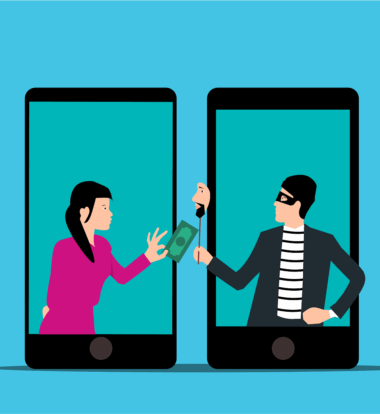

Steps to Protect Your Money from Fraudulent Investments

Investment scams are more prevalent than ever, making it crucial to safeguard your finances appropriately. Fraudsters devise ingenious schemes that target unsuspecting investors, often promising high returns with little risk. The first line of defense against investment scams involves conducting thorough research on any opportunity before committing any funds. This process includes verifying the credentials of firms and individuals promoting investment opportunities. One must ensure they are registered with the appropriate regulatory body. Monitoring feedback from other investors or seeking advice from trusted financial advisors can also be beneficial. Additionally, beware of high-pressure sales tactics that pressure one into making a quick decision. Legitimate investments never demand immediate commitments without allowing time for consideration. Another protective step is to educate oneself on common scams. Understanding how these scams operate is essential for recognizing red flags when they appear. If an investment opportunity sounds too good to be true, it probably is. Trust your instincts and always ensure your decisions align with your financial goals and risk tolerance. Remember, maintaining skepticism can often save you from potential loss.

Never Invest in Unregulated Markets

Another significant protective measure involves steering clear of unregulated markets or investment opportunities. Scams frequently circulate in these environments where regulatory oversight is weak or nonexistent. When considering an investment, always confirm that the offering complies with local regulations and standards. Contacting your country’s financial regulatory authority can provide valuable insights into whether specific investment offerings are legitimate or potentially fraudulent. Registered products or firms usually have public records validating their operations, making it easier to distinguish the good from the bad. Furthermore, verifying the legitimacy of the platforms you use for investing is essential. Before investing, make sure the brokerage or trading platform you choose is registered with the relevant agencies. Legitimate platforms typically have transparent policies regarding fees and commissions. Scammers often hide their tactics behind convoluted jargon or overly complex investment structures to mislead investors. Always ask questions about aspects you don’t clearly understand and ensure you grasp what you’re investing in. Never feel ashamed to seek clarity or additional information before proceeding with any investment decision.

Stay vigilant against unsolicited offers that appear in your inbox or phone. Fraudulent investment schemes may start with enticing emails or phone calls that present fantastic opportunities. Often, these messages convey urgency by suggesting that investments must be made quickly to take advantage of a limited-time offer. If you encounter unsolicited offers, approach them with skepticism. Never engage with unknown sources providing investment advice. The likelihood of falling victim to investment scams doubles for those who allow emotions to dictate their decisions. Scammers prey on excitement and curiosity, encouraging individuals to overlook protective practices. Additionally, monitor your financial accounts regularly for unusual transactions or discrepancies. Prompt detection of fraud can minimize damage and possibly aid in recovering lost funds, provided you act quickly. Should you suspect fraud, report it to your financial institution immediately. Most banks have established protocols for dealing with suspected fraud, enabling them to safeguard accounts effectively. Always prioritize your financial health by staying educated about potential scams and adopting stringent security measures. Avoid rushing into investment opportunities without considering their legitimacy and risks.

Utilize Due Diligence

Performing due diligence is a crucial step that every potential investor should undertake. Your understanding of investment opportunities should extend beyond surface-level information. Investigate the company’s history, management team, and financial performance to gain an inside perspective. Scrutinize available documentation, such as brochures and investment summaries, to verify their claims. Publicly available resources like financial news articles and market analysis can provide important context about the reliability of an investment. Engaging in thorough research helps clarify whether an opportunity aligns with your financial objectives. Another critical facet of due diligence pertains to understanding the potential risks involved. Any credible investment should come with clear information about its pitfalls, ensuring you realize what you could lose. Investing should involve genuine effort in understanding potential outcomes rather than mere speculation. Reach out to knowledgeable acquaintances or professionals for their opinions and insights regarding the investment. Gathering diverse viewpoints can unearth potential red flags that you may have overlooked initially. Ultimately, conducting diligent research can significantly bolster one’s defenses against scams.

In addition, consider utilizing the power of networking to gather valuable insights. Engaging with fellow investors can create an avenue for sharing experiences regarding different investment opportunities. Social media platforms and investment forums provide ideal spaces for discussing various investment prospects. Participating in discussions may reveal warnings about specific scams that other investors have encountered. Always keep in contact with your community of trusted investors, as their experiences can greatly inform your decisions and help you remain vigilant. Leveraging collective knowledge can significantly decrease the chance of falling victim to fraud. Joining investment groups can foster accountability among peers, encouraging members to keep each other updated about potential risks and verification processes. Engage actively in these forums to take advantage of their collective wisdom. Always support one another in constantly confirming the legitimacy of investment opportunities. Remember, an informed investor is a protected investor. Embrace the value of community through careful collaboration and monitoring of trusted sources. This network can serve as a crucial resource for discerning the legitimacy of investment opportunities.

Reporting Scams

If you suspect you have encountered a scam or have been victimized, it is essential to report the incident promptly. Early reporting can reduce the extend of potential damage and may assist authorities in preventing future scams. Many countries have dedicated resources for reporting investment fraud, such as financial regulatory authorities or consumer protection agencies. By submitting a report, you contribute to the larger effort to combat fraudulent practices aiming at innocent investors. Maintain records of all documentation related to the potential scam, including emails, messages, and transaction details. These records are crucial when reporting to authorities, as they provide evidence to support your case. In addition, consider alerting your financial institution about any suspicious activity associated with your accounts. Stakeholders within banking systems can implement security measures or block transactions to protect your funds. Fraud alert services and credit monitoring may also help safeguard your financial identity from further risk. By remaining proactive and engaged, you play an essential role in your protection and the prevention of scams. Remember, your actions can inspire others to take necessary precautions and avoid falling prey.

Ultimately, understanding how to navigate the investment landscape safely is essential for investors at all levels. Scammers will always adapt their tactics, so cultivating a proactive mindset is critical. Continuous learning regarding investment strategies, market trends, and regulatory updates significantly enhances your overall knowledge. Attending workshops or taking finance-related courses can expand your understanding of the investment environment. Extensive knowledge empowers you to recognize potentially fraudulent schemes more readily. Always prioritize staying informed about red flags indicating fraud. Follow financial blogs or subscribe to reputable news sources that provide valuable insights into market behaviors. Regular updates about scams and illegitimate firms can help keep your defenses high. By incorporating protective measures into your investment routine, you are less likely to suffer financial loss due to fraudulent practices. Approach every opportunity with diligence, understanding the risks involved is key. Make informed decisions that align with your financial goals, and ensure that every step is taken to protect your investment capital. The responsibility lies with each investor to uphold financial integrity in a landscape filled with uncertainties.

Conclusion: Building Investment Security

Finally, if you prioritize security when investing, you lay a strong foundation for your financial future. Always remember that with proper knowledge, research, and a cautious approach, you can protect your investments from fraudulent practices. Engage with credible sources of information and continually reassess your financial situation to maintain a robust investment portfolio. While the prospect of high returns may be enticing, maintaining integrity in investing should remain paramount. Take the necessary time to vet any proposals or opportunities thoroughly before acting. Pushing aside doubts for the sake of quick gains often invites unnecessary risk. As you move forward in your investment journey, consistently apply the strategies discussed. When informed, vigilant, and engaged, you empower yourself against potential fraud while working toward financial stability and success. This path leads to not just securing your capital but also helping you achieve your long-term financial goals. Always remain committed to continuous learning about investments while encouraging others to seek knowledge too. Investing should be a rewarding journey and comes with responsibility. Embrace these principles to safeguard your future in the investment landscape.