Trends in Mobile Payment Marketing for Consumer Finance

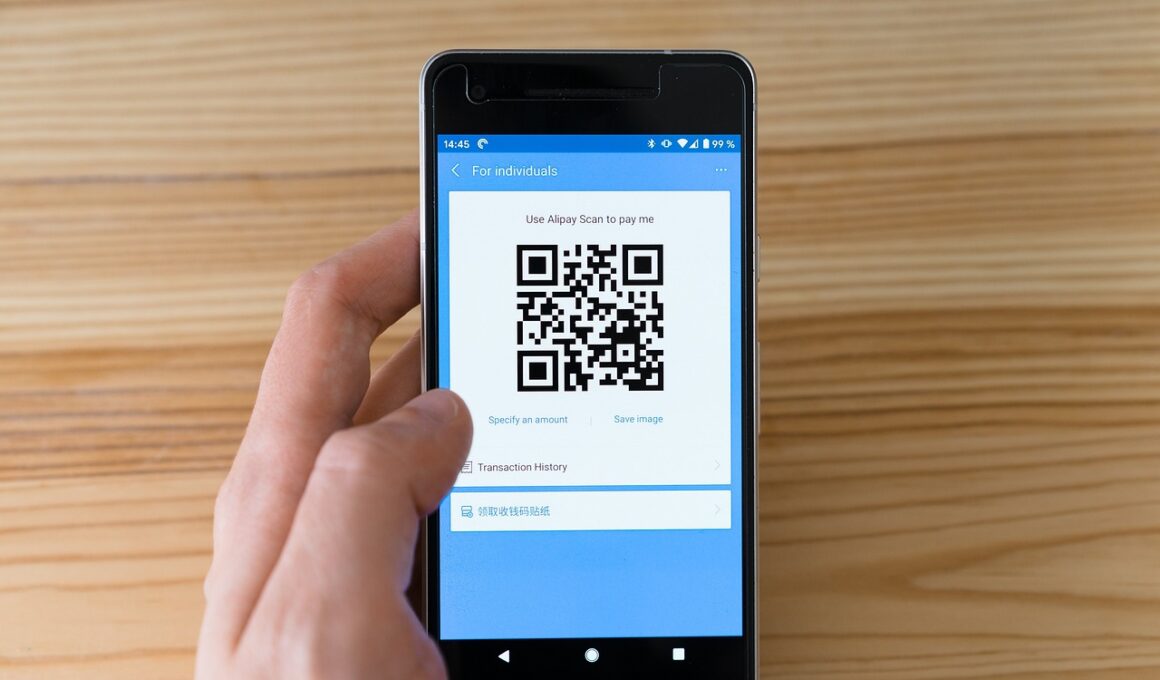

Mobile payment marketing continues to evolve rapidly, driven by technological advancements and changing consumer preferences. One major trend is the increasing adoption of contactless payments, where consumers prefer tapping their devices instead of traditional cash or card transactions. According to recent studies, over 70% of consumers now use mobile wallets like Apple Pay and Google Pay, supporting quicker transactions. Moreover, the integration of loyalty rewards within mobile payment systems enhances customer engagement and encourages repeat use. Financial institutions are leveraging these trends to create personalized marketing campaigns targeting consumers based on their spending habits. By analyzing transaction data, banks can identify opportunities for tailored offers, ensuring relevant promotions that resonate with their audiences. The rise of QR codes has also facilitated seamless payment experiences, bridging the gap between online and offline channels. Another vital aspect is the security features enhancing consumer trust, with biometric authentication becoming common in mobile wallets. This ensures that sensitive financial information stays protected, addressing consumer concerns over data breaches. Ultimately, businesses are expected to embrace an omnichannel approach to meet the diverse payment preferences of consumers, ensuring convenience and satisfaction.

As mobile payment solutions gain traction, integrating them with traditional marketing strategies becomes crucial. Marketers are now utilizing various platforms to amplify their mobile payment initiatives, engaging audiences effectively. Social media channels, for example, have emerged as vital spaces to promote mobile payment options directly to consumers. Campaigns featuring promotions, exclusive discounts, or cashback offers can result in increased adoption and use. Furthermore, influencers play a significant role in endorsing mobile payment methods, as their recommendations can significantly impact consumer acceptance. This trend demonstrates how valuable influencer partnerships can be in driving engagement within a brand’s target demographics. Moreover, mobile payment marketing emphasizes consumer education regarding the benefits of these technologies. As many consumers remain unaware of the advantages, informative campaigns can bridge that knowledge gap, showcasing ease of use and security. Businesses should also consider implementing user-friendly app interfaces that streamline transactions, enhancing the overall customer experience significantly. By focusing on these aspects, marketers can more effectively position mobile payments as a preferred choice in consumer finance. In conclusion, mobile payments demand integrated strategies that align traditional marketing with innovative technological advancements.

Personalization and Targeted Strategies

Further trends in mobile payment marketing focus on personalization and targeted strategies. Financial institutions and businesses are utilizing data analytics to create tailored experiences for each consumer. By analyzing purchasing behaviors and preferences, businesses can deliver customized offers that reflect individual users’ interests. A significant advantage of this approach is that it enhances customer loyalty and encourages repeat transactions, as consumers appreciate when companies cater to their specific needs. Loyalty programs embedded in mobile payment applications also play a pivotal role, as they reward frequent users, further incentivizing adoption. Moreover, the importance of location-based marketing is growing, granted by functionalities in mobile devices that allow businesses to connect with customers nearby. Sending timely offers and promotions to consumers as they approach a physical location helps to drive foot traffic significantly. Additionally, geo-targeting enhances the shopping experience, providing relevant deals to consumers based on their location. Businesses that effectively utilize these personalization strategies are likely to witness increased engagement and consumer satisfaction, thereby boosting sales and fostering brand loyalty effectively. Ultimately, these methods represent the future of mobile payment marketing in consumer finance.

Innovative partnerships are another trend shaping mobile payment marketing in consumer finance. Collaborations between financial institutions, retailers, and technology companies can lead to enhanced payment solutions designed for customer convenience. An example includes retailers partnering with mobile payment platforms to simplify the checkout experience significantly. Such partnerships often result in exclusive discounts or unique promotions, providing mutual benefits for all parties involved. Businesses are increasingly recognizing the importance of collaborations that enhance their competitive edge in mobile payment marketing. Utilizing shared data between companies allows for the optimization of promotional strategies, ensuring they align effectively with current market demands. Moreover, integration with popular e-commerce platforms has become common, allowing seamless transactions across various online shopping environments. In addition, businesses should focus on building trust with consumers, as partnerships that prioritize security can reassure customers about their transactions. Overall, innovative collaborations create a more fluid ecosystem for mobile payments, ultimately benefiting consumers with convenience and savings. As mobile payment continues to evolve, maintaining a focus on strategic partnerships will be essential for staying relevant in the competitive landscape of consumer finance.

The Role of Emerging Technologies

Emerging technologies are fundamentally reshaping mobile payment marketing. The inclusion of artificial intelligence (AI) and machine learning can greatly enhance how businesses understand consumer behavior. By utilizing these technologies, marketers can analyze vast amounts of transaction data, identifying patterns and trends that inform their marketing strategies effectively. Furthermore, AI can enable real-time fraud detection, providing an additional layer of security that consumers value highly. Blockchain technology too is gaining attention, promising secure peer-to-peer transactions that enhance transparency. This technology can revolutionize mobile payments by eliminating intermediaries, thereby reducing transaction fees and boosting speed. Additionally, augmented reality (AR) is making waves in mobile payment experiences, improving customer engagement through interactive advertising and promotions. By integrating AR into payment applications, businesses can enhance shopping experiences, enticing consumers to act on advertisements more efficiently. Keeping pace with these technological advancements is vital for businesses aiming to remain competitive. Therefore, investing in new technology can help marketers create unique, effective strategies that attract consumers in consumer finance. Ultimately, understanding and integrating these emerging technologies will be key to the future of mobile payment marketing.

In conclusion, mobile payment marketing is an ever-changing landscape influenced by technology and consumer behavior. Businesses must adapt to these trends to engage effectively with their audiences. The adoption of contactless payments, the emphasis on personalized marketing strategies, and the importance of collaboration all contribute to a more streamlined consumer experience. It is evident that consumers are seeking convenience and security in their financial transactions. Therefore, brands should prioritize implementing features that enhance these aspects. Moreover, harnessing the power of emerging technologies such as AI and blockchain can lead to more efficient payment solutions and innovative marketing tactics targeted toward consumer preferences. As various trends continue to unfold in mobile payment marketing, businesses should focus on creating meaningful interactions with their consumers. Emphasizing user experiences ultimately leads to increased loyalty and brand recognition. Companies that stay ahead of the curve and effectively respond to the evolving consumer landscape will thrive in the competitive marketplace. A proactive approach will allow businesses to develop cutting-edge strategies that drive success in the mobile payment ecosystem, shaping the future of consumer finance positively.

Future Outlook

Looking ahead, the future of mobile payment marketing in consumer finance seems promising, with various potential developments on the horizon. The continued growth of digital payment options will likely lead to more innovative solutions tailored for consumers. Furthermore, as global smartphone penetration increases, businesses will have a broader audience for their mobile payment strategies. To capitalize on this growth, marketers must remain agile, adapting to evolving trends and consumer expectations. The expansion of mobile payment capabilities will also broaden the horizon for personalized marketing opportunities, as businesses can reach consumers in real-time with relevant offers. Additionally, regulatory frameworks governing mobile payments will continue adapting to enhance security and consumer protection standards. Businesses must keep a close eye on these regulatory changes to remain compliant while providing a secure user experience. Furthermore, the integration of more diverse payment options, including cryptocurrencies, may become mainstream, offering consumers more choices. Overall, the future of mobile payment marketing holds vast potential for enhancing consumer experiences in finance, driving target engagement and loyalty. Thus, businesses must stay committed to continuous innovation and improvement in their mobile payment strategies.

In summary, mobile payment marketing is transforming the consumer finance landscape and presenting new opportunities for growth. By embracing current trends, such as contactless payments, personalized marketing strategies, and innovative collaborations, businesses can effectively engage their target audiences. Understanding and implementing emerging technologies is crucial for staying competitive in this rapidly evolving sector. Businesses are encouraged to adopt omnichannel approaches to cater to diverse consumer payment preferences while fostering trust and transparency. Additionally, education on mobile payment benefits can help demystify these technologies for consumers, encouraging widespread adoption. Strategic partnerships focusing on security and user-friendly experiences will only strengthen consumer trust. As we move forward, businesses must remain alert to developments in mobile payment marketing, continually adapting their strategies for evolving consumer needs. In conclusion, the future is bright for mobile payment marketing in consumer finance, and those who invest in innovative technologies and personalized customer experiences will be well-positioned for success.