The Role of Financial Modeling in Marketing Strategies

Financial modeling is a critical process that provides invaluable insights into supporting marketing strategies. By leveraging financial statements, organizations can discern market trends, analyze consumer behavior, and create budget forecasts that align with strategic goals. Specifically, financial modeling utilizes historical data to project future sales, allowing marketers to make informed decisions. This process helps in estimating profitability through cost analysis and revenue predictions. As companies assess their performance metrics, they can optimize their marketing channels based on financial consequences. This makes financial modeling a significant asset that drives marketing success. Marketers utilize tools such as spreadsheets to represent data visually, which allows for a clearer understanding and execution of strategies. Among various factors, marketers focus on key performance indicators, such as return on investment (ROI) and customer acquisition cost (CAC). These indicators guide marketing budget allocations and enhance resource management. Furthermore, integrating financial modeling fosters collaboration between finance and marketing teams, creating a holistic approach to decision-making. Enhanced communication between departments leads to a comprehensive understanding of how marketing initiatives impact overall business performance and financial outcomes.

Incorporating financial modeling into marketing strategy facilitates better risk assessment. By quantifying the financial implications of various marketing decisions, companies can recognize potential challenges before they arise. Financial models enable the simulation of different scenarios, allowing marketers to visualize outcomes based on varying investment amounts, promotional strategies, and pricing adjustments. This predictive capability assists marketers in formulating strategies that not only attract more customers but also stave off unfavorable financial impacts. For instance, conducting sensitivity analysis can help marketers determine how changes in consumer preferences or market conditions can affect sales forecasts. By doing so, they can proactively adapt their marketing efforts to mitigate negative effects. In addition to risk management, financial modeling aids in the accurate tracking of marketing performance over time. By continuously updating financial models with real-time data, companies can ensure that their marketing strategies remain relevant. This dynamic approach allows organizations to pivot quickly when market conditions change, making it easier to capitalize on emerging opportunities or respond to unforeseen challenges. Ultimately, effective financial modeling equips marketing teams with the insights needed to navigate a competitive landscape and optimize their marketing impact.

Enhancing Budgeting Through Financial Models

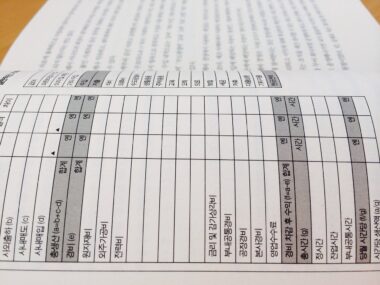

Effective budgeting is paramount to the success of marketing strategies, and financial modeling significantly enhances this process. With the help of detailed financial statements, marketers can allocate budgets more accurately. They analyze historical spending and performance metrics to make evidence-based decisions that align with corporate objectives. This helps in minimizing overspending on ineffective campaigns and ensuring that sufficient resources are directed towards high-impact initiatives. Financial models play a fundamental role in identifying the optimal marketing mix for companies. Marketers can experiment with different allocations, assessing outcomes based on past performance data. This not only aids in strategic planning but also helps articulate the marketing team’s value to stakeholders. Additionally, financial modeling allows marketers to set realistic goals by establishing attainable financial targets. By breaking down overall goals into smaller, more manageable targets, strategies become clearer and success easier to measure. Furthermore, incorporating visual representations of financial data simplifies complex budgeting processes. Tools such as graphs and dashboards provide quick insights, making it easier for marketing teams to communicate findings to executives and improve overall financial literacy across the organization.

Understanding consumer trends through financial modeling is essential for effective marketing strategies. Close examination of financial data can reveal valuable insights about customer preferences and spending habits. This analysis allows marketers to segment their audience more accurately and tailor marketing messages designed to resonate with specific groups. Moreover, gauging consumer response to previous marketing efforts provides a feedback loop for future campaigns, whereby organizations can continually refine their approaches. Financial statements offer empirical evidence that helps validate market assumptions and supports ongoing strategy adjustments. Furthermore, marketers can monitor performance metrics post-campaign to determine which strategies yielded the highest returns. This enables brands to spend wisely and prioritize marketing initiatives that align with their financial goals. Integrated financial analysis enables companies to weigh the long-term value of customers against their acquisition costs. By developing a comprehensive understanding of customer lifetime value, marketers can allocate resources toward campaigns that maximize profitability. The relationship between financial modeling and consumer insights ultimately leads to a more effective marketing strategy that fosters customer loyalty and drives growth. Thus, organizations can achieve sustainable success in the competitive marketplace.

Streamlining Decision-Making

Streamlined decision-making is a crucial benefit comprising financial modeling’s integration into marketing strategies. Timely and effective decisions are essential for seizing market opportunities and responding to competition. Financial models empower marketers to evaluate potential investments promptly and understand projected outcomes before commitment. This analysis speeds up the approval process, thereby enabling the marketing team to execute campaigns more rapidly. Moreover, shared financial insights between finance and marketing teams help in developing collective knowledge and expertise, encouraging collaboration on marketing initiatives. Financial modeling promotes a culture of data-driven decision-making, which fosters accountability and enhances strategic foresight. Teams can collectively assess risks and rewards of various marketing strategies to make choices that support overall business objectives. Implementing scenarios and forecasting through financial modeling enables organizations to preemptively plan for various market conditions, adding a layer of agility in marketing strategy execution. Additionally, conducting post-implementation evaluations allows companies to learn from past campaigns, fostering continuous improvement in marketing practices. In this way, the combination of financial modeling and effective decision-making leads to more efficient marketing strategies, ultimately promoting higher returns on investment and sustainable business growth.

Furthermore, financial modeling influences pricing strategies within marketing frameworks. Establishing the right pricing strategy is pivotal to achieving long-term profitability and market share. By analyzing financial data, marketers can determine optimal price points based on consumer elasticity and competitive landscape. Financial modeling provides structure to this analysis, allowing marketers to assess the ripple effects of pricing changes on overall sales and market positioning. It also leverages financial forecasting to predict how pricing adjustments may influence the demand for products or services. This quantitative understanding allows teams to test various pricing strategies, ensuring competitive pricing that supports brand objectives. Importantly, incorporating financial modeling enables marketers to make data-backed adjustments in real-time based on market feedback. Tracking financial implications tied to pricing strategies will help identify trends, thereby enabling businesses to respond accordingly. Organizations can enhance profitability while remaining competitive. By blending financial modeling with marketing insights, companies can establish a cohesive strategy that integrates financial performance with consumer engagement. Thus, financial modeling serves as a critical tool for establishing robust pricing strategies that drive profitability and customer satisfaction.

Conclusion: Future of Financial Modeling in Marketing

In conclusion, the role of financial modeling in marketing strategies has expanded significantly, showcasing its potential to shape the future of marketing practices. With growing emphasis on data-driven approaches, organizations that prioritize financial modeling will likely achieve remarkable advantages over competitors. As technology continues to evolve, integrating sophisticated financial modeling tools into marketing strategies will similarly advance, fostering enhanced predictive capabilities. Future marketing decisions will increasingly depend on accurate forecasts derived from financial insights. Companies will also leverage data analytics and machine learning to enhance their financial modeling capabilities, refining strategies based on real-time consumer insights. Furthermore, ongoing collaboration between finance and marketing departments will become crucial in harmonizing strategic initiatives and achieving full alignment across business objectives. Through effective communication and shared understanding, organizations can cultivate a collective mindset focused on maintaining competitive edge. This approach will allow for strategic agility, ensuring that marketing strategies remain responsive to evolving market dynamics. Ultimately, the alignment of financial modeling and marketing will lead to a time-efficient decision-making process that sustains long-term business success while maximizing profit margins. Thus, it signifies a pivotal shift in the marketing landscape.

Brands who embrace the role of financial modeling in their marketing strategies will find several competitive edge opportunities. By comprehensively integrating financial insights into the core of marketing practices, companies are better positioned to navigate challenges and leverage emerging trends. Organizations can harness financial models to make informed choices that align with market demands, ultimately boosting customer engagement and retention rates. Additionally, by continually investing in refining financial modeling techniques, businesses can cultivate a proactive approach to strategizing. This proactive stance not only mitigates risks but also opens avenues for innovation and adaptability in marketing strategies. Financial modeling, therefore, is not merely a procedural task; it is a cornerstone of strategic decision-making that fosters resilience. Integration of these sophisticated tools into daily marketing operations will encourage greater accountability across teams. By emphasizing the importance of financial performance, organizations foster an environment where marketing initiatives are scrutinized under the lens of financial viability. Furthermore, as younger and increasingly data-savvy professionals enter the field, it will demand a stronger emphasis on data analytics and financial literacy, ensuring that financial modeling retains prominence in shaping future marketing strategies and fostering enduring growth.