Creating Interactive Dashboards for Financial Reporting in Power BI

Power BI is a powerful tool that enables financial analysts to create interactive dashboards for reporting purposes. With its user-friendly interface, one can manage vast datasets efficiently. Utilizing Power BI facilitates real-time data analysis, making it an invaluable resource for stakeholders. Analysts can visualize data trends swiftly, translating complex figures into comprehensible visuals. A proficient understanding of DAX and Power Query can significantly boost your dashboard’s functionality. Moreover, leveraging calculated fields and measures offers deeper insights into financial metrics. Each dashboard can be tailored to specific needs, ensuring relevance and precision in reported data. Users should prioritize interactive elements that encourage audience engagement. Employing slicers and drill-through capabilities greatly enhances user experience. The goal of financial reporting is not merely reporting figures but storytelling through data. Analysts should strive for simplicity and clarity, eliminating potential confusion. Regular updates and maintenance of dashboards guarantee they remain aligned with business goals. Collaborating with other departments ensures comprehensive oversight, harmonizing various data sources effectively, which is essential for strategic decision-making. Overall, the impact of effectively utilizing Power BI can profoundly enhance financial reporting across organizations.

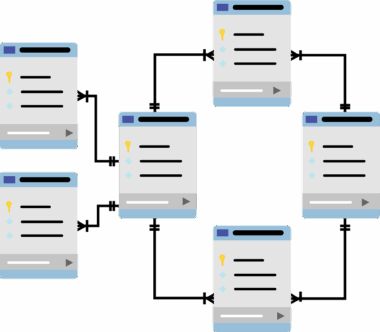

The initial step in creating effective dashboards in Power BI involves connecting to your data sources. Financial analysts often deal with various datasets, ranging from Excel sheets to SQL databases. Importing this data seamlessly into Power BI is crucial for analysis purposes. Once the data is imported, the next phase is cleaning and transforming this data to ensure accuracy. Power Query Editor is an essential tool for this task. It allows users to apply transformations, such as filtering and merging datasets, which improves the overall quality of the reports. After this stage, creating a data model with relationships between tables becomes vital. Understanding how these relationships work enhances the efficiency of your dashboard. Properly organized data in Power BI leads to more intuitive insights, making navigation easier for end-users. Utilizing the correct visualization types ensures data is conveyed effectively. For example, bar charts can represent financial trends, while pie charts illustrate percentages. Interactive features like tooltips can add layers of clarity. Useful dashboards are not just informative but also visually appealing, engaging users at various analytical levels. Finally, remember to regularly test and update dashboards, which keeps them relevant.

Key Features of Power BI for Financial Analysts

Power BI is packed with features designed specifically for analysts in the finance sector. One critical aspect is its real-time data refresh capability. This means that dashboards can reflect the latest data at any moment, helping users make informed decisions. The ability to create custom visualizations enables analysts to convey unique insights tailored to specific financial metrics. In addition, seamless integration with Microsoft Excel is a considerable advantage. Most analysts are already comfortable using Excel, and this familiarity aids in transitioning to Power BI efficiently. Power BI also offers robust sharing and collaboration options. This allows users to publish their dashboards online and collaborate with team members for enhanced decision-making processes. Security is another critical feature; Power BI adheres to stringent data protection standards, ensuring sensitive financial data is safeguarded. Users can set permissions that restrict access to certain dashboards based on roles, which is essential in corporate environments. Furthermore, Power BI supports natural language queries, making it easier for users to ask data-related questions and receive immediate visualizations. In summary, Power BI provides a comprehensive suite of tools that empower financial analysts to maximize their reporting capabilities.

Once the dashboards are designed, the focus should shift toward refining user experience. Providing users with options to customize their views can significantly enhance satisfaction. For example, allowing users to choose the metrics they want to display gives them a sense of control. Furthermore, training sessions should be organized to help users understand how to navigate and optimize their dashboards. Financial analysts must communicate clearly to users about how data is organized and displayed. Feedback from users can reveal potential areas of improvement, ensuring that dashboards serve their intended purpose effectively. Additionally, implementing best practices in data visualization is crucial. This includes using consistent color schemes and fonts, which aids in interpreting data quickly. Exploring live data connections can also provide dynamic insights that are especially impactful in the finance realm. Users appreciate seeing their data in real time, as it fosters confidence in the information presented. Lastly, encouraging audience engagement through key performance indicators (KPIs) monitoring can stimulate ongoing discourses, which may lead to better financial performance over time. By ensuring clarity and collaboration, financial analysts can maximize the utility of dashboards in Power BI.

Challenges in Financial Reporting with Power BI

Despite its myriad advantages, creating dashboards in Power BI does present certain challenges for financial analysts. One primary concern is the issue of data quality. Analysts must ensure that all datasets are accurate and clean; otherwise, misleading information may be presented to stakeholders. A lack of standardized processes for data collection may also impact results negatively. Another challenge involves user resistance. Some users may be hesitant to adopt new technologies like Power BI, primarily due to a lack of familiarity. Addressing this concern through comprehensive training can help alleviate fears and encourage innovation in reporting processes. Performance issues can also arise, especially when dealing with large datasets. Ensuring that dashboards load quickly is essential; this may require optimization techniques, such as aggregating data or using summary tables to improve performance. Additionally, maintaining consistency across different reports can be daunting, especially when multiple analysts create individual dashboards. It’s crucial to develop a common template that all users can adhere to, ensuring uniformity in financial reporting. Finally, keeping up with Power BI updates and features can be difficult. Analysts must stay informed to leverage the tool effectively.

When deploying Power BI workflows, collaboration plays a pivotal role in maximizing its effectiveness. Financial analysts must work alongside IT departments to ensure proper data security and integration. Collaborative approaches can mean the difference between a successful dashboard and underwhelming results. Engaging stakeholders during the design phase can enhance buy-in and ensure the dashboard aligns with their requirements. This collaboration ensures that the final product serves its intended purpose, providing actionable insights to decision-makers. Additionally, continuously seeking feedback from users can guide improvements effectively. Analysts should not view feedback as criticism but rather as an opportunity for growth. User preferences and suggestions can lead to innovative functionalities that improve overall experience. It’s essential to celebrate milestones and achievements when dashboards are successfully launched. Recognizing contributions from team members can increase motivation and foster a positive work environment. A strong community of users around Power BI can further bolster its adoption, providing a platform for sharing tips and best practices. Ultimately, collaboration, feedback, and recognition create a robust foundation for leveraging Power BI for financial reporting.

Future of Financial Reporting with Power BI

As organizations increasingly adopt digital technologies, the future of financial reporting through Power BI is promising. With advancements in artificial intelligence, analysts can expect even more sophisticated capabilities. Predictive analytics, for instance, can provide insights into future trends based on historical data. This predictive capability will allow organizations to make informed proactive decisions, maximizing potential opportunities for growth. Furthermore, the integration of Power BI with other business intelligence tools will enhance collaborative efforts, ensuring data is actionable across departments. The shift towards data-driven decision-making emphasizes the role of financial analysts in facilitating this transition. As dashboards evolve, personalization and user experience will take center stage. Future developments may also focus on simplifying complex processes, making it more accessible for non-technical users. Analysts must also remain aware of emerging data visualization trends to keep dashboards modern and engaging. Incorporating interactive elements, such as animated visuals and storytelling through data will elevate the user experience. As Power BI continues to evolve, its role in effective financial reporting will become more pronounced, supporting strategic objectives while encouraging data literacy across organizations.

To summarize, the use of Power BI for financial reporting presents a wealth of opportunities but also challenges. Maximizing its effectiveness requires understanding the nuances of data management, customization, and user collaboration. Financial analysts must remain proactive, continually adapting to the evolving landscape of reporting technologies. By embracing best practices and engaging with users, they can ensure dashboards contribute meaningful insights to the decision-making process. The tool’s capabilities are vast, and its impact on organizational financial health cannot be underestimated. Interactive dashboards designed for effective communication of financial data can foster transparency and trust among stakeholders. A well-designed dashboard not only informs but also inspires strategic action. As technology continues to develop, staying abreast of innovations will be vital for financial analysts. This commitment to continuous learning will undoubtedly enhance their reporting capabilities, making them integral players in their organizations. Ultimately, the future of financial reporting in Power BI is bright, offering analysts the tools to drive success. The ongoing integration of advanced analytics will further empower organizations, paving the way for smarter decision-making and growth.