Using Investor Education Resources to Avoid Scams

Investment scams often exploit individuals’ dreams of financial success. Understanding investment basics is crucial for safeguarding your finances. Here are several strategies to avoid falling victim to these schemes. First, always conduct thorough research on investment opportunities. Use reputable sources and resources, such as the Securities and Exchange Commission (SEC). Additionally, consider joining local investment clubs or associations where you can gain insights and knowledge from experienced investors. Familiarize yourself with common types of scams like Ponzi schemes, pump-and-dump tactics, and unsolicited emails promising high returns. Remember that if an offer sounds too good to be true, it is likely a scam. Also, never share personal information with unverified sources. When something seems off, trust your instincts and be cautious. Taking the time to educate yourself helps create a more secure investment environment. Arm yourself with the right knowledge and tools to make sound financial decisions, thereby increasing your chances of not only success but also peace of mind in your investment journey.

Another effective way to protect yourself against investment scams is using government resources for investor education. Many countries offer guides and tools to help individuals understand the investment landscape. The Financial Industry Regulatory Authority (FINRA) provides information on how to recognize and report scams. These resources include brochures, online courses, and webinars that explain the difference between legitimate and fraudulent investment practices. Learning the basics of how investments work is invaluable. Review educational materials that outline key terms and concepts in finance. Furthermore, consider using simulation tools or educational apps that allow you to practice trading without risking real money. Seeking continuous learning opportunities will prepare you for making informed investments. It is important to remember that scams are constantly evolving. Consistently updating your knowledge is essential in staying ahead of potential fraud. Networking with knowledgeable individuals in the investment field can provide guidance and insights that may be beneficial to your investment career.

Verify Before You Invest

Always verify the legitimacy of an investment claim by checking its registration with regulatory bodies. Legitimate investments should be registered with government authorities, such as the SEC in the United States. Use online search tools to validate company registrations. Many scams use fake names and websites to lure in investors. By taking a few moments to check the legitimacy of a company, you can save yourself from significant financial losses. Additionally, look for third-party reviews and ratings of investment firms or opportunities. Resources like Better Business Bureau (BBB) can provide valuable information about companies’ sincerity and trustworthiness. Speak with other investors to gather personal experiences with specific opportunities. Community knowledge can be a powerful weapon against scams. Participating in forums and discussion groups focused on investing may expose you to stories of both successes and pitfalls. The more informed you are, the better decisions you will make. Remember that reputable companies will always have nothing to hide, ensuring transparency in their operations.

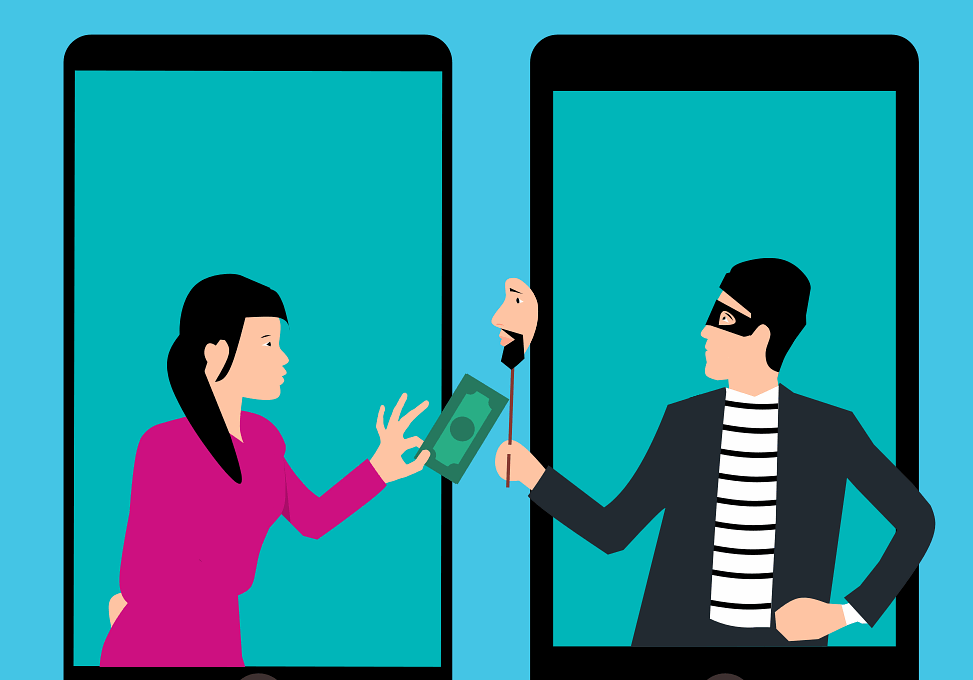

Staying connected with your network is vital while navigating the investment world and avoiding scams. Engaging with peers, financial advisors, and mentors keeps you informed about potential risks. They can alert you to current scam trends or suspicious opportunities. Attend finance-related events and workshops to interact with industry experts and gain fresh insights. This networking approach allows you to build relationships based on shared interests in investment education and success. Furthermore, be cautious about unsolicited offers, especially through social media or emails. Scammers often target individuals through these channels with attractive offers. If someone reaches out to you with a seemingly exceptional investment opportunity, evaluate it carefully. Asking questions and performing due diligence is crucial before considering any investment. A trustworthy investment source will always welcome inquiries and provide comprehensive answers. In contrast, a fraudster may evade inquiries or pressure you for quick decisions. Maintain open communication with your support network regarding concerns or questions about investments. Sharing experiences enhances collective knowledge and creates a safer investing environment for everyone involved.

Understand the Warning Signs

To successfully avoid investment scams, it’s essential to recognize the warning signs that indicate a potential fraud. Professional scammers often use high-pressure tactics, promising quick and guaranteed returns with little risk involved. Genuine investment opportunities require time, research, and often carry inherent risks. If you encounter an investment pitch that emphasizes urgency, it may be time to walk away. Another red flag involves vague explanations or complex jargon meant to confuse the average investor. Legitimate investments are explained clearly and concisely by knowledgeable professionals. Be wary of individuals who avoid answering direct questions about their investment strategy or business model. Furthermore, the endorsement of investments by celebrities or social media influencers does not guarantee legitimacy. Always perform independent research. Scammers also tend to push insistent requests for personal information, such as social security numbers or bank details, which should never be shared until you have verified the investment’s credibility. By understanding these warning signs, you empower yourself to sidestep potential financial traps.

Investing without proper knowledge or preparation can lead to substantial losses resulting from scams. To safeguard your financial future, it’s essential to develop a solid understanding of investment fundamentals. Start with self-education, utilizing various resources, including online articles, investment books, and finance-focused educational platforms. Comprehensive knowledge of different investment vehicles like stocks, bonds, mutual funds, and ETFs will aid you in making informed decisions. Additionally, consider engaging with a financial advisor who can guide you through investment strategies tailored to your goals and risk tolerance. Advisors can also help you navigate the complexities of investment terminology and market fluctuations. They can provide an external perspective on potential opportunities. Furthermore, remember that diversifying your investments is an essential mitigation strategy against scams. Solid diversification reduces your reliance on a single investment, thereby minimizing risk and potential loss exposure. Ultimately, the more educated you become regarding investment processes, the more prepared you will be to protect yourself from potential frauds targeting unsuspecting investors.

Trust Your Gut

In the investment world, intuition plays a significant role in identifying potential scams. If a deal or investment opportunity makes you feel uneasy, trust your instincts. The gut feeling often reflects underlying concerns that require further investigation. Taking time to reflect on an opportunity is never a bad idea. Allow yourself the space to process all the information and conduct thorough research before making decisions. Moreover, involve others in your discussions to gain additional perspectives. Sharing your thoughts or concerns with trusted friends or professionals can provide clarity. Transparent communication will likely uncover any hidden red flags within proposed opportunities. Understanding your emotional responses to potential investments enriches your overall investment experience. Remember, validating offers while maintaining a level of skepticism is constructive. If an investment opportunity appears rushed or forces you into decisions, exercise caution and reconsider your involvement. Practicing patience will not only give you better insights but ultimately help you avoid scams, ultimately fostering a more secure investment approach.

Finally, maintaining ongoing education significantly contributes to your ability to avoid investment scams over time. The landscape of investing constantly shifts, with new scams and trends emerging regularly. Engage in continuous learning through various channels such as podcasts, webinars, and online courses dedicated to personal finance and investment strategies. Subscribing to finance-related newsletters or blogs can help keep you informed about current market trends and potential risks. Furthermore, government agencies and financial organizations continuously update their educational resources, making them valuable for investors. Creating a habit of educating yourself ensures adaptability amidst changing market conditions. Stay flexible in your approach to investing and be open to revising strategies based on fresh insights and learning. This steady commitment to enhancing your understanding of investment principles not only prepares you for recognizing scams but contributes to your long-term success as an investor. As a result, you will cultivate both confidence and competence in your investment decisions, making it easier to distinguish between sound opportunities and fraudulent schemes.