Integrating Storytelling Into Financial Content Strategies

In today’s digital landscape, integrating storytelling into financial content strategies has become essential for engaging audiences. Financial institutions often face the challenge of presenting complex information in a manner that resonates with their target demographics. By utilizing storytelling techniques, marketers can craft narratives that not only educate but also engage consumers emotionally. Stories serve as a bridge, connecting intricate financial concepts with relatable human experiences. The goal is to create a narrative that simplifies the complex details of finance while captivating the audience’s interest. This approach allows businesses to stand out in a crowded marketplace where content overload is common. Rather than merely presenting numbers or data, a story can provide context that makes financial advice more digestible. Engaging stories can enhance trust, encouraging consumers to seek advice and services. Furthermore, storytelling can be leveraged through various mediums, including written articles, videos, and social media posts. By fostering a deeper emotional connection, companies can potentially increase customer loyalty and engagement. In essence, proficient storytelling is vital for crafting a financial content strategy that truly resonates with the audience.

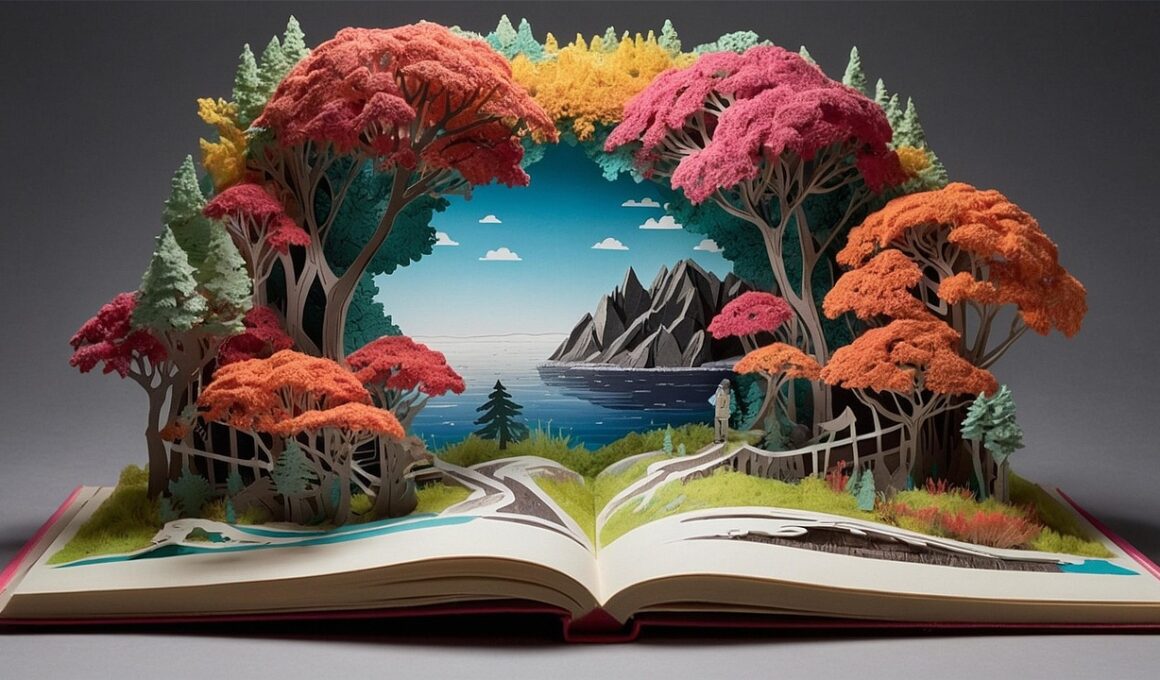

When developing storytelling for finance, it’s essential to identify your audience’s core needs. Understanding who your target audience is enables you to tailor your stories to their preferences and pain points. Utilizing customer personas can provide insights into the demographics of the audience, including their fears, aspirations, and financial literacy levels. For instance, millennials may be interested in stories that focus on budgeting for experiences, while retirees may prefer narratives centered on long-term security. By aligning the content’s theme with these particular interests, marketers can create a stronger connection with the audience. Communicating the brand’s message effectively requires pertinent storytelling techniques highlighting relatable scenarios. Visual elements can further enhance these narratives by making the content more engaging and memorable. Incorporating infographics or client testimonials into stories can help illustrate the impact of financial services on real lives. This approach humanizes financial institutions and fosters empathy among consumers. When audiences can envision themselves in the narrative, they are more likely to trust the service and connect personally. Consider using various channels to distribute these financial stories and reach audiences where they engage most.

Crafting Relatable Financial Stories

Crafting relatable financial stories entails weaving real-life scenarios that demonstrate financial principles effectively. Using characters that mirror the audience’s everyday situations can amplify the relatability factor. For example, presenting a story around a character’s journey of saving for a home can engage potential buyers personally. The narrative should follow the character’s struggles, educating the audience on budgeting and saving strategies along the way. By highlighting triumphs and setbacks, the audience can relate and learn through these experiences. Additionally, it encourages readers to see their journey as achievable, fostering optimism about overcoming financial hurdles. Storytelling in finance is not only about educating; it is about inspiring change and action. Financial institutions can employ case studies as powerful storytelling instruments to demonstrate how their services facilitated success stories among clients. This method strengthens credibility and promotes a sense of community among consumers. By showcasing varied success stories, brand loyalty is also nurtured, as consumers appreciate brands that genuinely foster growth and improvement in financial matters. Stories reflecting customer challenges and solutions contribute to a supportive narrative around financial literacy.

Furthermore, effective storytelling involves integrating emotional elements that resonate deeply with the audience. Emotion is a vital component that makes financial topics more approachable. For instance, sharing testimonials of clients who have achieved financial security or overcome debt through the brand’s guidance can evoke feelings of hope and trust. Engaging emotional stories manage to break through the often dry statistics typically associated with finance, leaving lasting impressions. This strategy not only humanizes the financial content but also allows audiences to relate to the characters and experiences presented. Using sensory language and vivid descriptions can transport the audience into the narrative, enhancing engagement levels even further. By triggering emotions, marketers can effectively capture attention, encouraging the audience to reflect on their financial situations. Additionally, a clear call to action should be included at the conclusion of each story, prompting readers toward the desired response, whether it be seeking advice or utilizing financial services. Ultimately, emotional storytelling can foster a greater connection with brands, thereby enriching overall consumer engagement and brand loyalty.

Measuring Storytelling Success

Once a captivating content strategy is implemented, measuring storytelling success becomes crucial for continuous improvement. Analyzing engagement metrics such as time spent on a page, social media shares, and comments can provide invaluable insights. Furthermore, tracking conversions resulting from storytelling campaigns helps evaluate their effectiveness both in terms of audience engagement and tangible business outcomes. Tools like Google Analytics can assist in compiling these metrics, providing a comprehensive overview of audience interactions with the content. Conducting surveys post-campaign can also glean qualitative feedback about consumer perceptions of the stories presented. It’s essential to adapt and refine the storytelling approach based on these analyses, ensuring that narratives resonate more vividly with the audience over time. By understanding the elements that captivate or repel audiences, marketers can continuously elevate their storytelling practices. Consider A/B testing different story formats and mediums to discover which resonates best with specific demographics. Iterative testing and data analysis can foster a culture of improvement and innovation within financial content strategies.

Incorporating storytelling into financial content strategies also opens avenues for collaboration with influencers and brands. Collaborating with financial influencers who can narrate personal finance stories enhances authenticity and relatability. Audiences tend to trust influencers they follow, and their endorsement can make the information more credible. Co-created stories that highlight shared experiences can extend the reach and engagement of financial content. Additionally, leveraging social proof through influencer partnerships can bolster brand trust, as audiences value advice from those they admire. Showcase various influencers on different platforms using tailored storytelling that resonates with their followers. Financial brands can also explore partnerships with organizations for joint storytelling efforts. By combining resources and expertise, companies can generate richer and more diverse narratives that educate audiences on important financial topics. This partnership approach allows for emphasis on cooperative stories that not only benefit marketing objectives but promotes financial literacy in the broader community. As a result, financial institutions can strengthen their market position while simultaneously contributing positively to society.

The Future of Storytelling in Finance

As digital marketing continues to evolve, the future of storytelling in finance appears promising. Emerging technologies such as Artificial Intelligence and Virtual Reality (VR) are reshaping how financial stories are communicated. AI-driven personalization enables tailored storytelling experiences, ensuring content appeals directly to individual preferences and needs. On the other hand, VR can immerse users within a financial narrative, providing an unprecedented interactive experience. Such advancements allow consumers to explore financial worlds and scenarios more engagingly. Furthermore, integrating multimedia elements enhances the depth of storytelling; videos, animations, and podcasts can complement written narratives. This versatility fosters increased engagement across different audience segments. Continued advancements will also come with practical applications of augmented reality (AR) in financial marketing, allowing consumers to visualize their financial goals through storytelling. As financial services become more user-centric, storytelling will undoubtedly play a pivotal role in marketing strategies, ensuring clarity and relatability through personal connections. Consequently, monitoring industry shifts and consumer behavior will be vital to ensuring that storytelling remains both effective and relevant in attracting and engaging audiences.

In conclusion, integrating storytelling into financial content strategies is not just a technique but a necessity for fostering meaningful connections with audiences. As finance becomes increasingly digitized, the importance of relatable, emotional narratives is paramount. Companies that effectively utilize storytelling not only promote financial literacy but also engender a sense of community among consumers. The emotional and relatable aspects of storytelling play a critical role in transforming dry and complex financial subjects into engaging dialogue. Through a comprehensive understanding of target audiences, effective storytelling can promote increased engagement, trust, and loyalty. As the industry progresses, the ability to adapt storytelling strategies to face emerging challenges will remain crucial. Collaboration through influencer engagement and innovative technology will become vital to ensuring continued relevance. As brands navigate the ever-changing financial landscape, they must prioritize crafting compelling narratives that resonate instantly with consumers. The future holds exciting possibilities for storytelling in finance, and embracing these advancements will set successful firms apart in a competitive marketplace. Ultimately, storytelling serves as a tool to demystify finance, making it a shared experience between brands and consumers.