario modeling continues to evolve, embracing dashboard functionalities in Power BI positions businesses to adapt quickly to shifting market dynamics while making more informed decisions based on data-driven insights.

Training teams to leverage Power BI effectively is crucial for maximizing the benefits of scenario analysis tools. Managers should invest in continuous learning programs that focus specifically on DAX expressions and best dashboard practices. Facilitating workshops can empower the entire team, enhancing their ability to build robust financial models independently. Analysts can create and deploy alerts to notify stakeholders when data cross critical thresholds, fostering a proactive response culture. Furthermore, combining user feedback into training sessions can develop a more tailored learning path, addressing specific needs regarding data storytelling and interpretation. Analysts should also create a knowledge base documenting common scenarios and insights, augmenting collective expertise in using Power BI. Moreover, exploring integration with other business intelligence tools may extend the analytical capabilities of financial models, enabling more holistic financial oversight. Empowering finance teams with practical skills through robust training directly correlates with improved scenario planning outcomes. As they become adept at using these innovative tools, they can confidently provide insights that shape strategic decisions, fostering long-term organizational success. Investing in such growth creates a sustainable model for financial excellence that keeps pace with evolving challenges.

Conclusion: Elevating Financial Analysis with Power BI

In conclusion, the synergy between scenario analysis and Power BI significantly enhances financial modeling and decision-making in organizations. By providing an interactive platform for diverse what-if scenarios, analysts can drive impactful strategies that adapt to fluctuating market conditions. The ability to manipulate financial data in real-time fosters an analytical mindset, encouraging the exploration of various outcomes based on different assumptions. This, in turn, supports thoughtfully crafted strategic plans that align resources according to emerging opportunities and potential risks. Additionally, the integration of user-friendly dashboards promotes streamlined communication, granting easy access to insights for various stakeholders. Financial analysts well-versed in Power BI and scenario analysis are better positioned to navigate uncertainty, enhance budget accuracy, and achieve optimal performance. Investing in the necessary tools and training creates a valuable asset for any organization aiming to lead in today’s competitive landscape. Strategic shifts guided by data-driven insights pave the way for innovative practices and solutions, ensuring long-term success in ever-changing environments. In essence, the combination of Power BI’s visual prowess with scenario analysis serves as a cornerstone for excellence in modern financial management.

This is another paragraph with exactly 190 words…