Unlocking Financial Markets: Insights from Industry Reports

Financial markets form a vital component of the global economy, driving investments, growth, and innovation. To navigate these intricate landscapes, stakeholders require up-to-date and comprehensive data. Industry reports serve as essential tools, offering insights into various financial sectors, trends, and forecasts. They aggregate information from multiple sources, ensuring that investors have access to the latest developments. The analysis within these reports helps identify potential opportunities and risks. Additionally, industry reports analyze consumer behavior, allowing businesses to enhance their strategies. They often include comparative analyses, enabling stakeholders to benchmark their performance against industry standards. By examining key performance indicators (KPIs), companies can make informed decisions that foster growth. Furthermore, reports frequently feature expert opinions and case studies that provide valuable context. Stakeholders may leverage these insights to adjust strategies and remain competitive. Thus, accessing reliable industry reports is crucial for making sound investments and strategic business decisions in financial markets. Understanding the underlying factors driving market trends can greatly benefit all parties involved, ensuring they are well-prepared for the challenges and opportunities ahead in this dynamic landscape.

The Importance of Data in Financial Markets

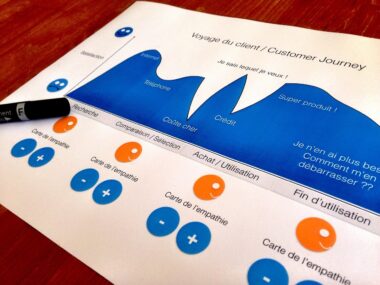

Data is the backbone of financial markets, influencing every decision made by stakeholders. Industry reports synthesize vast amounts of information, transforming raw data into actionable insights. Investors rely on these reports to understand market conditions, helping them predict future movements. The demand for accurate data has increased significantly over time, with stakeholders seeking reliable sources to inform their investment strategies. Reports often encompass various sectors including stocks, bonds, and commodities, providing a holistic view of market dynamics. Furthermore, properly analyzed data reveals patterns and correlations, equipping investors to capitalize on emerging opportunities. Industry reports usually include graphical representations of data, allowing for easier interpretation of trends. Additionally, they may offer predictive analytics based on historical performance, aiding stakeholders in decision-making processes. By accessing high-quality data, businesses can enhance their operational efficiency and drive profitability. Investors also depend on well-researched reports to mitigate risks associated with market volatility. A robust understanding of data not only informs investment strategies but also fosters greater confidence among stakeholders as they engage in financial activities. Consequently, the reliance on data signifies its crucial role within the financial markets landscape.

Market segmentation is an intricate aspect highlighted in financial reports, playing a crucial role in understanding consumer behavior and preferences. By categorizing the market into distinct groups, businesses can tailor their strategies to specific demographics. This practice is essential for companies seeking to optimize their outreach and maximize their market presence. Industry reports typically provide segmented data, detailing various consumer characteristics, including age, income, and spending habits. Such insights empower businesses to craft targeted marketing campaigns that resonate with potential customers. Furthermore, segmentation enables companies to identify gaps in the market, providing opportunities for product development and innovation. The ability to dissect consumer segments allows market players to refine their offerings, leading to increased customer satisfaction. Critics argue that oversimplifying consumer behavior can result in missed opportunities. Nonetheless, effective segmentation strategies are proven to yield positive results when appropriately applied. Stakeholders should continuously monitor market trends and dynamics to adapt segmentation strategies accordingly. Understanding consumer preferences and behaviors is a dynamic process that requires constant adjustments in strategies. Thus, leveraging industry reports for segmentation insights is imperative for businesses aiming to thrive in competitive markets.

Forecasting future trends is another significant aspect covered in industry reports, serving as a guide for strategic planning. Through analytical methodologies, reports attempt to project potential market developments over various periods. This information is vital for businesses and investors seeking to stay ahead of the competition. Effective forecasting incorporates historical data to project future performance, enabling stakeholders to make informed financial decisions. Industry experts often contribute to this process by providing insights based on economic indicators and market sentiment. An understanding of potential trends allows financial entities to allocate resources more efficiently, managing risks effectively. Investors might adjust portfolios based on these forecasts to maximize returns and minimize losses. Moreover, accurate forecasting can enhance trust among stakeholders, reinforcing commitment to data-driven decisions. Companies often utilize forecasting to identify opportunities for growth and expansion within their sectors. Comprehensive industry reports that include forecasts empower stakeholders with foresight strategies that can drive competitive advantages. However, accurate forecasting is challenging and depends on numerous variables, emphasizing the need for businesses to remain adaptable in dynamic market conditions.

The competitive analysis provided in industry reports plays a crucial role in evaluating market players. By examining key competitors, stakeholders gain insights into various strengths and weaknesses. Industry reports commonly assess market position, product innovations, pricing strategies, and operational efficiencies. This analysis helps businesses understand where they stand in relation to their competitors. Such information is essential for enhancing competitive strategies, as it offers opportunities for improvement and differentiation. Moreover, companies may glean insights into successful tactics employed by others in their niche. Understanding competitors can inform product development and marketing strategies, allowing businesses to stand out in crowded markets. The comprehensive nature of competitive analyses can expose trends within specific sectors, highlighting areas ripe for disruption. Stakeholders might refine strategies adopting a proactive approach based on these insights. A thorough examination of competitors can also indicate potential partnerships or acquisition targets, contributing to overall market growth. Ultimately, leveraging insights gained from competitive analysis equips businesses with the knowledge needed to navigate fluctuations in market dynamics effectively. Industry reports serve as essential tools for this purpose, offering a wealth of valuable information.

One of the notable features of industry reports is their comprehensive exploration of regulatory frameworks affecting financial markets. Various regulations influence market operations, profitability, and competitive practices. Understanding these frameworks ensures that businesses comply with legal requirements while minimizing risks associated with non-compliance. Reports often detail recent changes in regulations and their implications for market players. Stakeholders must grasp how regulations impact their strategies to avoid pitfalls. Industry reports can also highlight emerging regulatory trends, equipping businesses with insights necessary for strategic planning. This knowledge is essential for businesses operating in regulated environments such as finance and insurance. They may face unique challenges, as regulatory requirements continuously evolve. Stakeholders must proactively adapt their practices to align with regulatory standards while also optimizing performance. A comprehensive understanding of regulations fosters an environment of compliance that mitigates legal risks. Moreover, proactive regulatory reporting can enhance stakeholder confidence by showcasing transparency and accountability. Utilizing industry reports for regulatory insights is a proactive approach for businesses aiming to sustain compliance and remain competitive in financial markets.

In conclusion, industry reports represent invaluable tools for stakeholders navigating financial markets. They synthesize vast amounts of data, providing essential insights that drive informed decision-making processes. By examining market dynamics, segmentation, forecasting, competition, and regulations, these reports enable stakeholders to adapt their strategies effectively. As the financial landscape continues to evolve, the importance of robust and comprehensive analysis cannot be overstated. Companies that leverage the insights from industry reports are better equipped to thrive amidst challenges and seize growth opportunities. The accuracy and relevance of the data presented in these reports significantly influence investment strategies, operational efficiencies, and market positioning. Stakeholders must prioritize staying informed through high-quality industry reports to navigate the complexities of financial markets successfully. Furthermore, understanding the implications of these insights can foster a culture of informed decision-making, ultimately leading to sustainable growth and success. Therefore, making investments in accessing reliable industry reports is not just an option but a necessity for all stakeholders engaged in the financial sector. Unlocking financial markets requires the commitment to utilizing these reports as essential instruments in guiding strategic pathways.