Analyzing Operating Efficiency Through Financial Statements

Understanding operating efficiency is crucial for any business striving for success and sustainability. Financial statements offer valuable insights to assess how effectively a company utilizes its resources. To analyze operating efficiency, one should focus on key indicators, such as profit margins, return on assets, and operational cash flows. These metrics provide a comprehensive overview of a company’s performance and allow for comparison against industry benchmarks. Key performance indicators can help management identify areas that need improvement. A thorough financial statement analysis goes beyond mere number crunching; it involves understanding the underlying factors driving these metrics. Additionally, analyzing trends over several periods can highlight changes in operational efficiency. Financial statement analysis is essential for stakeholders, including investors, creditors, and employees. It fosters informed decision-making and enhances communication within the organization. By adopting structured assessment methods, companies can develop strategies to improve efficiency. Also, considering external factors, like market conditions, is essential in financial analysis as they can directly influence performance. Thus, financial statement analysis equips organizations with the necessary tools to enhance operational efficiency and sustain long-term growth.

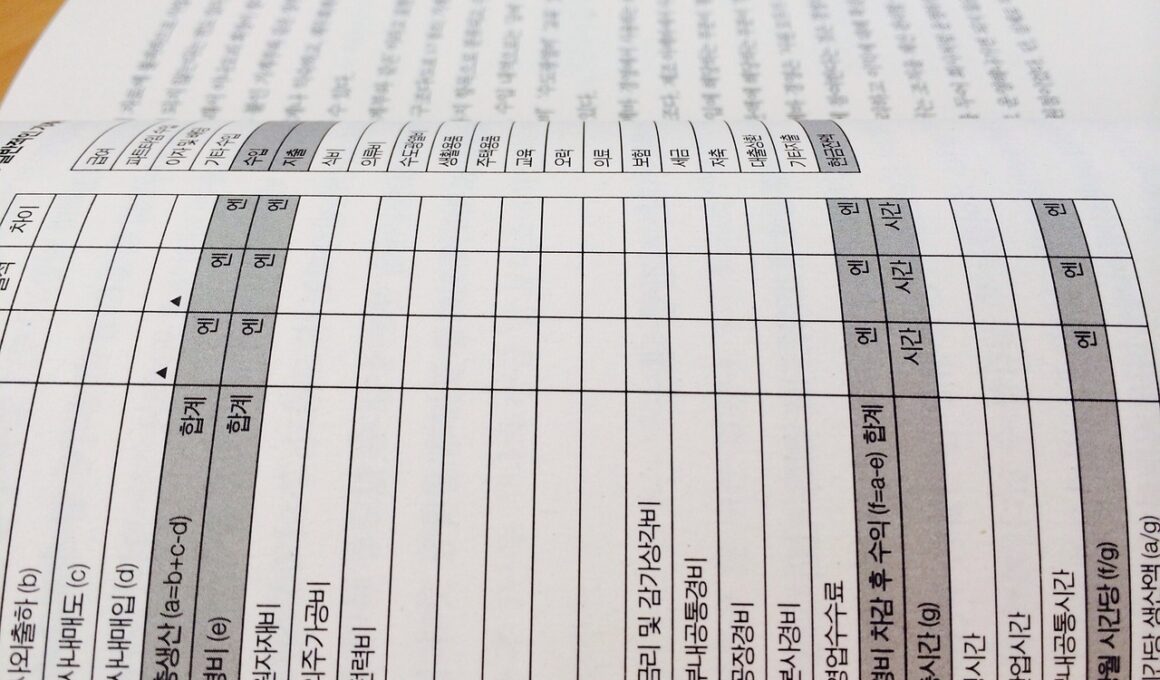

Operating expenses, an essential aspect of financial statements, play a significant role in assessing efficiency. Companies must closely monitor these costs to improve their profit margins and overall performance. Evaluating operating expenses involves analyzing fixed and variable costs, which impacts profitability. It’s crucial to distinguish between essential operational costs and discretionary spending, which can help identify potential savings. Furthermore, effective cost management contributes to enhanced operational efficiency. Stakeholders should pay attention to direct and indirect costs when evaluating expenses, as they directly affect financial health. By examining operational expense trends, one can identify inefficiencies in specific areas of the business. Additionally, conducting a comparative analysis with competitors offers further insight on expense management strategies. Implementing cost control measures, such as performance reviews and spending limits, can lead directly to improved efficiency. Numerous methodologies can be applied to streamline operations and reduce unnecessary expenditures. Regular audits and financial reviews should play a critical role in ensuring that all departments align with overall financial goals. Consequently, analyzing operating expenses is vital, revealing opportunities for improvement and enabling the organization to operate effectively in a competitive environment.

Key Ratios for Efficiency Analysis

Several key ratios provide insightful perspectives on operating efficiency. Ratios such as return on investment (ROI), return on equity (ROE), and asset turnover ratios serve as central figures for analysis. These metrics enable businesses to gauge their overall performance relative to resource usage. For instance, a higher asset turnover ratio indicates efficient use of assets in generating revenue. Conversely, a low ROI may suggest areas that require reevaluation for improved performance. Benchmarking these ratios against industry standards offers context for interpretation, highlighting relative performance. Analyzing these ratios over time allows stakeholders to detect patterns, uncovering operational strengths and weaknesses. Consistently monitoring these metrics can foster an ongoing improvement culture, essential for maintaining competitiveness. Additionally, it allows management to align business strategies with operational goals effectively. Effectiveness in execution can be enhanced by identifying areas with low ratios conducive to strategic initiatives. The power of ratios lies in their ability to distill complex financial data into more digestible insights, facilitating informed decision-making. Enhanced monitoring of efficiency ratios creates opportunities for businesses to adjust tactics in real-time, ensuring they remain agile and responsive to changes in the market.

Cash flow statements provide another layer of analysis critical for understanding operating efficiency. They detail how well an organization generates cash to cover operational costs and maintain liquidity. Understanding cash flows is essential since a business can be profitable yet face cash shortages. By analyzing cash flows from operating activities, stakeholders can observe the actual cash generated from core operations. This analysis is vital in analyzing working capital management, crucial for operational success. Monitoring cash flow performance cultivates an awareness of how expenses and revenues impact liquidity. Furthermore, cash flow analysis reveals potential risks associated with reliance on external financing. A comparison between cash flow and net income can highlight discrepancies that warrant attention. It’s imperative to identify trends in cash flows over several periods to manage liquidity effectively. In doing so, businesses can develop tactical responses to upcoming cash shortfalls. Furthermore, forecasting future cash flows enhances strategic planning endeavors. Enhancing cash flow management fosters greater financial stability and supports ongoing operational efficiency. Therefore, organizations should prioritize cash flow analysis and ensure it plays a central role in financial evaluations.

The Role of Budgets in Efficiency

Budgeting plays a pivotal role in analyzing and managing operational efficiency within an organization. A well-structured budget provides a roadmap for financial performance, enabling business leaders to set clear objectives. By outlining expected revenue and expenses, budgets facilitate informed decision-making in the allocation of resources. Regular budget reviews compare actual performance against planned targets, allowing stakeholders to identify variances and make course adjustments. Properly managing budgets helps control operating costs while maximizing revenue stream potential. Furthermore, engaging team members in the budgeting process can enhance accountability and encourage proactive cost management. By employing budgeting strategies, organizations can drive innovation and efficiency across departments. Moreover, budgets can uncover areas with excessive expenditures, ultimately contributing to cost reduction initiatives. Strategic budgeting enables companies to allocate funds to high-impact projects effectively. Integrating key performance metrics into the budgeting framework enhances operational insight and fosters data-driven decisions. In conclusion, cultivating a robust budgeting culture is critical for organizations looking to optimize their operational efficiency and achieve business objectives, ensuring they remain competitive in today’s economy.

Another vital aspect of financial statement analysis is understanding the implications of inventory management on operating efficiency. Efficient inventory management minimizes costs while optimizing stock levels to meet consumer demand. Monitoring inventory turnover ratios serves as a critical indicator of operational performance, revealing how effectively a company manages its inventory levels. A high inventory turnover ratio often signals efficient operations, while a low ratio might indicate potential overstocking or mismanaged inventory. Additionally, examining days sales of inventory (DSI) helps gauge how quickly products sell versus how long they remain in stock. A deep dive into inventory levels signals potential issues in production planning, purchasing strategies, and forecasting. Employing just-in-time inventory methods can minimize carrying costs, ensuring organizations maximize profitability. Advanced inventory management systems harness technology to automate and streamline processes, reducing human error and enhancing efficiency. Furthermore, organizations should foster collaborative relationships with suppliers to improve responsiveness and negotiate better terms. By emphasizing inventory management strategies, organizations can significantly enhance their operational efficiency and contribute positively to overall financial performance, fostering sustainable growth for the future.

Conclusion on Operational Efficiency

In conclusion, analyzing operating efficiency through financial statements is critical for long-term business sustainability. Financial statements act as comprehensive tools to evaluate key factors that influence operational success. By adopting a holistic approach to financial analysis, organizations can fortify their performance management strategies. This process involves integrating various financial metrics, such as key ratios and cash flow analysis, alongside operating expense evaluations. Furthermore, budgeting and inventory management encourage proactive measures for more efficient operations. Continuous monitoring of these factors cultivates a culture of accountability and performance improvement. Organizations that prioritize financial statement analysis can enhance their decision-making processes and foster a competitive advantage. By addressing operational inefficiencies, companies become agile, enabling them to adapt to changing market dynamics. Simultaneously, they can meet evolving customer demands effectively, driving business growth. Ensuring that operational efficiency remains a core focus can lead to improved financial health and enhanced stakeholder value. Ultimately, an unwavering commitment to strategic analysis and resource management creates a pathway for sustained success, significant profitability, and a firm foundation for future endeavors.

As organizations strive to harness operational efficiency, they can benefit immensely from leveraging data analytics and technology. By adopting modern technologies, companies can gain real-time insights into their financial performance, leading to more informed operational decisions. Analytics software can be instrumental in identifying trends and patterns within financial statements that indicate inefficiencies or areas for improvement. Companies can optimize resource allocation and identify cost-saving opportunities through sophisticated analytics. Moreover, machine learning algorithms can enhance forecasting accuracy, enabling businesses to anticipate market changes proactively. Integrating technology with financial modeling leads to a more nuanced understanding of efficiency metrics. Organizations that invest in analytics tools position themselves to enhance decision-making capabilities. Furthermore, training employees on data interpretation empowers them to contribute actively to improvements within their departments. Coupled with a comprehensive financial statement analysis framework, technology and analytics cultivate a culture of continuous improvement. Companies can respond nimbly to changing market conditions and achieve competitive advantages through focused operational efficiency strategies. In essence, the future of operational efficiency lies in the seamless blend of finance and technology, paving the way for innovative solutions and sustainable growth.