How to Apply for Guaranteed Issue Life Insurance: Step-by-Step Process

Guaranteed Issue Life Insurance provides individuals with a safety net, as it’s a policy that ensures coverage without health questions. This type of insurance is particularly beneficial for seniors or those with pre-existing conditions. To start the application process, gather essential documents such as identification, proof of residence, and any existing insurance information that might be relevant. Once you have these items, you can choose an insurance provider that offers guaranteed issue policies. Make sure to compare different plans and their prices. This research can help you select the most suitable one for your needs. Furthermore, you should consider the coverage amount that fits your family’s financial requirements. Policies can vary widely in cost, and knowing what is affordable is crucial. After selecting a provider, visit their official website or contact an insurance agent directly. They can guide you through the application process effectively, answering any questions you have along the way. This initial step is fundamental, as it sets the tone for securing your policy and overall peace of mind.

After gathering the necessary information, it’s time to complete the application form. The application for guaranteed issue life insurance is relatively straightforward compared to traditional policies. You won’t need to answer health-related questions, which simplifies the process significantly. Fill in your personal details, such as name, date of birth, and contact information accurately. It is vital to provide precise information, as any discrepancies might delay approval or cause issues later. Review all entered data thoroughly before submitting the application. Once you’re satisfied that everything is correct, submit the application electronically or via mail as per the insurer’s guidelines. In many cases, you’ll receive immediate confirmation of your application submission. Keep a record of the confirmation, as this will serve as proof of your request. Additionally, be prepared to complete payment for the policy, which may be required upfront or as specified in the terms. Understanding the payment methods and timelines is essential to ensure your policy becomes effective without any hitches. The next steps will unfold once your application is processed.

Understanding the Approval Process

Once the application is submitted, it enters the approval process, which typically takes place swiftly. The reviews generally check that all the provided information matches their criteria for granting coverage. Most approved applications can result in a policy being issued on the spot. However, this timing can vary between insurers. Consequently, it’s important to stay informed about your application status. If there are any delays, contact the customer service department of the insurance company directly. They can offer updates and resolve issues if necessary. Some companies even provide online portals where applicants can check their status themselves. If your application is approved, you’ll receive policy documents outlining the terms, coverage amount, and premium payment details. Make sure to read these documents carefully, understanding the nuances of your policy. Should any sections confuse you, don’t hesitate to reach out to your agent or the insurance representative for clarification. This step ensures there are no surprises when your policy is active. Additionally, knowing your entitlement helps you transition confidently to the next stage.

After receiving your policy documents, review your coverage options and their specifics. Understanding coverage limits is vital, as these will dictate what your life insurance will pay out in the future. Should you encounter any errors or concerns with the information provided, promptly contact your insurer. Timely communication at this stage can prevent misunderstandings and future complications. Next, familiarize yourself with premium payment schedules to ensure you don’t fall behind, as consistent payments are essential to maintain your insurance coverage. Ensure you understand the methods of payment—whether monthly, quarterly, or annually—so that you can set a payment plan that aligns with your budget. Additionally, pay attention to the grace period details, as missing payment deadlines could jeopardize your policy. It is also wise to consider designating beneficiaries early on. Having clear instructions on who will receive the benefits upon the policyholder’s passing can avoid confusion later on. When everything aligns properly, you can enjoy peace of mind knowing that your guaranteed issue life insurance is in place to provide for your loved ones.

Beneficiary Designation: An Important Step

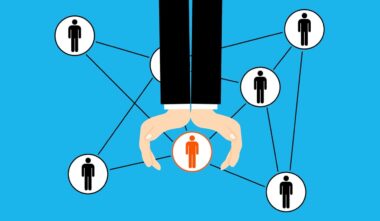

Designating beneficiaries is a crucial aspect of managing your guaranteed issue life insurance policy. A beneficiary is an individual or entity you choose to receive the payout upon your passing. This decision carries significant weight, as the chosen beneficiary impacts how the life insurance benefits are utilized. Most insurers allow you to select one or more beneficiaries, so consider your options wisely. It’s advisable to have a primary beneficiary and a contingent beneficiary in case the primary cannot receive the funds. When filling out the policy documents, make sure to also include the beneficiary’s full name and relationship to you, as this information ensures that funds go to the right individual. Additionally, keep your beneficiary information updated. Life changes, such as marriages, divorces, or births, may necessitate revisions. Contact your insurer to enact these changes formally, preventing past beneficiaries from receiving funds unintentionally. This proactive approach will provide clarity and security, ensuring your loved ones benefit as intended from your policy. Regularly reviewing and updating the information can offer substantial peace of mind.

Once your guaranteed issue life insurance policy is active, it’s essential to keep track of plan documents and communication from your insurer. Many companies offer online account management options, allowing you to view and manage your policy effortlessly. Within these portals, you’ll typically find features that enable you to review your coverage, check payment status, and even update beneficiary information if necessary. Take advantage of digital tools provided by your insurer, as they can simplify managing your policy. Another key element includes setting reminders for premium payments or policy reviews. Staying organized will help maintain your insurance in good standing while also assessing whether your current coverage remains adequate. As life circumstances evolve, reassessing your policy at least annually is advisable. Changes in health, income, or family dynamics might necessitate adjustments to your coverage. If you find that your needs have changed, consider discussing options with your insurance agent. They can assist in determining whether additional coverage is worthwhile or if policy adjustments would be preferable. Clear communication with your insurer ensures that your policy meets your evolving needs.

Conclusion: Ensuring Long-term Peace of Mind

In conclusion, applying for guaranteed issue life insurance is a straightforward process that provides invaluable benefits. With no health questions involved, it offers an accessible option for many. By following the steps outlined in this article, you can confidently secure coverage that meets your family’s needs. Always remember the importance of accurate information throughout your application to ensure a smooth process. After securing approval, thoroughly review your policy documents, payment options, and designate beneficiaries wisely. Your insurance policy is more than just a contract; it’s a promise of financial security for your loved ones. Commit to keeping your policy up to date and reviewing it for changes in needs or circumstances regularly. Enlisting the help of an insurance agent can add immense value in navigating these aspects. Ultimately, the right life insurance can effectively contribute to peace of mind, knowing that even in challenging times, your family’s financial future is safeguarded. It’s a proactive step that reflects your love and responsibility toward those you care for most. Consider this coverage an integral part of your financial planning.

As you embark on your insurance planning journey, remember that guaranteed issue life insurance serves as a beacon of security. It offers a viable safety net in uncertain life situations, allowing you to focus on what truly matters: your family’s well-being. By understanding the application process and what follows, you can navigate the complexities confidently. This approach affords you a more fulfilled life, knowing you’ve taken responsible steps to ensure your loved ones are covered financially. As you continue to explore your options, be proactive in seeking the assistance you might need. Many resources exist to help you comprehend the fine print of insurance policies. Use them wisely and always be prepared for life’s unexpected events.