Linking Power BI with Financial Databases for Real-Time Analysis

In today’s fast-paced financial landscape, analysts are increasingly relying on tools that facilitate real-time data analysis. Power BI, with its robust features, stands out as an essential platform for financial professionals. By enabling seamless connections to various financial databases, Power BI allows for dynamic reporting and visualization. This capability is critical for informed decision-making, as it provides up-to-date insights directly from the source. Linking Power BI to databases like SQL Server, Oracle, or financial cloud services enables analysts to generate customized dashboards that monitor key performance indicators continuously. Furthermore, financial analysts can automate report generation and disseminate this information to stakeholders instantly. Integrating Power BI with financial databases fosters an efficient workflow, eliminating the manual processes that are prone to errors. This integration ultimately enhances productivity across teams, as users can access information from anywhere, at any time, which is crucial for timely decision-making in finance. As organizations shift towards data-driven strategies, embracing tools like Power BI becomes necessary to remain competitive in the market.

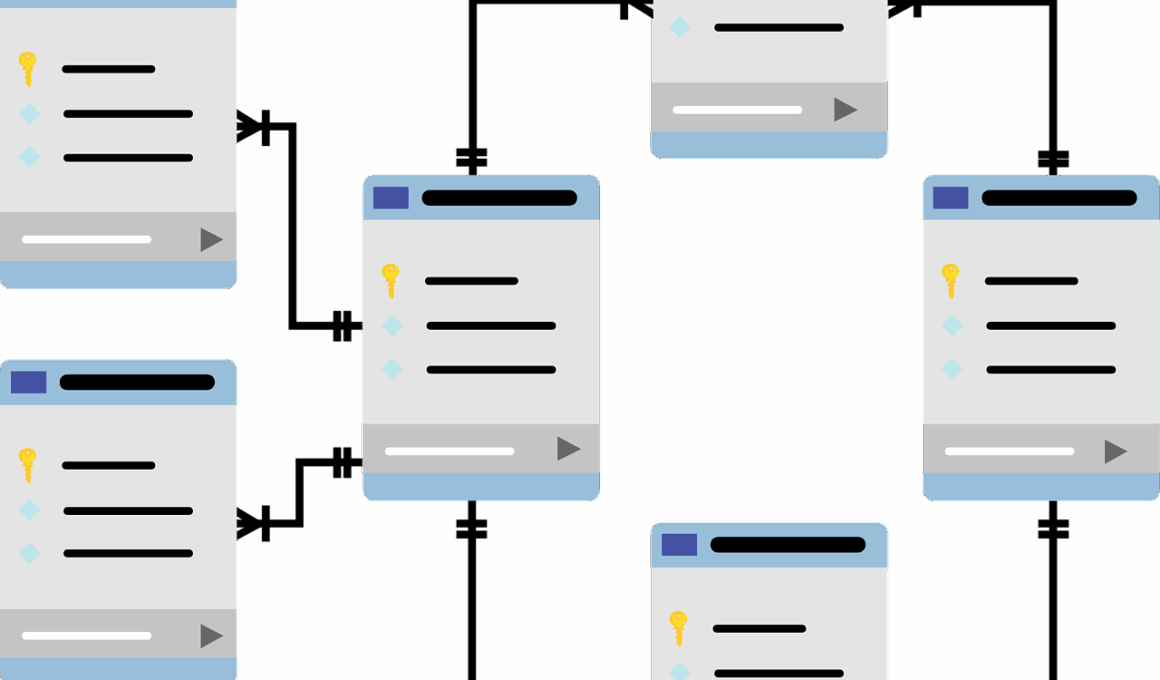

To successfully link Power BI with financial databases, it’s critical to have a clear understanding of both environments. Start by identifying the type of database that holds the relevant financial data. Each database system, whether it be SQL Server, MySQL, or cloud platforms like Azure, has its unique connection methods and protocols. For instance, establishing a connection to SQL Server requires the appropriate drivers and a set of credentials that authorize access to the data. Moreover, users need to define the data model they want Power BI to interact with, specifying tables, relationships, and measures crucial for analytics. This initial configuration is vital, as it sets the stage for how seamlessly Power BI can retrieve and visualize data. Analysts must also take care to map out any transformations needed before the data enters Power BI, such as filtering out non-essential information or aggregating data at different levels. By preparing data effectively, financial analysts ensure that the reports generated will be both accurate and insightful for stakeholders, leading to better financial outcomes.

Benefits of Real-Time Data Analysis

The primary advantage of linking Power BI with financial databases is the ability to perform real-time data analysis. Unlike traditional reporting methods, which often involve static data snapshots, real-time analysis provides insights as the data changes. This responsiveness allows financial analysts to react swiftly to market fluctuations, regulatory changes, or internal company developments. By utilizing Power BI’s real-time dashboard capabilities, analysts can monitor revenue, expenses, and other key metrics as they happen. This level of immediacy not only aids in identifying trends earlier but also empowers organizations to make data-driven decisions that can mitigate risks and capitalize on opportunities. Additionally, stakeholders across departments can engage collaboratively with the live data, fostering a culture of transparency and swift action. The visualizations Power BI creates are intuitive, making it easy for non-technical staff to grasp complex data and insights. Ultimately, this transformation enhances organizational agility, positioning businesses to adapt more effectively during periods of change.

To ensure a successful implementation of Power BI with financial databases, analysts should prioritize security and performance. Because financial data is sensitive, establishing secure connections is non-negotiable. This means employing secure networks, using encryption where necessary, and leveraging best practices in user authentication to protect data integrity. Moreover, performance can be enhanced through efficient data modeling and query design. Analysts should be mindful of the volume of data being pulled into Power BI—a larger dataset can result in slower performance, which detracts from the experience. It’s advisable to implement aggregations and views within the database to optimize performance before the data reaches Power BI. Furthermore, regular performance monitoring and adjustments will help maintain efficiency. With a focus on security and performance, financial analysts can maximize the effectiveness of their Power BI dashboards while ensuring compliance with industry regulations. This diligence not only fosters trust among stakeholders but also strengthens the overall data management strategy within the organization.

Sharing and Collaboration Features

An essential capability of Power BI lies in its sharing and collaboration features, which empower financial analysts to distribute insights across the organization. After creating dynamic dashboards and reports, analysts can publish these visualizations to the Power BI service, where stakeholders can access them in real-time. Power BI facilitates this sharing while maintaining necessary security protocols, ensuring that sensitive financial information is only viewable by authorized personnel. Furthermore, users can interact with reports, applying filters or drilling down into specifics without compromising the original dataset. This interactive nature enhances collaboration among teams, allowing members to discuss findings with data context readily available. Analysts should also consider using Power BI’s commenting features to engage in discussions directly within the report. This integration streamlines communication processes, ensuring everyone is aligned on interpretations and actions based on the data. Overall, the collaborative dimensions of Power BI significantly enhance team productivity and informed decision-making throughout the organization.

As financial analytics evolve, integrating Power BI with advanced data sources like machine learning models and AI becomes increasingly relevant. Financial analysts can enhance their reports and dashboards with predictive analytics, bringing forth deeper insights and forecasts. By linking Power BI to machine learning outputs, analysts can visualize trends and potential outcomes effectively. This goes beyond mere historical data analysis; predictive capabilities allow organizations to anticipate market movements and adjust strategies proactively. On top of this, combining Power BI with artificial intelligence tools can automate data cleansing and preparation processes, saving analysts time and ensuring data quality. Incorporating these advanced techniques fosters innovation within financial analysis, helping organizations outpace competitors who rely solely on traditional tactics. As technology continues to advance, the synergy between Power BI and cutting-edge analytics tools is likely to become a cornerstone of effective financial decision-making. By staying ahead of the curve, financial analysts can leverage these advancements to provide actionable insights that keep their organizations at the forefront of the industry.

Conclusion: Strategic Importance of Power BI

Linking Power BI with financial databases for real-time analysis is no longer just a trend; it is a crucial strategy that organizations must adopt to remain competitive. As companies face increasing amounts of data, the tools that facilitate its effective management and analysis become indispensable. Indeed, Power BI excels in transforming raw financial data into valuable insights through visualizations that are both informative and engaging. This capability empowers stakeholders to make decisions swiftly, fostering a culture of agility and responsiveness. Furthermore, the collaborative nature of Power BI ensures that insights are not siloed but shared widely across the organization. By integrating advanced analytics capabilities into their workflows, financial analysts will unlock even greater potential for risk management and optimization of resources. Thus, investing in Power BI isn’t merely about accessing data but harnessing its power to drive strategic initiatives. In conclusion, organizations that embrace this technology will be better equipped to navigate the challenges of the modern financial landscape and uncover opportunities for growth.

It’s essential for financial analysts to continuously seek knowledge in harnessing Power BI’s capabilities. Ongoing training and keeping up with new features can provide significant advantages. Engaging with the Power BI community online helps analysts share experiences and learn from each other. In addition, resources such as webinars, tutorials, and forums are widely available to support professional development. By honing their skills in Power BI, analysts can ensure that they are effective conduits of data-driven insights within their organizations. This commitment not only improves the quality of analysis but also builds credibility among stakeholders. Staying updated on industry trends and technological advancements in data analytics will further empower financial analysts. Companies benefit enormously from analysts who leverage tools like Power BI to identify actionable insights. Thus, long-term investment in training and development not only enhances individual capabilities but also aligns with organizational growth objectives. As data continues to transform business operations globally, investing in tools like Power BI is a prudent strategy for any forward-thinking financial analyst.